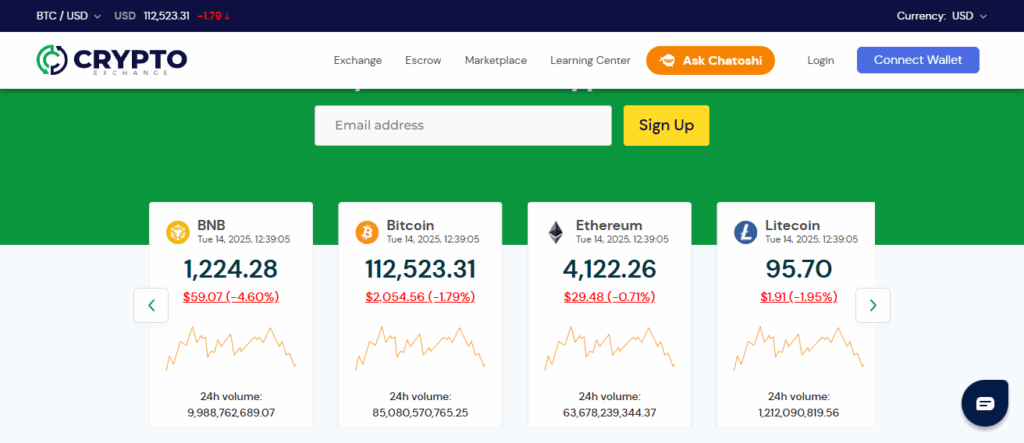

In this article, I will address services for the development of crypto exchanges needed to construct secure and scalable, as well as streamlined, cryptocurrency trading platforms.

These start with wallet integration and include liquidity management, compliance, mobile apps, and more.

By comprehending them, firms can formulate dependable exchanges to meet user demand, operational efficiency, and sustained development.

What Crypto Exchange Development Services?

Services for developing crypto exchanges assist companies in creating and implementing trading platforms for cryptocurrencies.

Such services begin with interface development and go on to include integration of blockchain technology and the implementation of legal and customer support systems compatible with various digital currencies.

Further, the services provide trading engines that operate in real-time, systems that comply with KYC and AML, fine security barriers, and oversight systems.

Service providers will construct Centralized Exchanges, Decentralized Exchanges, or combinations of the two, as specified.

These services allow new companies and existing businesses to enter the crypto market with appropriate infrastructure and advanced technology to provide users with easy and fast trading.

Why Secure Trading is Crucial In today’s Crypto Industry

Protection Against Hacks – Avoid the loss of digital currency from exchanges and wallets.

Irreversible Transactions – Any crypto transfers made cannot be reversed.

User Trust – Confidence comes from the credibility instilled by the platform’s security.

Regulatory Compliance – Meet KYC/AML requirements.

Fraud Prevention – Phishing attacks, scams and malware threats are reduced.

Market Stability – Secure platforms help instill calm and fend off manipulation during breach attempts.

Reputation Management – Prevent the exchange from losing money and damaging the image of the platform.

Why Security is the Backbone of Crypto Exchanges

Protects User Funds

Effective security systems shield users’ crypto assets from theft and hacking, keeping unauthorized access at bay, thus fostering trust and acceptance of the platform.

Maintain Platform Reputation

Security breaches damage the trustworthiness of a trading platform. Reliable security systems draw more traders and investors to the platform.

Ensures Regulatory Compliance

KYC and AML guidelines are other regulations that exchanges must adhere to. Operational shutdowns and fines can be issued if they are not followed.

Prevent Fraud & Scams

Phishing, bogus transactions, and other malware are countered by advanced security to protect users and the exchange from loss.

Supports Market Stability

Secure exchanges block sudden breaches or hacks that prompt panic selling and volatility, thus sustaining market stability.

Core Features of a Secure Crypto Exchange

Multi-layer Security: Employs various protective methods like firewalls, encryption, and intrusion detection, securing and protecting against unauthorized access.

2FA & KYC/AML: Identity verification and two-factor authentication ensure only legitimate users trade, helping to reduce fraud while regulatory compliance is upheld.

Cold Wallet Integration: Keeps cryptocurrencies in cold storage as an additional protective measure against online hacks, guaranteeing user assets maximum security.

Encrypted Transactions: Transactions and all data are encrypted, protecting against interception, manipulation and theft within transfers.

Liquidity Management: Impacts user experience by decreasing measurable market volatility through integrating asset and trading pair management.

Admin Dashboard & Risk Monitoring: Real-time insights on risk mitigation, security threat, and operational resource abuse through suspicious activity tracking.

Crypto Exchange Development Services Explained

UI/UX Design

Craft user-friendly interfaces for smooth navigation to enhance trading experiences across multiple devices.

Blockchain Integration

Links the exchange to the blockchain for secure, transparent, and decentralized transaction and asset movement records.

Smart Contract Development

Creates automated, self-executing contracts for trustless, efficient, and accurate transaction execution on the platform.

Matching Engine Development

Develops a high-speed engine to match buy and sell orders for real-time trading accurately.

Wallet Integration

Digital wallets with multiple layers of protection for secure storage, sending, and receiving of cryptocurrencies.

Payment Gateway Integration

Facilitates user deposits and withdrawals from any location by seamlessly enabling fiat-crypto and crypto-fiat transactions.

Benefits of Hiring a Professional Development Company

Expertise and Experience: Professional developers foster deep familiarity along with knowledge and strategies. Best practices guarantee a professional and reliable crypto exchange.

Faster Deployment: Experienced teams improve efficiency in processes. Getting to market quicker can be achieved compared to in-house or inexperienced teams.

Ongoing Maintenance and Security Updates: Ongoing support and maintenance ensures that cyber threats are kept at bay and the system works.

Scalable Solutions: Professionals create systems that accommodate growing user demand. They allow increasing traffic, expanded features, and more crypto options.

Best Practices for Secure Crypto Exchange Development

Regular Audits: Systematically reviews code and operations for vulnerabilities, accuracy, and overall platform security.

Penetration Testing: Understand weaknesses by simulating cyberattacks and preventing unauthorized access to assets.

Regulatory Compliance: Avoid penalties and build user trust by ensuring adherence to KYC, AML, and other legal standards.

Using Advanced Encryption Algorithms: Employs strong cryptographic methods to protect sensitive data and thwart hacking attempts.

Pros and Cons

Here’s a clear Pros and Cons breakdown for Crypto Exchange Development Services for secure trading:

Pros:

- Enhanced Security: Multi-layer security, encryption, and cold wallets protect user funds.

- Regulatory Compliance: Built-in KYC/AML features ensure legal adherence.

- Professional Expertise: Experienced developers deliver reliable, scalable, and efficient platforms.

- Faster Deployment: Streamlined development reduces time-to-market.

- Customizable Features: Smart contracts, wallets, matching engines, and dashboards tailored to needs.

Cons:

- High Costs: Professional development services can be expensive for startups.

- Time-Intensive: Full-featured, secure platforms require careful planning and testing.

- Maintenance Required: Continuous updates and monitoring are necessary to counter evolving threats.

- Dependence on Developers: Long-term reliance on external experts for updates or fixes.

Conclusion

In conclusion, developing a Crypto Exchange is important for creating safe, functional, and dependable trading platforms.

These services incorporate multi-layer security, encrypted transaction and wallet systems, and other compliance measures that protect user funds, manage regulations, and improve trust.

Professional development focuses on the scalability of the system, real-time trading efficiency, and automatic updates which make secure trading possible and enhance confidence in the crypto industry which is fast evolving and high risk.

FAQ

They are end-to-end solutions for building secure, scalable, and compliant cryptocurrency trading platforms.

It ensures safe deposits, withdrawals, and storage of multiple cryptocurrencies.

They provide market depth, reduce slippage, and improve trading efficiency.

It’s the core system that matches buy and sell orders in real time.

It prevents fraud, ensures legal compliance, and builds user trust.