In this article, I will analyze the Best Projects on the BNB Smart Chain that are influencing the crypto and DeFi world.

These include some of the top decentralized exchanges, as well as innovative gaming and lending projects that offer fast transaction speeds, low fees, and diverse earning potential.

These are some of the most interesting BSC projects that I’d like to share with you, whether you are just starting or are an experienced trader.

How To Choose the Best Binance Smart Chain Projects

Check Project Purpose – Understand the field of the project – is it trading, lending, gaming, or NFTs? Defined objectives suggest practical value.

Evaluate Community Support – A strong presence on Telegram, Discord, or Twitter is a good indicator of their trust and project advancement.

Assess Security – Avoid projects that don’t disclose their smart service contracts and past security issues.

Analyze Team & Partnerships – A reputable and seasoned group strengthens the project’s credibility.

Tokenomics & Rewards – Ensure fair incentives in the project.

Platform Activity – A project is more reliable the more active users and transactions it has.

Governance & Roadmap – A project that is open about its governance and has a clear roadmap demonstrates long-term vision.

Cross-Chain Compatibility – Projects that operate across multiple chains can provide increased liquidity and opportunities.

User Experience – Streamlined service and UI/UX ensure wider adoption of the project.

Key Points & Best Binance Smart Chain Projects List

| Project Name | Key Points |

|---|---|

| PancakeSwap (CAKE) | Leading DEX on BSC, offers yield farming, staking, lotteries, and NFT trading. |

| BakerySwap (BAKE) | AMM-based DEX, NFT marketplace, and yield farming platform on BSC. |

| Venus (XVS) | Decentralized lending and borrowing protocol, supports stablecoins and synthetic assets. |

| BurgerSwap (BURGER) | DEX with AMM model, token farming, and liquidity mining incentives. |

| SafePal (SFP) | Crypto wallet and hardware wallet ecosystem, integrated with DeFi apps on BSC. |

| Trust Wallet Token (TWT) | Official Binance wallet token, supports staking, DeFi access, and discounts. |

| AutoFarm (AUTO) | Yield optimizer on BSC that automatically compounds farming rewards. |

| Alpha Finance Lab (ALPHA) | Cross-chain DeFi platform, offering lending, leveraged yield farming, and risk management. |

| Mobox (MBOX) | Play-to-earn NFT gaming platform, combines DeFi yield farming with gaming rewards. |

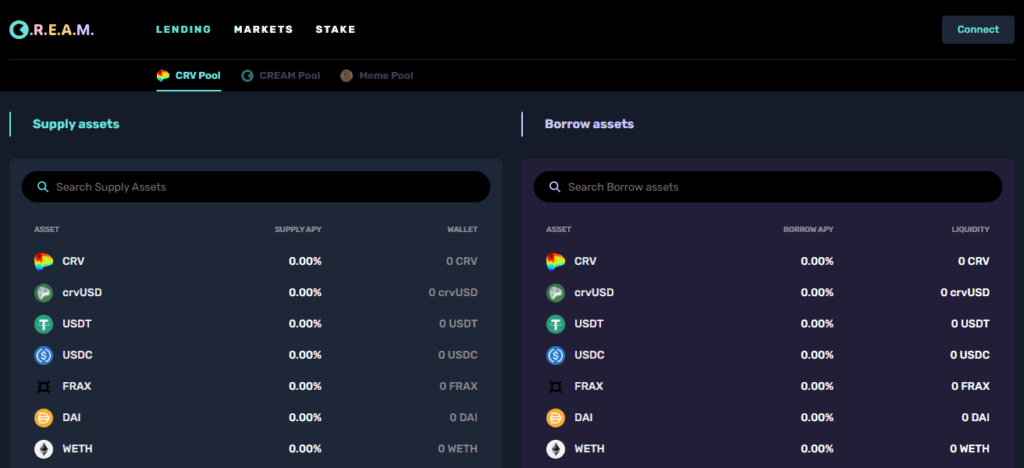

| Cream Finance (CREAM) | Lending, borrowing, and DeFi platform on BSC with high APY farming options. |

10 Best Binance Smart Chain Projects

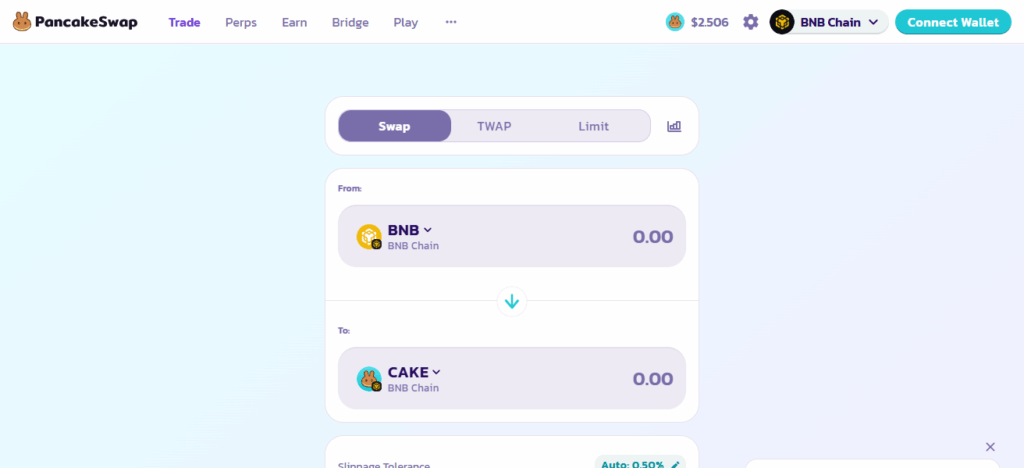

1.PancakeSwap (CAKE)

PancakeSwap is a leader among Binance Smart Chain DEXs. It provides automated market-making (AMM) services, enabling users to swap tokens at a fraction of the cost compared to Ethereum-based DEXs.

Apart from just trading, the platform offers a wide range of features, including yield farming, staking CAKE to earn interest, liquidity provider lotteries, and purchasable NFT collectibles.

With its lightning-fast transactions and minimal gas fees, PancakeSwap is a top choice among DeFi enthusiasts. The platform is also equipped with governance functionalities that enable users to control the platform’s future. This attracts more users and liquidity to the BSC.

| Feature | Description |

|---|---|

| Decentralized Exchange (DEX) | Swap BEP-20 tokens quickly with low fees. |

| Yield Farming | Provide liquidity and earn CAKE rewards. |

| Staking | Stake CAKE tokens to earn additional rewards. |

| Lottery System | Participate in lotteries for prizes. |

| NFT Marketplace | Buy, sell, and trade NFTs. |

| Governance | CAKE holders vote on protocol upgrades. |

2.BakerySwap (BAKE)

BakerySwap is an Automated Market Maker Decentralized Exchange (AMM DEX) on BSC that creatively integrates DeFi with NFTs. Users can trade tokens, earn yield, and farm while providing liquidity.

The NFT marketplace enables digital art creators to mint, purchase, and sell digital artworks on the blockchain. BakerySwap’s unique DEX features include tokenized lottery systems and NFTs with gamified incentives.

Low fees and fast transfers are appealing to small and large traders. BAKE’s community-oriented governance enables them to propose and vote on changes to the platform. This makes the platform adaptable while maintaining its focus as a decentralized finance (DeFi) ecosystem.

| Feature | Description |

|---|---|

| AMM DEX | Automated market-making token swaps. |

| Yield Farming | Earn BAKE tokens by providing liquidity. |

| NFT Marketplace | Trade and mint NFTs on the platform. |

| Lottery & Gamification | Participate in gamified token lotteries. |

| Governance | BAKE holders vote on platform proposals. |

3. Venus (XVS)

Venus is a decentralized lending and borrowing platform on the BSC, often referred to as the Binance Smart Chain version of Ethereum’s Compound. Users can lend their crypto, earn interest, and borrow assets with collateral.

Venus allows users to borrow against their holdings without liquidating their crypto by supporting stablecoins and synthetic assets.

Its governance token, XVS, allows users to participate in the protocol’s updates and vote. Venus’s lending, borrowing, and synthetic stablecoin features enable users to boost capital efficiency.

In addition to swift processing times and low fees, Venus’ compatibility with BSC wallets provides accessibility to DeFi newbies and seasoned traders in search of high-yield options.

| Feature | Description |

|---|---|

| Lending & Borrowing | Lend assets or borrow against collateral. |

| Synthetic Assets | Mint and trade stablecoins like VAI. |

| Governance | XVS holders vote on protocol updates. |

| Low Fees | Fast transactions with minimal gas costs. |

| Capital Efficiency | Optimize returns using collateralized lending. |

4.BurgerSwap (BURGER)

BurgerSwap operates an exchange on the BSC network, utilizing an AMM architecture for token swaps and liquidity provision. Liquidity miners receive BURGER tokens as liquidity rewards for their contributions to trading pools.

Private governance empowers token holders to vote on proposals and roadmaps. Differentiation stems from the platform’s intuitiveness, along with unique offerings such as NFTs and advanced DeFi yield strategies.

Traders and DeFi enthusiasts are drawn to the low fees and speed of the transactions. The multifunctionality of trade, farming, and governance further adds to its value as a BSC project.

| Feature | Description |

|---|---|

| AMM DEX | Swap tokens via liquidity pools. |

| Liquidity Mining | Earn BURGER tokens by providing liquidity. |

| Governance | BURGER holders vote on proposals. |

| NFT Integration | Supports NFTs in the ecosystem. |

| User-Friendly Interface | Simple design suitable for beginners. |

5.SafePal (SFP)

SafePal is a banking ecosystem in crypto wallets offering both hardware and software wallets. Users can manage and stake crypto assets and store it, while being protected, and do DeFi operations without losing the added functionality.

Using the SafePal wallet, users can access and interact with browser-based BSC applications thanks to the integrated ecosystem, which includes DApp support. The ecosystem’s native SFP token serves as a governance token, staking token, and reward token as well.

SafePal provides users with the highest level of security while offering DeFi safety and the utility of the SFP token. Their wallets are offline and thus can protect the private key with ease. Along with their DeFi offerings, SafePal provides users with a secure method to access Binance Smart Chain assets, without compromising token utility.

| Feature | Description |

|---|---|

| Wallet Ecosystem | Supports software and hardware wallets. |

| DeFi Integration | Access Binance Smart Chain DeFi protocols. |

| Staking Rewards | Stake SFP tokens for rewards. |

| DApp Browser | Interact with decentralized apps via wallet. |

| Governance | SFP holders vote on ecosystem decisions. |

6. Trust Wallet Token (TWT)

TWT is the native token for Trust Wallet, a mobile cryptocurrency wallet owned by Binance. While Trust Wallet enhances the experience by offering staking rewards, governance participation, and discounts on DAPP services, other wallets do not.

Trust Wallet is highly versatile for DeFi, NFTs, and token swaps due to its support for multiple blockchains. A TWT user can vote on the promotions available and platform improvements, and can also claim various offers.

Binance Smart Chain’s integration enables fast and cheap transactions, which is beneficial for crypto beginners. Trust Wallet’s simplicity, multi-chain compatibility, and strong security controls, along with TWT, have rightfully become the go-to options for BSC users interested for DeFi.

| Feature | Description |

|---|---|

| Multi-Blockchain Support | Works with BSC, Ethereum, and other chains. |

| Staking Rewards | Stake TWT to earn rewards. |

| Governance | Participate in platform proposals and voting. |

| DApp Access | Interact seamlessly with decentralized apps. |

| Discounts & Incentives | Get rewards and platform discounts. |

7.AutoFarm (AUTO)

Designed to optimize yields on the BSC, AutoFarm is a yield farming platform that maximizes farming rewards. It allows users to earn higher APYs on funds without manual intervention, thanks to the automated compounding of rewards from diverse liquidity pools. Users providing liquidity benefit from reduced gas fees, thanks to innovative contract technology.

Governance is exercised through the voting of holders on proposals and updates, which are implemented in the form of AutoFarm tokens. AutoFarm is an aggregator of multiple DeFi protocols, simplifying yield farming.

Due to its yield farming simplification, automation, and high degree of transparency, alongside other protocols on the Binance Smart Chain, AutoFarm is a popular choice among users, experts, and novices in DeFi for asset growth.

| Feature | Description |

|---|---|

| Yield Optimization | Automatically compounds farming rewards. |

| Multi-Protocol Integration | Aggregates liquidity pools across BSC protocols. |

| Governance | AUTO holders vote on updates and proposals. |

| Low Fees | Automated smart contracts reduce gas costs. |

| Passive Income | Simplifies yield farming for all users. |

8. Alpha Finance Lab (ALPHA)

Alpha Finance Lab is a multi-chain DeFi platform that emphasizes boundary-pushing finance tools. On BSC, it’s involved in lending, leveraged yield farming, and risk mitigation, which allows users to optimize return and minimize risk.

ALPHA token holders can vote on and contribute to the protocol’s future development. The platform is multi-chain, which improves liquidity and accessibility across ecosystems.

Alpha Finance combines opportunities and safety to appeal to DeFi users excited by innovation and capital efficiency. With a focus on risk-adjusted returns, it is a leading BSC project and part of a growing community of traders and liquidity providers seeking advanced DeFi tools.

| Feature | Description |

|---|---|

| Cross-Chain DeFi | Supports multiple blockchains for liquidity. |

| Lending & Borrowing | Borrow or lend assets for profit. |

| Risk Management | Tools for safer DeFi investments. |

| Governance | ALPHA holders vote on protocol changes. |

| High Yield Opportunities | Designed to maximize returns efficiently. |

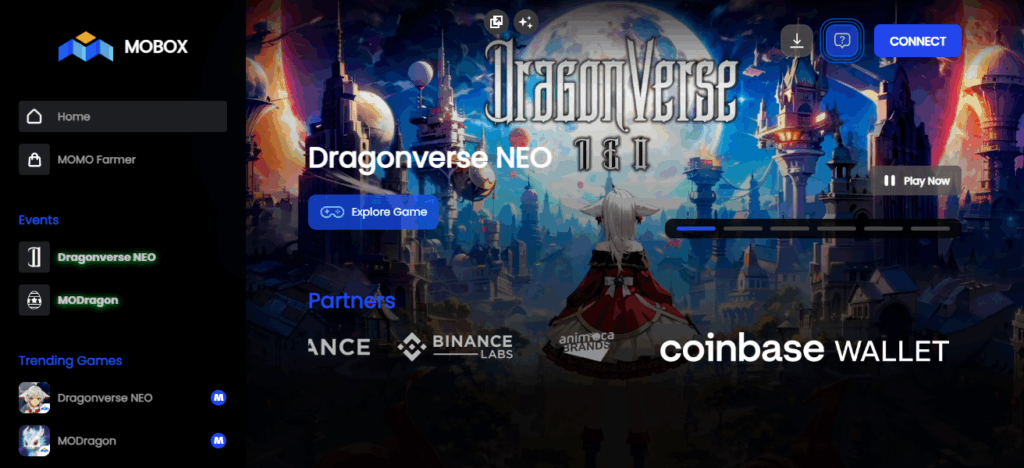

9. Mobox (MBOX)

Mobox is a play-to-earn NFT gaming platform on the BSC that combines decentralized finance (DeFi) with blockchain gaming. Users stake MBOX tokens while playing games and participating in NFT farming, earning rewards.

Players can mint, trade, and utilize in-game NFTs, creating a unique blend of gaming and finance. DeFi is gamified, featuring elements such as yield farming, gameplay-based token rewards, and the Mobox ecosystem’s user engagement.

There are also rapid, low-cost transactions on the BSC, making it accessible to gamers everywhere. Mobox offers blockchain games, NFTs, and DeFi in a single platform, making it entertaining and financially viable.

| Feature | Description |

|---|---|

| Play-to-Earn Gaming | Earn tokens by playing blockchain games. |

| NFT Farming | Stake tokens and earn NFTs for gameplay. |

| Token Rewards | Earn MBOX through staking and games. |

| Gamified DeFi | Combines DeFi incentives with gaming. |

| Fast Transactions | Low-cost and quick interactions via BSC. |

10. Cream Finance (CREAM)

Cream Finance is a lending and borrowing DeFi platform o the BSC that allows liquidity providers to earn interest on the cryptoassets. Users of the platform can earn interest on the assets that they deposit or can borrow crypto after providing collateral.

The platform also provides token farming with a pleasing token APY. Users who hold the CREAM token can participate in governance on the protocol and vote for its upgrades, as well as for the risk parameters it defines. One of the main focuses of Cream Finance is community involvement, with a focus on protecting the audited smart contracts.

The integration of numerous BSC-based tokens enables varied lending and borrowing contracts. To attract both beginners and seasoned users, Cream Finance offers a comprehensive suite of DeFi services, including lending, borrowing, and yield farming, all on a single platform, providing high returns on the Binance Smart Chain.

| Feature | Description |

|---|---|

| Lending & Borrowing | Lend or borrow assets using collateral. |

| Yield Farming | Earn high APY through farming programs. |

| Governance | CREAM holders vote on platform updates. |

| Security Audits | Smart contracts are audited for safety. |

| Multi-Asset Support | Supports multiple BSC-based tokens for DeFi activities. |

Conclsuion

In conclusion, in addition to decentralized exchanges such as PancakeSwap and BakerySwap, and lending protocols like Venus and Cream Finance, the BSC network boasts an extensive ecosystem of self-sustaining, innovative projects. All of these projects, i.e.

DeFi, NFT, and gaming unlock myriad high-yield and secure wallet opportunities, supplemented with low-fee transactions that are completed in seconds.

The ease of access to enhanced crypto trading, investment, and DeFi functionality makes the BSC ecosystem one of the most sought-after in the world.

FAQ

BSC is a blockchain network offering fast transactions and low fees, supporting DeFi, NFTs, and smart contracts.

PancakeSwap, BakerySwap, Venus, BurgerSwap, SafePal, Trust Wallet Token, AutoFarm, Alpha Finance Lab, Mobox, and Cream Finance.

Most are audited and widely used, but it’s always best to research and invest carefully.