In this post , I analyze the Best Online Bill Pay Services available and how they assist you in paying and managing your bills in a swift, safe, and efficient manner.

The service providers and platforms relieve you of the manual financial task with automation, prompts, and real-time tracking.

Having an efficient online bill pay service for personal or business purposes will save you time, simplify your payment, and help you avoid late payment penalties.

Key Points & Best Online Bill Pay Services

| Service | Key Features |

|---|---|

| Rippling Bill Pay | AI-driven invoice capture, payroll & HR integration, policy-based approvals |

| Bill.com | Accounts payable/receivable automation, international payments, ERP integration |

| Wave Payments | Free invoicing, accounting, and bill pay tools; integrates with H&R Block |

| Tipalti | Global AP automation, tax compliance, multi-currency support |

| Quicken Bill Pay | Bill tracking, forecasting, check payments, integrates with Quicken Premier/Home & Business |

| Doxo | Bill pay to over 120,000 billers, payment tracking, reminders |

| Papaya | Snap & pay via photo, bill reminders, auto-pay options |

| Paymentus (Finovera) | Bill alerts, archiving, payment history |

| Everyday Money Management | In-home consultations, bill & insurance claim management, banking & notary services |

| Plumb Bill Pay | Vendor management, expense tracking, account reconciliation, personalized service |

| MoneyGram Bill Pay | Pay bills online or in-person, supports thousands of billers, same-day payments |

| Western Union Bill Pay | Domestic & international money transfers, supports various billers |

| Walmart Bill Pay | Bill pay while shopping, supports various billers |

| PayPal | Online payments, invoicing, international transfers |

| Stripe | Subscription billing, global support, fraud detection, customizable APIs |

| Square | Invoicing, POS tools, online payments, reporting |

| Zelle | Instant bank transfers, no fees, integrated with many banks |

17 Best Online Bill Pay Services

1. Rippling Bill Pay

Rippling Bill Pay focuses on startups and SMBs. It integrates Bill Pay with payroll and HR, facilitating simple flow management of company expenses.

Clients can set automated payments and policy-driven invoice approvals, as well as direct-from-accounting integration. AI tools optimize expense tracking and reporting.

Rippling consolidates functions, reducing time wasted on switching and NC. It is ideal for businesses that require expense control, employee management and simple configurations.

| Feature | Description |

|---|---|

| Invoice Automation | Automatically capture and process invoices from vendors. |

| Payroll & HR Integration | Seamless integration with payroll and HR functions. |

| Policy-Based Approvals | Custom approval workflows to control payments. |

| Multi-User Access | Different user roles and permissions for security. |

| Accounting Sync | Connects with accounting software to update financial records automatically. |

2. Bill.com

Bill.com is an industry leader in automation for accounts payable and receivable processes targeted for small and medium sized businesses and bigger companies.

It automates invoice approval workflows, connects with QuickBooks and NetSuite for accounting software, and facilitates domestic and international electronic payments.

Businesses are able to use ACH and credit cards and request international wire transfers which allows them to better manage their cash flow.

Bill.com dashboards are user friendly and provide active updates on payments and overdue invoices. The use of Bill.com eliminates the use of paper checks, and is able to speed up the payment process.

Bill.com is a cloud service, which means that payment is fast, and service is scalable for growing companies which also makes it compliant and safe to use.

| Feature | Description |

|---|---|

| AP/AR Automation | Automates accounts payable and receivable processes. |

| Electronic Payments | Supports ACH, credit card, and international wire transfers. |

| Invoice Approval Workflows | Custom workflows for invoice approvals. |

| ERP Integration | Integrates with QuickBooks, NetSuite, and other ERPs. |

| Payment Tracking | Provides real-time payment status updates. |

3. Wave Payments

Wave Payments specifically targets freelancers and small enterprises looking for complimentary and user-friendly financial services.

Users can manage their unified expenses and invoicing for the system integrated with accounting.

Users can manage their expenses and invoicing for the system integrated with accounting. It offers services that allow the user to send invoices and schedule payments for recurring bills. Exceptionally, the services are offered without subscription payments.

Pricing reminders are automated to reinforce the cash collection policy. Wave Payments can also process credit cards and offer payroll for added services as your small business ecosystem evolves.

The system is user-friendly, and this is what small business owners and solopreneurs want for managing their bills. Cost-conscious customers will also appreciate the system’s pricing.

| Feature | Description |

|---|---|

| Free Bill Payment | No subscription fees for bill payments and invoicing. |

| Invoicing & Accounting | Integrated tools for tracking invoices and expenses. |

| Recurring Payments | Schedule automated recurring bills. |

| Mobile Access | Manage bills and invoices via mobile app. |

| Security Features | Secure encryption for safe transactions. |

4. Tipalti

Tipalti targets enterprises from mid to large scale ones needing global accounts payable automation.

It assembles mass payments while ensuring compliance to tax laws, international payments, cross-border multi-currency processing, and international banking regulations.

Its system automates invoice capturing and approval workflows, supplier onboarding, and onboarding workflows to drastically mitigate manual errors.

Tipalti has also embedded risk management, fraud detection, and reporting features to eliminate blind spots on cash flow visibility.

Companies with large vendor networks are able to efficiently pay their suppliers in more than 190 countries.

Integrating with ERP systems allows Tipalti to decrease operational overhead while enhancing accuracy in payments. This system is great for firms making cross-border payments in large volumes.

| Feature | Description |

|---|---|

| Global Payments | Supports payments in multiple currencies across 190+ countries. |

| Tax & Compliance Automation | Ensures tax compliance and regulatory reporting. |

| Supplier Management | Onboarding, verification, and communication with suppliers. |

| Invoice Capture & Approval | Automates invoice processing and approval workflows. |

| Fraud Prevention | Detects anomalies to reduce risk of fraudulent transactions. |

5. Quicken Bill Pay

Designed for individuals and small businesses that already use Quicken’s personal finance or business software.

Bill tracking, automation for paying bills, and paying by check or electronic transfer. Recurring payments and reminders can be scheduled, and payments can be tracked and monitored to avoid late fees.

Integration with Quicken’s accounting tools provides clear visibility for cash flow, budget planning, and financial forecasting.

It reduces administrative stress by managing multiple bills from one simple dashboard. It is ideal for users wanting to streamline their personal finance and bill payment processes for efficient financial centralization.

| Feature | Description |

|---|---|

| Bill Scheduling | Automate recurring payments to avoid late fees. |

| Integration with Quicken | Syncs with Quicken personal or business software. |

| Payment Reminders | Alerts users about upcoming bills. |

| Check & Electronic Payments | Pay via check or e-transfer from the platform. |

| Budget Tracking | Monitor expenses and cash flow alongside bill payments. |

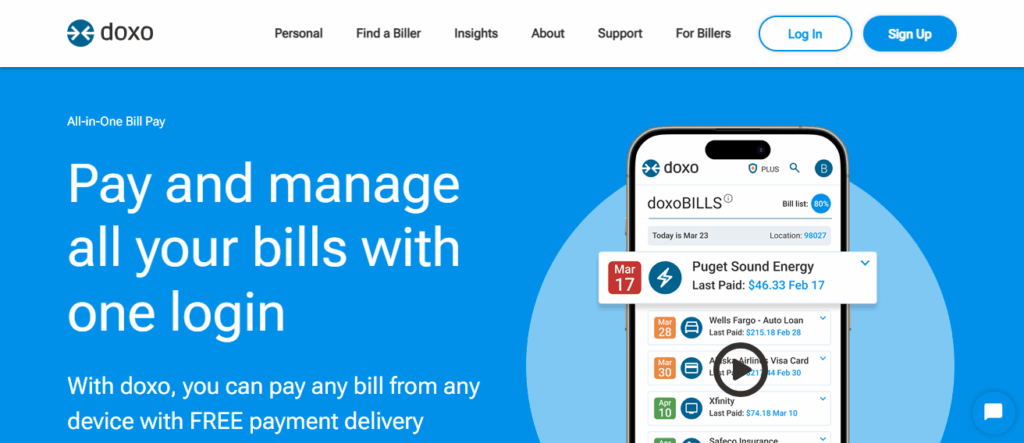

6. Doxo

Doxo is a consumer-focused bill payment platform supporting over 120,000 billers. It centralizes payments, reminders, and bill management in a secure environment.

Users can schedule one-time or recurring payments, track due dates, and receive alerts to prevent late fees. DoxoPLUS, a premium plan, offers additional features like automatic payments and unlimited bill storage.

Its user-friendly interface makes it easy to link multiple bank accounts and manage all bills from a single app.

Doxo emphasizes security and convenience, appealing to busy individuals who want a reliable, all-in-one solution to manage household bills without navigating multiple billing websites.

| Feature | Description |

|---|---|

| Centralized Bill Management | Manage multiple bills in one dashboard. |

| Payment Reminders | Alerts to prevent late payments. |

| DoxoPLUS Auto-Pay | Automatically pay bills on schedule. |

| Secure Payments | Encrypted platform for safe transactions. |

| Supports Many Billers | Works with over 120,000 billers nationwide. |

7. Papaya

Papaya is a mobile-first bill payment service focused on speed and simplicity. Users can pay bills by snapping a photo of the invoice, and Papaya’s system automatically extracts payment details.

It also offers recurring bill management, reminders, and notifications for upcoming payments. Its automation reduces the risk of late fees, and the intuitive interface makes it easy for tech-savvy users to manage multiple bills from a smartphone.

Papaya integrates with major banks and billers, providing a seamless and fast alternative to manual entry or traditional online banking platforms. It’s ideal for consumers seeking efficiency in everyday payments.

| Feature | Description |

|---|---|

| Snap & Pay | Pay bills by taking a photo of the invoice. |

| Bill Reminders | Alerts for upcoming payments. |

| Recurring Payments | Set up automated payments. |

| Bank Integration | Connects with multiple banks for seamless transactions. |

| Mobile-First | Optimized for smartphone users. |

8. Paymentus (Finovera)

Paymentus, and more infrequently, Finovera, markets its offerings to consumers and small businesses. Paymentus focuses on managing the presenting, paying, and processing of payments and bills through its mobile app or online portal.

Paymentus accepts payments through cards and direct payments, and Paymentus processing confirms payment transactions in real time.

Paymentus users can track, automate, and manage payments, even consolidated bills, and payment transaction history and reports can help understand spending patterns.

Paymentus users have also the option to automate payment transactions, manage consolidated bills and Paymentus of multiple providers, and track and automate Paymentus and payment transactions in needed history and reporting for faster and more streamlined management.

Paymentus also protects its users’ data and reduces on-paper billing and statements. Paymentus is ideal for small commercial and individual needs, and small to medium commercial needs.

| Feature | Description |

|---|---|

| Online Bill Presentment | Receive and view bills digitally. |

| Multiple Payment Options | Credit/debit card, bank transfer, and mobile payments supported. |

| Payment Tracking | View past and pending transactions easily. |

| Recurring Payments | Automate regular bills. |

| Secure & Compliant | Data protection with regulatory compliance. |

9. Everyday Money Management

Everyday Money Management users may be older adults, have a chronic illness, or have someone undergoing a service that encompasses financial assistance handholding.

Services used for Everyday Money Management also include in-home consultations, bill payment, insurance claim management, and banking support.

Money managers record billing for payment service to track, also control payment of expenses, and secure financial document records.

The system allows for bill payment on the internet, wherein most people have most control and access, to also help with ease for bill payments.

Everyday Money Management also provided technology to work with people to help reduce the needed system’s stress, control late payments for the clients’ financial needs, and prevent and be sure that payments have actually been made.

Everyday Money Management also provided technology to work with people to help reduce the needed system’s stress, control late payments for the clients’ financial needs, and prevent and be sure that payments have actually been made.

| Feature | Description |

|---|---|

| Personalized Assistance | Dedicated managers assist with finances. |

| Bill Payment Management | Ensure all bills are paid on time. |

| Banking Support | Help with account management and transfers. |

| Insurance & Claim Management | Manage insurance payments and claims. |

| Accessibility Focus | Ideal for older adults or individuals with special needs. |

10. Plumb Bill Pay

Plumb Bill Pay services high-net-worth clients and those needing specialized bill management. It provides personalized vendor management, account reconciliation, and expense tracking.

Clients can simplify payments, create reminders, and receive detailed reports on their expense tracking for their home or business.

Plumb’s professionals manage intricate financial arrangements, including utilities, subscriptions, and property cash flows to ensure deadlines are met.

Their high service approach blends technology and personalized attention, perfect for busy professionals and owners of multiple real estate properties

Who require safe management of their bills and oversight of their accounts without needing to control the process their hands.

| Feature | Description |

|---|---|

| Personalized Services | Concierge-like bill management for high-net-worth users. |

| Vendor Management | Manage multiple service providers efficiently. |

| Account Reconciliation | Track and reconcile bills and expenses. |

| Expense Reporting | Generate detailed reports for household or business spending. |

| Timely Payments | Ensures all bills are processed on schedule. |

11. MoneyGram Bill Pay

MoneyGram Bill Pay allows customers the flexibility of paying their bills online or paying cash at a MoneyGram location.

It works with thousands of billers, and customers can pay bills using any of the following: cash, credit/debit card, or bank account transfers.

Payments are processed on the same day, which helps customers pay bills on time. MoneyGram is helpful for people who want to pay bills in cash or send money across borders.

Its layout is security and ease of use which helps people without bank accounts or those seeking bank alternative for payments across several layers.

| Feature | Description |

|---|---|

| Online & In-Person Payments | Pay bills online or at MoneyGram locations. |

| Supports Thousands of Billers | Wide coverage of utility, telecom, and other services. |

| Same-Day Processing | Payments processed quickly for timely settlement. |

| Multiple Payment Methods | Cash, credit/debit cards, and bank transfers supported. |

| Secure Transactions | Encrypted payment processing for safety. |

12. Western Union Bill Pay

Western Union Bill Pay facilitates both domestic and international bill payments and is available through a nationwide agent network. Users can pay utility bills, loans, and services using cash, bank accounts, and cards.

Western Union Bill Pay is best suited for international customers looking for dependable service to pay bills in different countries because of its global reach. Payments are monitored and confirmed for users’ peace of mind.

Western Union is focused on providing reliable services and accessibility. For customers without online banking, Western Union offers convenient services.

This ensures that customers, even those in different countries, are able to pay their bills on time.

| Feature | Description |

|---|---|

| Global Reach | Pay bills domestically and internationally. |

| Multiple Payment Options | Cash, card, or bank account payments supported. |

| Agent Network Access | Use physical locations for convenience. |

| Payment Tracking | Receive confirmations for each transaction. |

| Accessibility & Reliability | Ideal for users without online banking access. |

13. Walmart Bill Pay

Walmart Bill Pay, customers can pay bills and do their shopping in one trip. Walmart Pay supports utility, telecom, and other common billers which can be paid online or in-store.

Bills can be consolidated for one scheduled payment and payment history can be viewed for easy management along with instant receipts.

This service is designed for customers who want to combine shopping with bill payment, and offers ease and peace of mind.

Walmart Bill Pay is a key integration into Walmart’s services, solidifying its position as a one-stop shop for consumers seeking to manage household, errands, and bills.

| Feature | Description |

|---|---|

| In-Store & Online Payments | Pay bills during shopping trips or online. |

| Multi-Biller Support | Manage utility, telecom, and other common bills. |

| Immediate Receipts | Confirm payment instantly with receipts. |

| Bill History Tracking | Track past payments for record-keeping. |

| User-Friendly Interface | Simple and accessible for everyday users. |

14. PayPal

Every day, people complete personal and business transactions, and even online bill payments, through PayPal.

It provides functions like secure money transfer, bill payments, and multiple account administration.

PayPal connects with thousands of merchants and billers making it easy to process payments domestically and internationally.

For freelancers, small businesses, and individuals, PayPal’s platform is useful thanks to its invoicing, recurring billing, and payment tracking features.

PayPal provides safe and reliable payments thanks to its robust security features and buyer and seller protection.

Users who seek a single platform for all their financial transactions can also enjoy PayPal’s mobile and web access.

| Feature | Description |

|---|---|

| Online Bill Payments | Pay bills through PayPal’s secure platform. |

| Invoicing & Recurring Payments | Create invoices and schedule recurring payments. |

| Multi-Currency Support | Send and receive money internationally. |

| Buyer & Seller Protection | Secure transactions with fraud prevention. |

| Mobile & Web Access | Manage bills from any device. |

15. Stripe

Stripe is mainly targeted at developers and online businesses who require strong payment infrastructure.

It offers multiple features like recurring billing, subscription management, and global payments.

For automated bill collection, invoicing, and payment reconciliation, businesses can integrate Stripe through their APIs.

Stripe’s tools for fraud prevention, reporting, real-time analytics, and risk management are robust. For ease of vendor payouts, Stripe allows marketplaces to split payments to multiple recipients.

Because it is easy for developers to customize payment tools, Stripe is a great fit for online billing and payment management for startups, e-commerce, and SaaS businesses.

| Feature | Description |

|---|---|

| Subscription Billing | Automate recurring payments for services. |

| Global Payments | Accept payments in multiple currencies. |

| Developer APIs | Customizable integration for websites and apps. |

| Fraud Detection | Protects against payment fraud. |

| Reporting & Analytics | Insights into payment trends and financial health. |

16. Square

Square provides a complete set of payment features for contractors and small businesses, including tools for paying bills, point-of-sale transactions, invoicing, and reporting.

Customers can build and send invoices, set up payments to be automatically charged, and receive payment by cards and digital wallets.

Square is integrated with hardware tools barring POS terminals for in-person transactions. It also provides tools for tracking cash flow, financial reporting, and supports subscription billing, which adds to its functionality.

Square is appreciated for being user-friendly and decreasing payment related administrative tasks and obtaining payment promptly and paying for services on time, thereby proving its worth for small businesses and entrepreneurs.

| Feature | Description |

|---|---|

| Invoicing & Billing | Create and send invoices with payment tracking. |

| Point-of-Sale Integration | Manage in-person transactions alongside online payments. |

| Recurring Payments | Automate scheduled billing. |

| Analytics & Reporting | Track revenue, sales, and customer data. |

| Multiple Payment Methods | Accept credit cards, digital wallets, and more. |

17. Zelle

Zelle also lets customers make payments using their smartphones and bank accounts and without payment apps.

Most major U.S. banks support Zelle, and customers with Zelle linked to their accounts can make and receive payments for services in a matter of minutes, and there is no payment fee.

Zelle is great for people within a household paying their bills, paying their monthly rent, and for families and friends sending money to each other.

Zelle’s virtually instant payments make checks unnecessary and there is no need for third party apps to complete transactions.

From a user’s perspective, the Zelle system integrated with their online banking system is very convenient because of the instant payment features available, as well as the comfort of using their banking system for payments and personal transactions.

| Feature | Description |

|---|---|

| Instant Transfers | Send and receive money quickly between bank accounts. |

| Bank Integration | Works directly within most major U.S. banking apps. |

| No Fees | Free peer-to-peer payments and bill splitting. |

| Easy Setup | Simple registration with email or phone number. |

| Secure Transactions | Payments protected by participating banks’ security measures. |

Conclsuion

To summarize, the most effective online bill pay services simplify the management of finances, increase security of payments, and save a considerable amount of time.

PayPal, Zelle, and Doxo focus on the consumers, whereas Rippling, Bill.com, and Tipalti are aimed at businesses, and all of them have considerable value due to their unique features.

Each of these services will help you minimize mistakes, streamline your payments, and help you better handle your finances whether they are personal or professional.