This article is intended to talk about Best crypto Exchanges for Proffessional Crypto Arbitrage\”. Crypto Arbitrage involves making profit when a certain currency has a lower and a higher price across various exchanges.

Based on how crypto is traded on different exchanges, the price is different on different exchanges. This article will talk about exchanges where the price of a given currency is different and would have high liquidity, and low cost fees. Essential for every crypto trader.

Key Points & Best Crypto Exchanges For Professional Crypto Arbitrage

Coinbase Pro — Strong regulatory compliance and fiat on-ramps

Kraken — Wide range of fiat pairs and robust security

KuCoin — Large altcoin selection and competitive fees

Gate.io — Extensive altcoin listings and arbitrage opportunities

Bybit — Fast execution and strong derivatives focus

Gemini — US-regulated with institutional-grade security

MEXC — High-volume altcoin trading and arbitrage-friendly spreads

Poloniex — Veteran exchange with niche coin markets

Crypto.com Exchange — Integrated ecosystem with fiat gateways

Deribit — Specialized in crypto options and futures for arbitrage

10 Best Crypto Exchanges For Professional Crypto Arbitrage

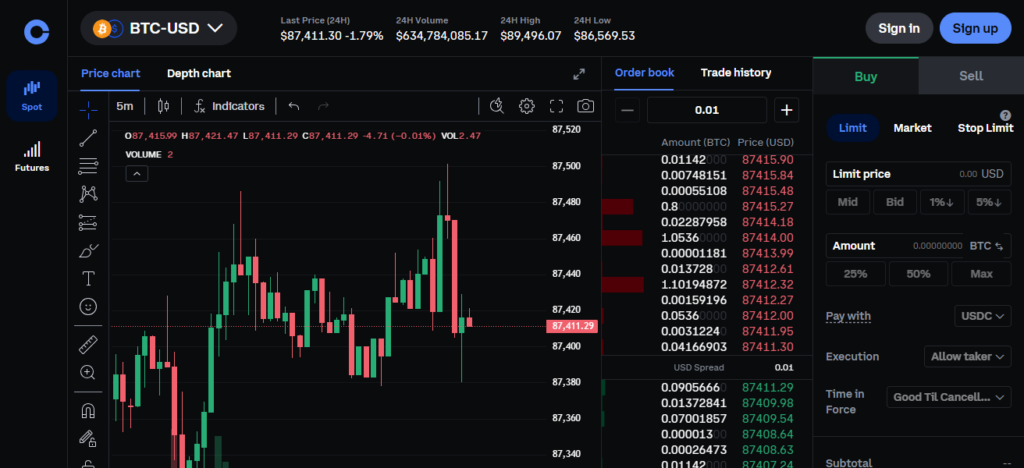

1. Coinbase Pro

Considering the liquidity and the trading costs, the best choice for professional arbitrage is Coinbase Pro.

The platform also provides features such as advanced order types, and traders are able to arbitrage to great extents through the provision of real-time market data, enabling the execution of large-volume arbitrage efficiently.

They also have high standards of security and insurance for digital assets. The interface is user friendly and it has a robust API that is integrated with Coinbase.

This makes it easy to move money quickly which is essential for arbitrage trading on multiple exchanges, and it allows for safe trading.

Features Coinbase Pro

- High Liquidity: The exchange has strong liquidity for big crypto pairs which will lead to arbitrage opportunities with minimal slippage.

- Advanced Trading Tools: The exchange has multiple, advanced trading features like limit, stop, and market orders that allow for accurate and optimal order execution.

- API Access: The exchange grants the freedom to implement fully automated trading and connect with trading bots for seamless execution.

- Regulated and Secure: Coinbase Pro has insurances for their customer’s assets and they comply with US regulations which enhances safety for professional traders.

| Pros | Cons |

|---|---|

| High liquidity in major pairs, ideal for arbitrage. | Limited altcoin selection compared to other exchanges. |

| Competitive trading fees for high-volume traders. | Slower listing of new tokens. |

| Advanced order types and robust API for automation. | Withdrawal fees can be higher than some competitors. |

| Regulated and insured, providing strong security. | Not available in all countries. |

| Easy transfer between Coinbase accounts for quick arbitrage. | Mobile app is less feature-rich for professional traders. |

2. Kraken

An extensive range of cryptocurrencies and fiat pairs make Kraken an arbitrage possibility. It provides a stable and highly secure environment with two-factor authentication, cold storage, and low fees for high-volume trading.

It has advanced charting tools and margin trading, while also providing API access for professionals to implement automated trading.

Consistent liquidity results in minimal slippage for large trades, making Kraken an overall good option for arbitrage in both the spot and futures markets.

Features Kraken

- Wide Crypto and Fiat Pairs: The exchange has several coins and even fiat currencies in order to allow for flexibility in arbitrage.

- Low Fees: The exchange is known for their competitive price offerings, which can lead to profitability for high-volume traders.

- Margin Trading: The exchange also has the ability to enable high-spread and rapid market movements for both spot and futures, leveraged arbitrage.

- Strong Security: The exchange has two-factor authentication and cold storage for enhanced trading security and peace of mind.

| Pros | Cons |

|---|---|

| Wide range of cryptocurrencies and fiat pairs. | User interface may feel complex for beginners. |

| Low trading fees for high-volume traders. | Occasional withdrawal delays during peak times. |

| Strong security measures including cold storage. | Some altcoins have lower liquidity. |

| Margin trading available for advanced arbitrage strategies. | API has rate limits compared to other exchanges. |

| Stable and reliable execution for professional traders. | Less competitive for high-frequency trading. |

3. KuCoin

Due to its extensive range of altcoins and reasonable trading fees, arbitrage investors flock to KuCoin. This exchange enables the multiple types of trading that arbitrage is dependent on – spot, margin, and futures trading.

The exchange’s high liquidity on its main trading pairs alongside its quick execution speeds helps prevent missing out on trading opportunities.

Furthermore, KuCoin members can automate their trading strategies through professionally designed trading bots that integrate with the api.

KuCoin prioritizes the safety of their the high volume transactions by implementing 2FA, withdrawal whitelists, and other safety measures.

Features KuCoin

- Extensive Altcoin Selection: Hundreds of cryptocurrencies listed, offering ample opportunities for rapid-arbitrage.

- Multiple Trading Types: Trading features that offer multiple strategies such as spot, margin, and futures trading.

- API and Bots: The ability to assimilate automated trading and high-frequency arbitrage.

- High Liquidity in Popular Pairs: Achieves rapid execution and as a result, minimal slippage

| Pros | Cons |

|---|---|

| Huge selection of altcoins for diverse arbitrage opportunities. | Security risks in the past; though improved, caution is needed. |

| Spot, margin, and futures trading available. | Higher fees for fiat deposits. |

| High liquidity in popular trading pairs. | Customer support response can be slow. |

| Strong API support for automated trading. | Occasional interface complexity for new users. |

| Supports trading bots for efficient arbitrage. | Regulatory compliance varies by region. |

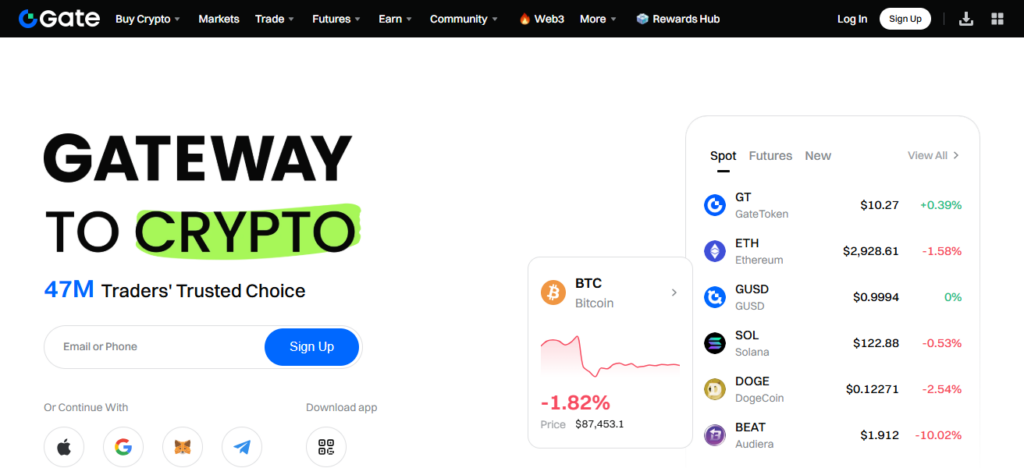

4. Gate.io

The great variety of cryptocurrency and the level of price spreads makes Gate.io an appropriate exchange for arbitrage positions. Gate.io accommodates users which various trading options such as spot, margin, and futures.

This option flexibility is great for more sophisticated arbitrage strategies. Also, the exchange affords the ease of using their APIs for the automation of frequent trading.

Their deep liquidity of popular and smaller market cap coins also minimizes the risk of slippage which is crucial for arbitrage.

As for Gate.io security measures, the exchange also has cold wallets and withdrawal protections, so professional users can match trading strategies across several exchanges without risk.

Features Gate.io

- Wide Asset Coverage: Gate.io has a few thousand coins including many new ones that can be used for arbitrage.

- Multiple Markets: Gate.io also has a spot, margin, and futures market that can be used for more advanced trading strategies.

- Robust API: There is an API for Gate.io that supports automation and high frequency trading.

- Competitive Fees: Fees are low enough that they are not a concern for frequent trading, and that improves profitability.

| Pros | Cons |

|---|---|

| Wide range of crypto assets including emerging altcoins. | UI can be less intuitive for beginners. |

| Supports spot, margin, and futures trading. | Liquidity for some minor tokens is low. |

| Competitive trading fees. | Occasional slower withdrawal processing. |

| Robust APIs for automated arbitrage. | Limited regulatory compliance in some regions. |

| Deep liquidity for major coins reduces slippage risk. | High-frequency trading can hit API rate limits. |

5. Bybit

Bybit is one of the best options for derivatives arbitrage because of its emphasis on futures and perpetual contracts. Bybit’s advanced trading options and low trading fees maximize the profitability of any arbitrage strategy.

Bybit’s liquidity is impressive and allows for fast order execution. The platform also has a multitude of advanced trading features such as live stream data, up to the second APIs for trading bots, and facilitates real time charting.

The trading platform also has robust cybersecurity features such as cold wallets, multi-signature authentication, and two-factor authentication. This makes Bybit a perfect platform to cross arbitrage in volatile cryptocurrency investments.

Features Bybit

- Futures & Perpetual Contracts: Bybit has a large focus on derivatives which makes it and ideal exchange for arbitrage.

- High Liquidity & Low Slippage: With high liquidity and low slippage, traders can easily and quickly make trades without missing any opportunities.

- Advanced Tools & Charts: Bybit has a variety of tools that can be used for the analysis of trades on an advanced level.

- API Access: With the API, traders can automate their trades for use with arbitrage strategies.

| Pros | Cons |

|---|---|

| Excellent for futures and perpetual contract arbitrage. | Limited spot market compared to others. |

| High liquidity and low slippage. | Higher learning curve for beginners. |

| Low trading fees, increasing arbitrage profitability. | Regulatory limitations in some countries. |

| Advanced charting tools and API for automation. | Limited altcoin selection for spot arbitrage. |

| Fast execution for high-frequency trading. | Customer support response can vary. |

6. Gemini

Gemini creates a safe and compliant ecosystem that is very beneficial for pros into arbitrage trading. There is a good amount of liquidity in most of the crypto pairs as well as good pricing and a strong matching engine that allow for the effective use of most arbitrage strategies.

Gemini has timestamped files with automatic request format reporting for automated breaks as well. The assets are digital but insured for safety and while their marking is regulatory compliance there are no real concerns.

There is also real time market data and many ways to place an order to allow for better trade execution to prevent slippage and missing arbitrage opportunities.

Features Gemini

- Regulated & Secure: Gemini is fully regulated and compliant with the United States

- Reliable Execution: With slippage becoming a large issue for arbitrage trades, Gemini is a safe bet with their stable platform and minimal lag.

- API Support: Automated trading tools for advanced traders.

- Competitive Fees for High Volume: Most suited for large operations surrounding arbitrage.

| Pros | Cons |

|---|---|

| Highly secure and regulated exchange. | Fewer altcoins compared to KuCoin or Gate.io. |

| Competitive fees for high-volume trading. | Spot liquidity is lower for minor coins. |

| API access for automated arbitrage strategies. | Advanced features are limited for derivatives traders. |

| Reliable execution with minimal slippage. | Can be slower in listing new cryptocurrencies. |

| Insurance coverage for digital assets. | Geographic restrictions limit availability. |

7. MEXC

MEXC is probably one of the best exchanges regarding arbitrage activities because of the huge amount of different coins and trading pairs with different altcoins that have big market moves.

One of the best features of this platform is that this platform is one of the best for arbitrage with spot, margin and futures trading.

MEXC has very efficient and deep liquidity for all of the trading pairs, thereby giving the the trader the least amount of slippage out of any trading platform.

All the things mentioned before paired with the very low trading fees this platform is very profitable. The company’s API also provides great opportunity for high frequency trading for professionals.

In addition, this platform has one of the best safety features in the industry, with cold wallets and two factor authentications. Finally, the platform is easy to use, and provides easy access to transferring and trading.

Features MEXC

- Large Cryptocurrency Selection: Great for altcoin arbitrage.

- Spot, Margin & Futures Trading: Flexibility of strategies that can be used.

- Low Trading Fees: This makes MEXC a great platform for arbitrage as it is cost efficient.

- API for Automation: Supports bot trading and high frequency arbitrage strategies.

| Pros | Cons |

|---|---|

| Large selection of cryptocurrencies for diverse arbitrage. | Some lesser-known coins have low liquidity. |

| Spot, margin, and futures markets available. | Regulatory compliance may be limited. |

| Low trading fees. | Customer support can be slow. |

| API access for automated trading. | Website and UI can feel cluttered. |

| Fast execution and high liquidity in major pairs. | Occasional withdrawal delays. |

8. Poloniex

Arbitrage has been made easy by Poloniex as one of the more dependable platforms. Because of the affordable fees, users can trade as many different cryptocurrencies as they want.

Using Poloniex, users can perform both margin and spot trading, allowing users to implement an even wider range of different arbitrage strategies.

Because of the good liquidity and lower spreads, users are able to complete large trades with not as much slippage. Poloniex has very well created APIs allowing for automated strategies.

This exchange has prioritised safety by storing their users funds offline and using two factor authentication.

Professional arbitrage traders are able to trade and complete their strategy seamlessly with the help of varying advanced orders.

Features Poloniex

- Wide Range of Cryptos: Good for cross-exchange arbitrage.

- Easy Transfers: Transfers to and from other platforms in seconds.

- Spot & Margin Trading: There are a number of markets for varied arbitrage strategies.

- API Access: Enables automated trading and use of trading bots.

- Competitive Liquidity: Shallow markets for popular coins reduce the risk of slippage.

| Pros | Cons |

|---|---|

| Wide range of cryptocurrencies and trading pairs. | Past security incidents may concern some traders. |

| Spot and margin trading supported. | UI feels outdated compared to newer exchanges. |

| Competitive trading fees. | Some minor coins have low liquidity. |

| API support for automated trading. | Customer support is limited. |

| Deep liquidity for major coins reduces slippage. | Fewer advanced tools for derivatives arbitrage. |

9. Crypto.com Exchange

The low trading rates and selection of cryptocurrencies make Crypto.com Exchange alluring for arbitrage. With options for spot and derivatives trading, there is flexibility for all types of arbitrage.

The exchange has high liquidity in well-traded pairs which minimizes slippage and re-quoting. Professional traders can automate their strategies through API access and their assets will remain secure behind Crypto.com over 2FA, cold storage, and other safety features.

Furthermore, Crypto.com’s efficient system for deposits and withdrawals allows quick transfers of funds to and from other exchanges to capitalize on time-sensitive arbitrage opportunities.

Features Crypto.com Exchange

- Low Trading Fees: This is affordable for arbitrage that Is done frequently.

- Spot & Derivatives Markets: This allows a wider arbitrage set.

- High Liquidity in Major Coins: Trade execution is speedy.

- API & Automation: This allows trading bots for advanced strategies.

| Pros | Cons |

|---|---|

| Low trading fees and competitive spreads. | Limited futures and derivatives options. |

| Spot and derivatives trading available. | Altcoin liquidity can be inconsistent. |

| High liquidity in popular pairs. | Not fully available in all countries. |

| API access for automated arbitrage. | Withdrawal and deposit fees may apply. |

| Strong security with cold storage and 2FA. | Advanced charting tools are limited. |

10. Deribit

Since Deribit focuses mainly on crypto derivatives, it is ideal for options and futures arbitrage. It has the deepest market liquidity, the lowest trading fees, and the highest leverage options available, increasing the profitability for any arbitrage trades.

Deribit has advanced trading tools and market data for automated trading via their API. Speed of execution and latency are critical for arbitrage, and Deribit is very strong in this area.

Deribit has strong security measures, like cold storage and 2FA. It is one of the best crypto exchanges for advanced arbitrage trading.

Features Deribit

- Derivatives Specialization: Trading futures and options is the best for arbitrage.

- High Liquidity & Low Fees: This liquidates in the large trades.

- API for Automated Strategies: This is for algorithmic and high frequency arbitrage trading.

- Fast Execution & Low Latency: This is for effectively capturing the price differentials.

| Pros | Cons |

|---|---|

| Best for derivatives arbitrage (futures and options). | Very limited spot market. |

| Deep liquidity and low trading fees. | Less suitable for beginners. |

| High leverage options for profit maximization. | Not all coins available for trading. |

| Fast execution with low latency. | Regulatory compliance is limited in some regions. |

| Robust API for automated high-frequency trading. | Customer support can be slower during peak periods. |

Conclusion

In summation, professional crypto arbitrage depends on what exchange one decides to work with. Out of all the trading platforms

Coinbase Pro, Kraken, KuCoin, Bybit, and Deribit offer the most liquid and secure platforms with the lowest fees and best advanced trading functionalities. Pricing discrepancies in the highly volatile crypto markets enable traders to maximize arbitrage profits.

FAQ

Crypto arbitrage is buying a cryptocurrency on one exchange at a lower price and selling it on another at a higher price to earn profit.

Top exchanges include Coinbase Pro, Kraken, KuCoin, Gate.io, Bybit, Gemini, MEXC, Poloniex, Crypto.com, and Deribit.

High liquidity, low trading fees, multiple trading pairs, fast execution, robust API support, and strong security.

Yes, if you use regulated platforms with strong security features like cold wallets, two-factor authentication, and insured assets.

Yes, most professional exchanges like KuCoin, Bybit, and Deribit provide APIs for automated or algorithmic trading.