This article will focus on the leading crypto exchanges that offer cross-chain liquidity swaps—venues that facilitate effortless transfers of assets between various blockchains.

As the DeFi space becomes largely interconnected, these exchanges serve an important function in connecting Ethereum, BNB Chain, and Polygon.

We will examine their characteristics and advantages, and the ways in which they ease multi-chain trading for both users and developers.

Key Points & Top Crypto Exchanges for Cross-Chain Liquidity Swaps 2025

Symbiosis – Known for its SIS Chain and deep liquidity routing across multiple networks

1inch – A powerful aggregator that sources liquidity from numerous DEXs and bridges

Li.Fi – Integrates with 20+ bridges and DEXs for efficient multi-chain swaps

Rango Exchange – Offers wide network coverage and excels in NFT and gaming ecosystems

LetsExchange – Registration-free platform supporting 5,000+ coins across 300+ blockchains

THORChain – Enables native cross-chain swaps without wrapped assets

Socket – Offers modular liquidity routing and bridge aggregation

Across Protocol – Known for fast and cost-efficient bridging across L2s

Orbiter Finance – Specializes in L2-to-L2 swaps with low fees

XY Finance – Offers cross-chain swaps and yield aggregation across major networks

10 Crypto Exchanges For Cross-Chain Liquidity Swaps

1. Symbiosis

Symbiosis allows users to perform decentralized cross-chain swaps. The platform allows users to perform swaps and navigate the intricate token bridging systems.

Its SIS token allows ease of use in decentralized finance. Symbiosis owns SIS Chain which allows the facility to track the liquidity and perform fast and secure swaps.

Symbiosis is important to users and protocols to transfer tokens in ecosystems like Ethereum, Polygon, BNB Chain, and others.

Symbiosis can also be used to perform cross-chain swaps even in the absence of centralized exchanges and wrapped tokens.

Symbiosis Features

| Feature | Description |

|---|---|

| Cross-Chain Support | EVM & non-EVM chains (Ethereum, BNB, Polygon, etc.) |

| Native Token | SIS |

| Liquidity Routing | Via SIS Chain |

| User Experience | Simple UI for seamless swaps |

| Custody | Non-custodial |

| Use Case | Traders and protocols seeking fast, secure cross-chain swaps |

2. 1inch

1inch has developed into a premier DEX aggregator. It offers the best swap rates by drawing liquidity from numerous decentralized exchanges.

1inch not a bridge, but it facilitates multi-chain swaps by integrating with cross-chain protocols. Pathfinder ensures minimal slippage at optimal pricing.

For users interested in fast and inexpensive token swap, 1inch services are most suitable. It caters to other essential DeFi functionalities, providing wallets and staking services. It caters to advanced users and offers DeFi functionalities to beginners at the same time.

1inch Features

| Feature | Description |

|---|---|

| Aggregator Type | DEX & bridge aggregator |

| Routing Algorithm | Pathfinder for optimal pricing |

| Supported Chains | Ethereum, BNB Chain, Polygon, Arbitrum |

| Wallet Integration | Native wallet with staking features |

| Custody | Non-custodial |

| Use Case | Efficient token swaps with minimal slippage |

3. Li.Fi

Li.Fi offers cross-chain liquidity and bridge aggregation, linking users with over 20 bridges and DEXs.

It offers smart routing, atomic swaps, and gas optimization tools to simplify the transfer of assets between blockchains.

Developers can add Li.Fi’s SDK to their dApps to provide cross-chain access and liquidity. It supports Ethereum, Optimism, Arbitrum, Polygon, and Avalanche chains.

Li.Fi is most useful to DeFi protocols, wallets, and NFT platforms because their users need unrestricted asset transfer and cross-chain access without multiple bridge integrations.

Li.Fi Features

| Feature | Description |

|---|---|

| Aggregator Type | Bridge + DEX aggregator |

| Developer Tools | SDK & APIs for dApp integration |

| Supported Chains | Ethereum, Optimism, Arbitrum, Polygon, Avalanche |

| Routing Intelligence | Smart routing with gas optimization |

| Custody | Non-custodial |

| Use Case | dApps and wallets needing seamless cross-chain functionality |

4. Rango Exchange

Rango Exchange is a multi-chain DEX and bridge aggregator excelling in EVM and non EVM chains, including Cosmos and Solana.

It offers a unified interface to users to swap tokens in different ecosystems. Using DEXs and bridges, Rango’s routing engine determines the most efficient path to execute a swap.

It is widely used in the NFT and Gaming sectors because of their extensive multi-chain support.

It’s also a developer favorite for embedding cross-chain capabilities in wallets and dApps. For complex swaps, deep liquidity, and intuitive UI are most important. Rango is the first choice for most users because of these two parameters.

Rango Exchange Features

| Feature | Description |

|---|---|

| Chain Coverage | EVM & non-EVM (Cosmos, Solana, etc.) |

| Routing Engine | Combines DEX and bridge liquidity |

| Developer Tools | API access for integration |

| UI Experience | Intuitive interface |

| Custody | Non-custodial |

| Use Case | NFT/gaming platforms and complex swaps |

5. LetsExchange

LetsExchange is a non-custodial crypto exchange offering services for 5,000+ coins and tokens for over 300+ blockchains.

It enables swaps with no upper limit and does not require users to register. This is for the users who prefer privacy.

LetsExchange does not use traditional bridges to execute cross chain swaps. Instead, it has integrated liquidity providers and smart routing.

The platform prioritizes simplicity, requiring users to perform a few clicks to exchange assets.

It is specially designed for traders and investors who want to diversify their crypto portfolios across other blockchains and and want to ignore wallets and bridges.

LetsExchange Features

| Feature | Description |

|---|---|

| Asset Coverage | 5,000+ coins across 300+ blockchains |

| Registration | Not required |

| Swap Limits | No upper limits |

| Routing | Smart routing via liquidity providers |

| Custody | Non-custodial |

| Use Case | Privacy-focused users and portfolio diversification |

6. THORChain

THORChain is a decentralized liquidity protocol that allows you to swap assets between different blockchains natively and without wrapping tokens first.

It allows swaps across blockchains by bonding liquidity with RUNE, the native token, in unique liquidity pools. It supports Bitcoin, Ethereum, BNB Chain, Litecoin, and more.

The customer’s assets remain in their custody throughout the swap, which makes THORChain extremely trustless.

It is non-custodial and ideal. It powers interfaces such as THORSwap and supports liquidity providing which generates yield in DeFi. It is also a critical tool for liquidity providers.

THORChain Features

| Feature | Description |

|---|---|

| Native Asset Swaps | No wrapped tokens |

| Liquidity Mechanism | RUNE-bonded pools |

| Supported Chains | Bitcoin, Ethereum, BNB Chain, Litecoin |

| Custody | Full asset custody during swaps |

| Interfaces | THORSwap and others |

| Use Case | Trustless cross-chain trading and yield generation |

7. Socket

Socket is a modular interoperability protocol designed to create efficient and secure cross-chain asset transfers. It provides a unique smart routing function for swaps by pooling bridges and liquidity.

Its architecture allows developers to craft bespoke cross-chain solutions using its interoperability SDK and APIs.

It includes Ethereum, Polygon, Arbitrum, and Optimism in its support. Self-service bridging and a seamless experience for end users is particularly appealing to decentralized apps (dApps).

In Search of DeFi composability, and speed for cross-chain functionality, interoperability protocols and DeFi builders look to Socket.

Socket Features

| Feature | Description |

|---|---|

| Interoperability Model | Modular protocol with bridge aggregation |

| Developer Tools | SDK & APIs |

| Supported Chains | Ethereum, Polygon, Arbitrum, Optimism |

| Routing | Smart liquidity routing |

| Custody | Non-custodial |

| Use Case | Scalable cross-chain infrastructure for dApps |

8. Across Protocol

Across Protocol is a cross-chain bridge that prioritizes rapid and cost-efficient transactions while maintaining robust security.

It adopts a relayer model to quickly bridge Ethereum to Layer 2s: Arbitrum, Optimism, and Base.

It minimizes slippage and gas costs by routing transactions to liquidity pools with slippage and gas costs bypassed with incentivized relayers.

Users wanting to transfer assets between L2s quickly will love Across, as other options are slow and costly.

It also targets developers, providing tools to incorporate cross-chain interactions into their applications.

Their dedication to user experience and overall performance is why they excel at providing a bridge service.

Across Protocol Features

| Feature | Description |

|---|---|

| Bridge Model | Relayer-based |

| Supported Chains | Ethereum, Arbitrum, Optimism, Base |

| Speed & Cost | Fast transfers with low gas and slippage |

| Developer Tools | APIs & SDKs |

| Custody | Non-custodial |

| Use Case | Fast L2-to-L2 transfers for DeFi users |

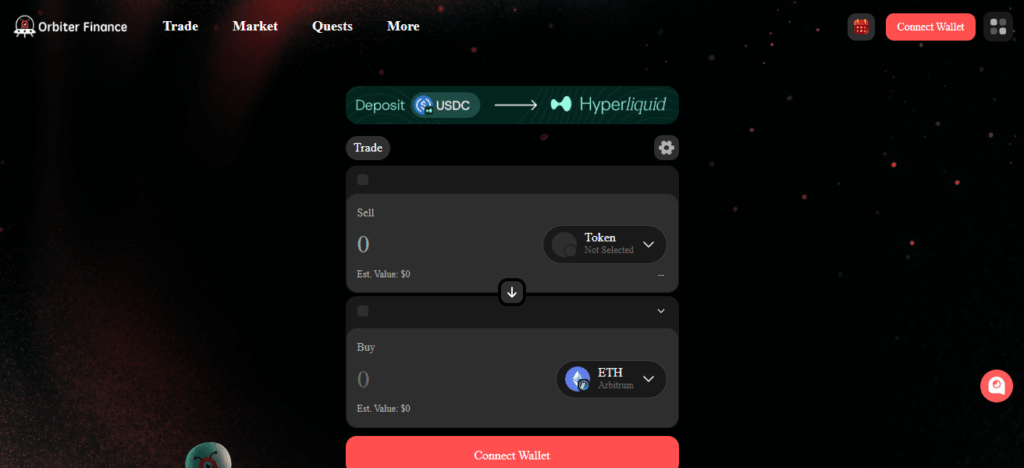

9. Orbiter Finance

Orbiter Finance is a decentralized cross-rollup bridge catering to users wishing to conduct fast and low-cost transactions between Layer 2 networks.

Their service extends to Arbitrum, Optimism, zkSync, and StarkNet as well. With their own peer-to-peer model, Orbiter reduces reliance and gas costs associated with center relayers, as senders and receivers interact directly.

This is valuable to DeFi users that smoothly transition assets between Layer 2 networks to unlock yield and gas savings.

Their user-friendly interface and small fee structure are also appealing to traders and protocols embedded within Ethereum’s layer scaling ecosystem.

Most traders and protocols within the Ethereum scaling ecosystem appreciate effortless moving between Layer 2 networks.

Orbiter Finance Features

| Feature | Description |

|---|---|

| Bridge Type | Peer-to-peer cross-rollup bridge |

| Supported Chains | Arbitrum, Optimism, zkSync, StarkNet |

| Fees | Low-cost transfers |

| UI | Simple interface |

| Custody | Non-custodial |

| Use Case | Frequent L2 asset movers and yield seekers |

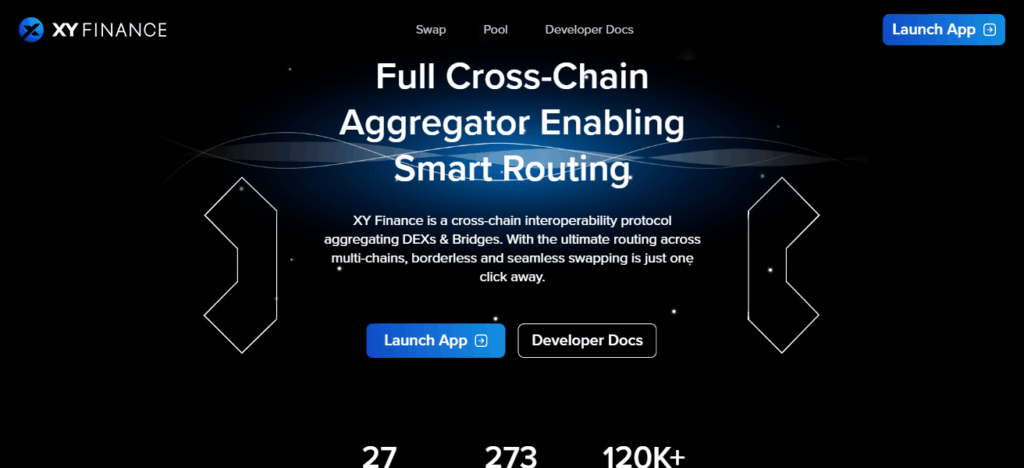

10. XY Finance

XY Finance functions as a swap and yield aggregator decentralized across the Ethereum, BNB Chain, Polygon, and Avalanche blockchains.

It merges bridge and DEX liquidity which creates reliable yield transfer and acquisition functions. XY Finance has a simple one-click swap and NFT bridging functionality.

Rentable integrations include APIs and SDKs. XY Finance is appropriate for users seeking to coordinate multi-chain DeFi protocols encompassing swaps, staking, and liquidity provisioning.

XY Finance Features

| Feature | Description |

|---|---|

| Swap + Yield | Combines cross-chain swaps with yield aggregation |

| Supported Chains | Ethereum, BNB Chain, Polygon, Avalanche |

| NFT Support | NFT bridging capabilities |

| Developer Tools | APIs & SDKs |

| Custody | Non-custodial |

| Use Case | DeFi users optimizing strategies across chains |

Conclusion

In conclusion, The best crypto exchanges for cross-chain liquidity swaps allow users to execute cross-chain activities seamlessly, swiftly, securely, and at lower costs.

Symbiosis, THORChain, Li.Fi, and Rango are at the forefront, providing extensive liquidity, intelligent routing, and wide network compatibility.

These features cater to DeFi users needing simple, non-custodial solutions for trading across multiple chains.

FAQ

It’s the exchange of crypto assets between different blockchains without using centralized exchanges.

THORChain and Symbiosis support native swaps without wrapped tokens.

Platforms like LetsExchange offer registration-free swaps.

Yes, most—including 1inch, Li.Fi, and Socket—are non-custodial.

Rango Exchange and Symbiosis support a wide range of chains.