This article focuses on the Best Crypto Exchanges for Launchpad Investments. These are the platforms

Where participants can buy promising blockchain projects before they even launch. These exchanges ensure safe environments to access vetted token sales.

Consequently, investors can take part in sales for the newest big opportunities in the crypto market.

All traders, beginners or the most seasoned, need to pick the most strategically advantageous launchpad for their crypto investments.

Key Points & Best Crypto Exchanges for Launchpad Investments

Binance Launchpad: Premier platform offering vetted token sales with global reach and strong investor protection.

TrustPad: Secure multi-chain launchpad enabling decentralized fundraising for promising blockchain projects.

BullPerks: Community-driven launchpad and VC platform supporting early-stage crypto startups with fair access.

Red Kite: Polkadot-powered launchpad focused on transparency, investor safety, and high-quality project selection.

Polkastarter: Decentralized IDO platform enabling cross-chain token launches with strong community engagement.

Seedify Fund: Incubator and launchpad supporting GameFi and metaverse projects with strategic backing.

Bybit Launchpad: Centralized platform offering token launches with transparent allocation and growing popularity.

Gate.io Startup: Frequent token launches with diverse project selection and strong exchange liquidity.

KuCoin Spotlight: Launchpad offering early access to innovative projects with global user base.

OKX Jumpstart: Curated token sales with compliance focus and seamless integration into OKX ecosystem.

10 Best Crypto Exchanges for Launchpad Investments

1. Binance Launchpad

Binance Launchpad is the largest and most prominent token launch platform in the industry. Users of Binance Launchpad get early access to high quality blockchain projects.

Due to Binance’s long standing reputation in the industry and its large user base and liquidity, investor protection is ensured.

Due to the token projects launched on Binance Launchpad gaining high visibility and high trading volume, it has become a top choice for project developers and investors alike.

Due to its successful project launches, such as Axie Infinity and Sandbox, it sets the standard for crypto fundraising and early-stage investment opportunities.

Features Binance Launchpad

| Feature | Description |

|---|---|

| Platform Type | Centralized |

| Token Distribution Model | Lottery-based allocation |

| Vetting Process | Rigorous due diligence and compliance checks |

| User Base | Largest global crypto exchange |

| Notable Launches | Axie Infinity, Sandbox, Polygon |

| Participation Requirement | Hold and stake BNB tokens |

| Investor Protection | High – backed by Binance’s security and legal infrastructure |

| Liquidity Support | Immediate listing on Binance with deep liquidity |

2. TrustPad (Launchpad)

TrustPad is a multi-chain decentralized launchpad that strives to create a safe and compliant fundraising environment.

With supportive networks on BNB Chain, Ethereum, and Polygon, TrustPad is able to expand to different ecosystems.

TrustPad is unique in that it prioritizes investor protection with KYC procedures and audits on all smart contracts.

TrustPad creates a balanced ecosystem with tiered participation, giving all investors, big and small, opportunities to sponsored token sales.

TrustPad is well known in the industry for ease of use and transparency. TrustPad is now an established decentralized capital launchpad for the early crypto industry, with a growing portfolio of completed IDOs.

Features TrustPad

| Feature | Description |

|---|---|

| Platform Type | Decentralized, multi-chain |

| Supported Chains | BNB Chain, Ethereum, Polygon, Solana |

| Token Distribution Model | Tiered staking system |

| KYC Requirement | Yes, for investor safety |

| Community Governance | DAO-based decision-making |

| Security Measures | Smart contract audits and compliance |

| Project Categories | DeFi, NFTs, Web3 |

| Accessibility | Inclusive for small and large investors |

3. BullPerks (Launchpad)

BullPerks functions as a decentralized launchpad and as a venture capitalist. It provides access to early-stage crypto projects to retail investors that are usually available only to venture capitalists.

Access to the platform is gated based on staking, which is tiered and designed to reward users based on their retention.

It provides support for multi-chain launches and focuses on the community for project votes. The platform has a reputation for excellent due-diligence and focuses on strategic partnerships.

BullPerks seamlessly aligns the incentives of the investors and the projects, thereby, fostering trust.

It is focuses on users who are interested in the investment and the governance of the projects.

Features BullPerks

| Feature | Description |

|---|---|

| Platform Type | Decentralized Launchpad + VC model |

| Token Distribution Model | Tiered staking with guaranteed allocations |

| Community Focus | Strong – retail investors gain VC-level access |

| Supported Chains | Multi-chain (BNB, Ethereum, Polygon) |

| Governance | Community voting and feedback |

| Security | KYC and smart contract audits |

| Project Vetting | High-quality, early-stage crypto startups |

| Unique Offering | Dual launchpad and investment platform |

4. Red Kite (Launchpad)

Red Kite is a Polkadot-native launchpad developed by the PolkaFoundry team, offering a secure and transparent environment for token sales.

It focuses on high-quality project curation, rigorous vetting, and investor protection. Red Kite supports multi-chain launches and integrates with KYC/AML protocols to ensure compliance.

The platform uses a tiered system for participation, rewarding long-term supporters with better allocation opportunities. With a strong emphasis on community governance and fairness

Red Kite has hosted several successful IDOs across DeFi, GameFi, and NFT sectors. Its integration with the Polkadot ecosystem gives it a unique edge in cross-chain project support.

Features Red Kite

| Feature | Description |

|---|---|

| Platform Type | Decentralized (Polkadot-native) |

| Token Distribution Model | Tiered staking and whitelist system |

| Compliance | KYC/AML integrated |

| Supported Chains | Polkadot, Ethereum, BNB Chain |

| Project Vetting | Strict quality control |

| Community Role | Governance and project selection |

| Launch Categories | DeFi, GameFi, NFTs |

| Security | Smart contract audits and investor protection |

5. Polkastarter (IDO Platform)

Polkastarter is a decentralized IDO platform that enables cross-chain token pools and auctions. Built on Ethereum and Polkadot, it allows projects to raise capital in a decentralized, interoperable environment.

Polkastarter is known for its community-driven approach, with users participating in governance and project selection. The platform uses a whitelist and lottery system to ensure fair token distribution.

It supports a wide range of project categories, including DeFi, NFTs, and Web3 infrastructure.

With a strong track record of successful launches and a vibrant community, Polkastarter remains a leading choice for early-stage crypto investments and decentralized fundraising.

Features Polkastarter

| Feature | Description |

|---|---|

| Platform Type | Decentralized IDO platform |

| Token Distribution Model | Whitelist and lottery system |

| Supported Chains | Ethereum, Polkadot, BNB Chain, Polygon |

| Community Engagement | High – users vote and participate in governance |

| Project Categories | DeFi, NFTs, Web3 |

| Accessibility | Open to retail investors |

| Security | Audited smart contracts |

| Unique Feature | Cross-chain token pools and auctions |

6. Seedify Fund (Launchpad/Incubator)

Seedify is a blockchain incubator and launchpad focused on GameFi, metaverse, and play-to-earn projects. It offers funding, mentorship, and marketing assistance to early stage ventures scaling successfully.

Via a tiered staking system, investors can engage in token sales and gain early access to projects with high potential.

Seedify fosters community and provides a DAO governance framework, enabling token owners to shape governance actions.

This gaming and metaverse ecosystem focus has cultivated a committed community and many successful project launches. For those interested in blockchain gaming, Seedify represents a compelling opportunity.

Features Seedify Fund

| Feature | Description |

|---|---|

| Platform Type | Launchpad + Incubator |

| Focus Areas | GameFi, Metaverse, Play-to-Earn |

| Token Distribution Model | Tiered staking system |

| Community Governance | DAO-based decision-making |

| Support Services | Funding, mentorship, marketing |

| Security | KYC and smart contract audits |

| Notable Launches | Gaming and metaverse projects |

| Accessibility | Inclusive for small investors |

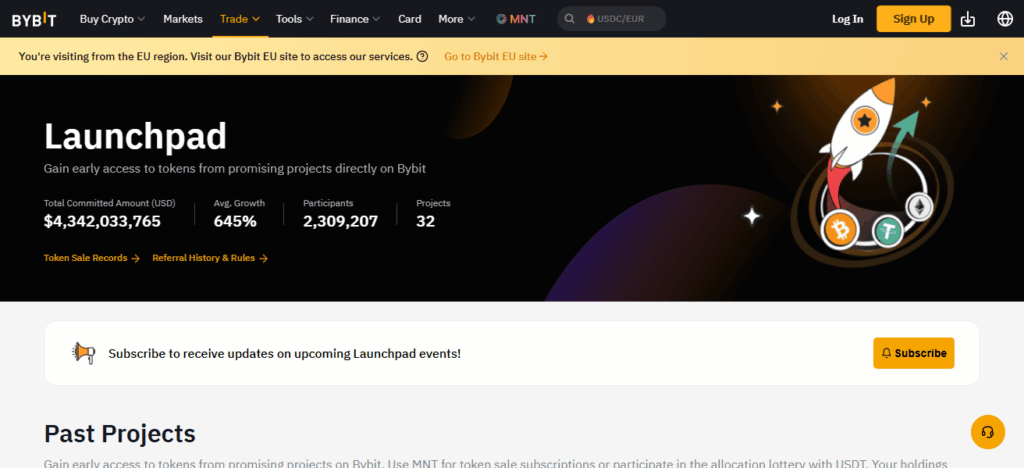

7. Bybit (Launchpad)

Bybit Launchpad is a vetted service within the Bybit ecosystem that issues Digital Assets through the Bybit trading platform.

It is a vetted service that helps Bybit’s ecosystem to achieve decentralized trading activities in a subscription-based model.

Users place BIT tokens in order to participate in token launches. Bybit assesses the quality of assets to ensure a satisfied clientele. With more and more assets being successfully launched and the platform being user-friendly

Bybit Launchpad simplifies the process for new retail investors, and new blockchain startups receive easy access to a fundraising platform.

Features Bybit Launchpad

| Feature | Description |

|---|---|

| Platform Type | Centralized |

| Token Distribution Model | Subscription-based (using BIT tokens) |

| Compliance | High – due diligence and legal checks |

| User Base | Global retail and institutional investors |

| Liquidity Support | Immediate listing on Bybit |

| Project Vetting | Thorough screening process |

| Accessibility | Simple interface and clear participation rules |

| Security | Exchange-grade protection |

8. Gate.io (Startup / Launchpad)

Gate.io Startup is the token launch platform of the Gate.io exchange, with many launch projects on offer. Users receive early access to innovative blockchain initiatives spanning DeFi, NFTs, and Web3.

Participation Options include free airdrops and the purchase of launch tokens. Gate.io manages risks by auditing projects and relying on community insights.

Its large user community and significant liquidity present attractive conditions for initiating token launches.

Due to the consistent range of asset and robust performance, Gate.io Startup, provides investors looking for regular launchpad opportunities a great place to do so.

Features Gate.io Startup

| Feature | Description |

|---|---|

| Platform Type | Centralized |

| Token Distribution Model | Airdrops and token purchases |

| Launch Frequency | High – frequent new projects |

| Supported Categories | DeFi, NFTs, Web3 |

| User Base | Large global exchange |

| Security | Internal audits and KYC |

| Accessibility | Open to all Gate.io users |

| Liquidity Support | Fast listing on Gate.io |

9. KuCoin (Spotlight)

KuCoin Spotlight is the token launch platform of the KuCoin exchange, offering early access to promising crypto projects. It focuses on high-quality, vetted startups with strong fundamentals and growth potential.

KuCoin leverages its global user base and liquidity to support successful token launches. The platform uses a lottery-based allocation system, ensuring fairness and accessibility.

KuCoin Spotlight has hosted several notable projects that have seen significant post-launch performance. With a user-friendly interface and strong community engagement

It provides a reliable gateway for retail investors to participate in early-stage blockchain innovations and benefit from potential upside.

Features KuCoin Spotlight

| Feature | Description |

|---|---|

| Platform Type | Centralized |

| Token Distribution Model | Lottery-based allocation |

| Project Vetting | High-quality, innovative startups |

| User Base | Global retail investors |

| Security | Exchange-grade protection |

| Accessibility | Easy participation via KuCoin account |

| Liquidity Support | Listing on KuCoin with strong volume |

| Notable Launches | Several successful DeFi and Web3 projects |

10. OKX Jumpstart

As the launchpad arm of the OKX exchange, OKX Jumpstart offers carefully selected and compliant token sales to clients.

Users gain trusted and compliant access to vetted blockchain projects, leveraging OKX’s infrastructure and liquidity.

To take part in Jumpstart token sales, users are required to stake OKB tokens, and Jumpstart employs a subscription economic model.

OKX Jumpstart practices transparency while focusing on investor guarantying and regulatory adherence.

OKX Jumpstart has earned respect in the crypto industry and serves as a reliable platform to investors and developers alike in respect to diverse offerings, including DeFi, games and even infrastructure.

Features OKX Jumpstart

| Feature | Description |

|---|---|

| Platform Type | Centralized |

| Token Distribution Model | Subscription-based (using OKB tokens) |

| Compliance | Strong regulatory alignment |

| Project Vetting | Curated selection with quality control |

| User Base | Global OKX users |

| Security | Exchange-grade infrastructure |

| Launch Categories | DeFi, Gaming, Infrastructure |

| Liquidity Support | Immediate listing on OKX |

Conclusion

In conclusion, top launchpads in the crypto space provide access to new blockchain projects with growth potential in a manner that is safe and transparent.

Binance, TrustPad, and Polkastarter are the leaders in safeguarding their investors, supporting community-driven initiatives, and providing multi-chain.

Whether they are centralized or decentralized, each one allows for unique ways to access token sales, solidifying their place as must-have resources for crypto investing in 2025.

FAQ

A launchpad is a platform that hosts early-stage token sales, allowing investors to buy tokens before public listing.

Binance Launchpad is the most widely used, known for high-profile and secure token launches.

Yes, most centralized and some decentralized launchpads require KYC for compliance and investor protection.

Early access to promising projects, potential high returns, and vetted investment opportunities.

Most platforms require staking native tokens or holding a minimum balance to join token allocations.