In this article, we explore the Best Tether (USDT) Yield Opportunities in 2025. Investing has become easier in the digital age, especially with stablecoins.

There are several USDT earning streaming facilities available now, in Bybit, Binance, Aave, Curve Finance, and more.

We explore the options available in 2025 and try to help strike a balance between risk, liquidity and the expected earning.

Key Points & Best Tether (USDT) Yield Opportunities In 2025

Bybit: Flexible savings and lending deliver strong APY for USDT investors.

Binance: Combines flexible and locked savings products for diversified USDT yields.

Gate.io: Exchange lending enhanced by bonus tiers ensures higher USDT returns.

MEXC: High-rotation fixed and flexible yields attract active trading participants.

HTX: Structured USDT products provide predictable outcomes with defined parameters.

Aave: Decentralized lending offers 2–14% APY, instant withdrawals, no KYC.

Ledn: Centralized platform ensures stable 8.5% APY with regulatory compliance.

EarnPark: Advanced yield strategies target up to 35% APY opportunities.

De.Fi: Aggregates DeFi farming opportunities for optimized USDT staking rewards.

Curve Finance: Stablecoin liquidity pools deliver consistent yields through optimized protocols.

10 Best Tether (USDT) Yield Opportunities In 2025

1. Bybit

Bybit is the most distinguished in the USDT space among central exchanges for adjustableand fixed-term savings products with reserve disclosures.

USDT products at Bybit had a wide range of APR as of late (around 2.5% to 777% with higher exotic or leveraged offerings), although core fixed savings rates are on the conservative side.

Although BYBIT has a range of USDT products, With verified USDT reserves, Bybit’s APR has higher rates than most competitors, along with increasing flexibility and transparency, making Bybit stand out as a USDT products provider for Bybit’s potential customers.

Features Bybit

| Feature | Description |

|---|---|

| Flexible Savings | Users can deposit USDT with no lock-in period |

| Lending Options | Peer-to-peer lending for higher APY returns |

| Strong APY | Competitive yields compared to other centralized exchanges |

| User-Friendly | Simple interface for beginners and professionals |

2. Binance

Binance still reigns supreme as the most popular platform for USDT savings and lending. Simple Earn flexible savings APY also hovers in the 4.0%-7.5% range.

There is a greater range of financial products that vary by conditions, risk, and reward, including the 406.0%

APY of the more aggressive structured financial products offered that can, however, incur risk. The offerings are also more secure and accessible than Binance’s other competitors.

Features Binance

| Feature | Description |

|---|---|

| Flexible Savings | Withdraw anytime without penalties |

| Locked Savings | Higher APY for fixed-term deposits |

| Dual Investment | Structured products combining savings and trading |

| Security | Strong compliance and insurance protection |

3. Gate.io

Gate.io offers a simple way and soft staking to earn interest on USDT with a simple way to earn interest on a flexible basis with interest compounded every hour.

Depending on the products and the demand at the moment, the interest on USDT can even range from 300 to 2.5%.

The clients can even plan their entry only at the time of the special promo interest rates offered by the company.

Although not competing volume-wise with Binance and Bybit, Gate offers flexible options and variable interest rates

Especially for small and medium balance clients, making it a good alternative for clients looking for fixed USDT returns.

Features Gate.io

| Feature | Description |

|---|---|

| Exchange Lending | Lend USDT directly to traders |

| Bonus Tiers | Extra rewards for larger deposits |

| Flexible Terms | Choose between short-term and long-term lending |

| Liquidity | High trading volume ensures stable returns |

4. MEXC

MEXC has grown to become a notable USDT yield platform owing to its Hold & Earn and fixed closings products.

On its website, MEXC posts about its APY’s of 12 % and even up to 600 % depending of a fixed term closings, promotional boosts, and early subscriptions perks.

It is easy for passive investors as interest is earned daily and there is no need for manual staking. However, as is the case with almost all high-yield options, the greatest yield often has restrictions in some form.

Limited capacity, time bonuses, and tiered rates are the most 10 restrictions and yield will almost certainly decrease once those conditions expire.

Features MEXC

| Feature | Description |

|---|---|

| High-Rotation Yields | Frequent opportunities for flexible and fixed APY |

| Flexible Savings | Withdraw anytime with moderate returns |

| Fixed Savings | Lock USDT for higher APY |

| Active Trader Focus | Designed for users who trade regularly |

5. HTX

HTX Services Clients Looking for USDT Yield. They Provide USDT Par Yield But Also Provide Savings With A Derivative Plane, Such As “Shark Fin. And Dual USDT Investment Products With Market Linked Returns.

They Provide Advertised USDT APR Of Between ~3 Percent To 329 Percent APR. HTX Provides Structured USDT Products Which Provide Yield Paths To Those Generally Considered Alternative With Increased Risk And Complexity.

For Simple Yield Savings, HTX Services Provide A Flexible Earn Savings With A Lower Yield Trade Off. For Such A Product, HTX Services Provide Increased Liquidity And Simplicity.

Features HTX

| Feature | Description |

|---|---|

| Structured Products | Predefined yield strategies for USDT |

| Predictable Outcomes | Clear parameters for risk and reward |

| Flexible Options | Short and long-term investment choices |

| Security | Exchange-backed protection for deposits |

6. Aave

Aave is a prominent decentralized lending protocol that allows you to safely earn yields on USDT. If you look at the data from 2025, you will notice that APY tends to range from approximately 2% to 6% on Aave.

However, it does change based on the demand available and the protocol’s level of utilization.

Aave’s major advantages, such as flexibility, the ability to easily transfer assets to any other DeFi protocol and cross-chains, as well as the visible contract code, are all part of the system’s design.

Yields may, however, be lower than other CeFi savings options, and yields are dependent on the overall demand for DeFi, meaning they will be volatile.

Features Aave

| Feature | Description |

|---|---|

| Decentralized Lending | Peer-to-peer lending without intermediaries |

| APY Range | 2–14% depending on market demand |

| No KYC | Anonymous participation allowed |

| Instant Withdrawals | Liquidity pools enable fast access to funds |

7. Ledn

Ledn provides the most transparent, simple, and compliant savings account (the USDT Growing Account) at a nominal 8.5% APY (the interest starts lower, around 6.5%, until 100,000 USDT is deposited, and then increases to 8.5% over the threshold).

Ledn is reportedly able to generate yield by lending the deposited stablecoins to a bitcoin-margin loan book collateralized at a 2:1 ratio and, historically

The company claims to have a loan book default-free. For yield-seeking clients who just want their USDT exposed to a less risky volatility, counterparty centralization, and less opaque audit/reserve reporting, Ledn is the most balanced offering in 2025.

Features Ledn

| Feature | Description |

|---|---|

| Stable APY | Fixed 8.5% annual yield |

| Regulatory Compliance | Operates under financial regulations |

| Daily Compounding | Interest added daily for higher returns |

| Centralized Platform | Easy access and strong customer support |

8. EarnPark

Even though you included EarnPark as one of the yield sources, there is a lack of public data in recent mainstream yield-rate aggregations for EarnPark USDT yield, and there is no credible or consistent data available.

It is absent in multiple lists pertaining to stablecoin yield from 2025, and there is no evidence from credible of the top stablecoin yield companies surveys even including it in the greater than top 10.

This lack of data transparency would warrant a greater level of uncertainty and possibly uncalculated risk when considering USDT EarnPark, and you should exercise extreme caution and do a thorough check of the latest audit or reserve data.

Features EarnPark

| Feature | Description |

|---|---|

| High APY | Up to 35% yield opportunities |

| Advanced Strategies | Uses algorithmic yield farming |

| Risk-Reward Balance | Higher risk but potentially huge returns |

| Innovative Platform | Focused on maximizing stablecoin yields |

9. De.Fi

Predictably, with regards to De.Fi (or “DeFi”, for that matter), with regards to simply automated finance protocols that allow for USDT lending or liquidity provision, the yields are highly variable.

If you look at historical data, some protocols in DeFi provide around 4% to 12% (or other stablecoin) yield, depending on the liquidity utilization, the demand for the pool, and the incentivization of the pool.

The disadvantage of DeFi, as you mentioned, is the composability and the flexible smart contracts.

However, there are smart contracts and algorithms that can run flexibly in liquidity pools, and there will be risks, including yield/rate volatility, utilization and liquidity risks and smart contract risks.

Features De.Fi

| Feature | Description |

|---|---|

| Aggregator | Collects best DeFi yield opportunities |

| Staking Options | Stake USDT across multiple protocols |

| Yield Farming | Access to top farming pools |

| Risk Management | Built-in tools to assess smart contract risks |

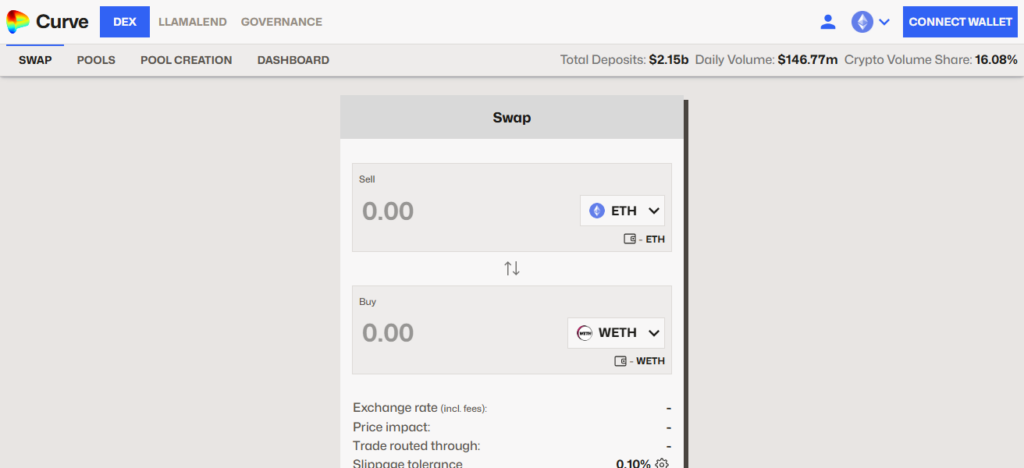

10. Curve Finance

Curve Finance is a decentralized exchange that is optimized for stablecoins and it is possible to earn yield through the StableSwap liquidity pools by depositing USDT, and any other stablecoins, into the pool and receiving a portion of the trading fees and any other protocol incentives that may be available.

Its AMM design reduces slippage and the risk of impermanent loss, so pools of stablecoins are much safer than pools of volatile assets.

Over the course of 2025, the stablecoin pool APY on Curve has been between 5% and 15%, depending on the volume, pool composition, and reward incentives.

For users that are comfortable taking on the risk that comes with on-chain liquidity provision and smart contracts, Curve has been one of the top options to earn decentralized yield on USDT.

Features Curve Finance

| Feature | Description |

|---|---|

| Stablecoin Pools | Optimized liquidity pools for USDT |

| Consistent Yields | Reliable APY from stablecoin trading |

| DeFi Protocol | Fully decentralized and transparent |

| Liquidity Incentives | Rewards for providing liquidity to pools |

Conclsuion

To sum up, USDT yield opportunities include CeFi exchanges, DeFi protocols, and regulated lenders. In the case of CeFi lending protocols, Ledn, has moderate, regulated yields while Bybit, MEXC, and Binance have higher, but conditional yields.

Aave and Curve, DeFi lending protocols, offer steady yields with a focus on transparency and self governance.

Overall, it will come down to your risk appetite, liquidity requirements, and the need for centralization.

FAQ

USDT yield is the interest or return earned by lending, staking, or providing liquidity with Tether stablecoins.

CeFi exchanges like Bybit, Binance, MEXC, and HTX offer the highest promotional or structured yields, sometimes exceeding 100% APR for special products.

DeFi platforms like Aave and Curve are decentralized and transparent, but carry smart‑contract and liquidity risks.

Flexible savings generally yield 2–8%, while promotional or structured products can range from 50–600% APR depending on conditions.

Flexible savings or DeFi pools allow near-immediate withdrawal, but fixed-term or structured products may have lock-up periods.