In the article, I will detail the Best Aggregator Tools for DEX Trading which help users pinpoint the best value per price across various DEXs.

DEX Aggregator Tools improve trade efficiencies by optimizing slippage and cutting down on fees.

These tools also help in multi-chain transactions. Whether users are new to DeFi or seasoned pros

DEX Aggregator tools provide an optimal experience while making token swaps on DEXs rapid and economically sensible.

Key Points & Best Aggregator Tools For Dex Trading

| Aggregator Tool | Key Points |

|---|---|

| 1inch | Offers best price discovery by splitting trades across multiple DEXs; supports Ethereum, BSC, Polygon, and more. |

| Jupiter | Solana-focused aggregator; optimizes routes to provide best swap rates on Solana ecosystem. |

| Matcha | User-friendly interface by 0x; finds best prices across multiple DEXs; supports limit orders. |

| Paraswap | Aggregates liquidity from multiple DEXs; provides gas-efficient trades and price protection. |

| OpenOcean | Multi-chain DEX aggregator; supports cross-chain swaps with best rate routing. |

| Zapper | Focused on DeFi portfolio management and yield optimization; integrates multiple DEXs for swaps. |

| Firebird Finance | Optimizes trading routes on BSC and Polygon; focuses on low slippage swaps. |

| LI.FI | Cross-chain aggregator enabling multi-chain swaps; focuses on bridging and routing efficiency. |

| KyberSwap | Provides liquidity aggregation across multiple DEXs; supports token swaps with competitive rates. |

| Beefy Finance | Yield optimizer platform; uses DEX aggregators for automated profit maximization strategies. |

10 Best Aggregator Tools For Dex Trading

1. 1inch

1inch is among most well-known decentralized exchange (DEX) aggregators in the crypto space.

It services a range of DEXs to obtain the most well-priced trade offers and executes the trade by breaking the order into various sizes to obtain the most liquidity and the lowest slippage.

Available on the Ethereum, Binance Smart Chain, and Polygon blockchains, 1inch employs optimized algorithms to trade.

1inch also offers limit orders, governance liquidity pools via the 1INCH token, and other components of the system.

The user-friendly platform and wallet integrations attract users who look for effective and affordable decentralized trading.

Features 1inch

- Best Price Discovery: Splits your trades across a number of DEXs to get the best available rate.

- Multi-chain Support: Functions in Ethereum, BSC, Polygon, and a few others.

- Low Slippage Execution: Trade slippage is minimized with advanced route execution.

- More DeFi Functionality: Limit orders, liquidity pools and governance with the 1INCH token.

2. Jupiter

Jupiter is one of the best DEX aggregators on the Solana blockchain. Along with automated market makers on Solana, it analyses the best token swap and token swap throughout the available AMMs and DEXes.

Through advanced routing algorithms, Jupiter provides customers with the best value on their trades, optimizing for slippage and fees.

Jupiter is focused on speed, providing rapid processing of orders because Solana DEXes and AMMs are available in real-time.

Jupiter is able to quickly process token swaps requests as customers on Solana prefer speed and efficiency.

Jupiter provides integration to Solana wallets and offers a cross platform and price discovery and efficient value exchange.

Features Jupiter

- Solana Optimized: Built to be the best DEX for Solana ecosystem swaps.

- The Best Price Split: Best price is calculated by splitting trades across multiple Solana DEXs.

- Quick and Cheap: Solana has the fastest and lowest cost transactions in the market.

- Simple Dashboard: Solana wallets and Dapps can be integrated simply.

3. Matcha

Developed by 0x, Matcha is a DEX aggregator designed for ease of use, offering clients the best possible swap rates across different decentralized exchanges.

It leverages 0x’s liquidity protocol, which dynamically assesses hundreds of liquidity sources, splitting trades to optimize prices and minimize slippage.

It features limit and recurring orders, bridging the gap between decentralized finance and traditional trading.

Matcha’s intuitive and simple interface, which integrates seamlessly with wallet software, is designed for all levels of experience, from novices to expert traders.

For all these reasons and more, Matcha is recognized and trusted in the DEX aggregator space.

Features Matcha

- 0x DEX Aggregation: Checks multiple DEXs to get the best rate for your swap.

- Efficient Trade Route: Slippage is reduced by cutting the trades into multiple pieces and reallocating trade routes.

- More Advanced Functionalities: Limit orders and other advanced functions like recurring swaps.

- User-Friendly Interface: Dashboard designed for ease for new traders and advanced users.

4. Paraswap

Paraswap is a Defi Swapping services aggregator providing users with optimal swapping prices by pooling liquidity from different Defi exchanges.

Its complex routing algorithms with trade execution minimize users’ slippage and reduce transaction fees.

Paraswap is compatible with several Ethereum layer networks and chain-agnostic wallets, smart contracts, and dApps, allowing Paraswap users to facilitate cross-chain transactions.

Traders appreciate Paraswap interface due to execution of complex and large trades and gas optimization tools. It is also simple and user friendly.

Thanks to Paraswap liquidity and gas optimization tools, professional Defi users are able to execute trades in a decentralized and trustless environment. Paraswap is focused on the value of the trade for the user.

Features Paraswap

- Liquidity Aggregation: DEXs are combined in order to determine the best swap rates.

- Optimization of Slippage and Fees: Overall transaction costs is reduced by smart routing.

- Cross-Chain Support: Allows swaps on Ethereum compatible networks.

- Easy Integration: Will work with wallets, dApps, and smart contracts.—

5. OpenOcean

OpenOcean strives to be the one-stop-shopping destination as a DEX aggregator across blockchains for value-seeking traders.

OpenOcean serves Ethereum, BSC, Polygon, Solana, and other ecosystems, and offers the flexibility to traders in both single-chain and cross-chain swaps.

OpenOcean’s proprietary Smart Order Routing Technology optimizes trade execution, and the system mitigates price slippage by spreading liqudity across multiple sources.

OpenOcean’s uncomplicated interface and sophisticated wallet integrations guarantee consumer focus.

By extending cross network access to liquidity and favorable trade execution, OpenOcean offers traders the opportunity to efficiently and economically interface with multiple DeFi networks to optimize the DeFi ecosystem.

Features OpenOcean

- Multi-Chain Aggregation: Ethereum, BSC, Polygon, Solana, Avalanche. Plus more.

- Routing Optimization: Trades are split across different DEXs to get the best prices.

- Cross-Chain Swaps: Enables trading on a single chain or multiple chains.

- User Friendly: Simple design and wallet integrations for straightforward trading.

6. Zapper

Zapper offers DeFi investors a unique glimpse into their portfolios through aggregation, monitoring, and yield optimization.

Token swaps are a breeze through a variety of DEXs and users are able to keep tabs on their entire DeFi portfolio through a single screen.

Zapper makes yield farming, staking, and liquidity provision effortless as it automates and enhances the optimization of investments.

Zapper’s integration as a DEX aggregator means users’ trades are guaranteed the best market rates through swaps on a variety of decentralized exchanges.

Added automation of Zapper’s customizable trade analytics and dashboards provide the vision traders seek, while the automation sells efficiency for the asset management and yield farming integration.

Features Zapper

- Portfolio Management: View and track all your DeFi assets in one place.

- DEX Aggregation: Achieves the best prices by swapping through multiple DEXs.

- Yield Optimization: Eases the processes of staking, farming, and providing liquidity.

- Dashboard Insights: Automated strategies and analytics for efficiency in your portfolio.

7. Firebird Finance

Firebird Finance specializes in serving as a decentralized exchange (DEX) aggregator focused on optimizing swap values on Binance Smart Chain (BSC) and Polygon – minimizing slippage in the process.

The platform’s innovative algorithms define transaction partitioning and determine the best execution venues from a multitude of liquidity providers in the system to maximize trader’s profit on a transaction.

With a high focus on gas consumption optimization, users’ transaction costs are minimized. Along with speed of execution, transaction cost minimization is a highly prioritized customer feature.

With the amount of attention on low slippage, broad access to liquidity, and multi-chain compatibility, Firebird Finance meets impressive standards on efficiency for those aiming to enhance their trading experience in DeFi.

Features Firebird Finance

- Multi-Chain Support: Mostly on BSC and Polygon.

- Low Slippage Trading: Routes your trade through a relevant DEX to minimize price impact.

- Gas Optimization: Eases the transaction costs.

- Interface: Minimal and clear design for traders of every level.

8. LI.FI

LI.FI is a cross-chain DEX aggregator that allows users to swap tokens over different blockchains seamlessly.

LI.FI integrates DEX aggregation and bridging to allow users to swap assets over different chains. LI.FI uses smart routing algorithms that minimize slippage and transaction costs to guarantee that users get the lowest rates.

LI.FI partnered with Ethereum, BSC, Polygon, and Avalanche to allow traders to complete multi-chain transactions without employing multiple traders.

LI.FI is designed for users that need to complete cross-chain DeFi strategies because of the opacity, high rates, and long wait times of other systems. LI.FI’s wallet and DeFi protocol integration streamline its use in the DeFi ecosystem.

Features LI.FI

- Cross-Chain Swaps: Swap assets across different blockchains.

- Best Rates: Gets best rates through DEX Aggregation on all supported networks.

- Smart Routing: Slippage and transaction costs are significantly lowered.

- Integration: Compatible with top wallets and DeFi protocols.

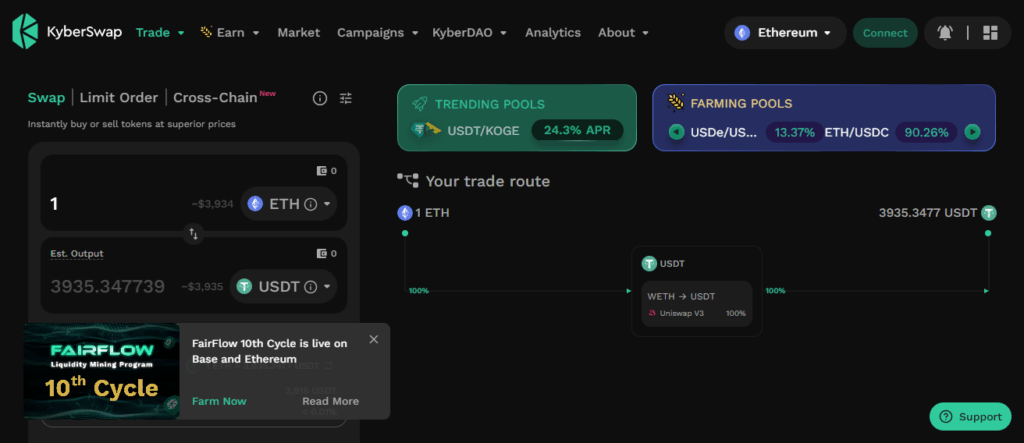

9. KyberSwap

KyberSwap is a decentralized exchange aggregator, and it maganges to assemble liquidity across a number of different DEXs to guarantee the best price for a token swap.

It uses the Kyber Network’s liquidity protocol to execute rapid, low-slippage transactions, and it works on multiple Ethereum-compatible chains.

KyberSwap’s clever routing system determines the best possible paths for trades, and it may even split orders across multiple different liquidity sources to achieve better execution.

Apart from swaps, KyberSwap offers analytics to assist users in optimizing their trading strategies, as well as the option of providing liquidity.

Relaible performance, seamless wallet integration, and ease of use explain KyberSwap’s popularity among traders looking for secure and efficient solutions for decentralized trading.

Features KyberSwap

- Liquidity Aggregation: Pools DEX liquidity to get better rates for swapping.

- Advanced Routing: Optimizes DEX use by splitting a single trade among multiple sources.

- Multi-Chain Support: Available on all Ethereum-compatible networks.

- Analytics & Tools Provides trading insights and liquidity provision options.

10. Beefy Finance

Beefy Finance functions as a DeFi yield optimization solution by automating farming strategies and efficiently executing trades using DEX aggregators.

It pools user funds and implements optimized strategies for yield farming, liquidity providing, and staking, to maximize respective returns.

It works with many different blockchains and DEXs and is therefore able to search for and find the best prices for swaps and liquidity provision.

Most users appreciate the benefits of automatic compounding, which increases profits while requiring less manual effort.

The first and only fully decentralized liquidity DEX aggregation and efficient asset management system, with transparent control and multi-chain support

Automatic compounding, secure smart contracts, and a user-friendly interface, allows users to access and control their resources.

Features Beefy Finance

- Yield Optimization: Automates farming strategies for maximum returns.

- DEX Integration: Uses aggregators for efficient swaps and liquidity management.

- Multi-Chain Support: Works across multiple blockchains for diversified strategies.

- Automation & Transparency: Automatic compounding and clear dashboards for users.

Conclsuion

In summary, tools such as 1inch, Jupiter, Matcha, Paraswap, OpenOcean, Zapper, Firebird Finance, LI.FI, KyberSwap, and Beefy Finance DEX aggregators facilitate decentralized trading by guaranteed best prices, minimal slippage, and support across various chains.

Efficient routing, portfolio management and yield optimization empower users, making trading in DeFi seamless, affordable, and within reach for novices and seasoned participants.

FAQ

Most support Ethereum, BSC, Polygon, Solana, Avalanche, and other major blockchains.

Yes, it’s widely trusted with audited smart contracts and a strong community reputation.

Aggregators like LI.FI and OpenOcean support cross-chain token swaps.

Yes, they split trades across multiple DEXs to minimize price impact.

Yes, tools like Matcha, Jupiter, and Zapper have simple, intuitive interfaces.