This article analyzes the Best Aggregators To Discover Bridging Deals that make asset movement across different blockchains easier.

These services identify optimal paths, lower costs, and help with slippage, making the transition less hassle.

From novice users to developers, knowing these aggregators can ease and secure cross-chain transaction at lower prices, making the crypto trading experience more efficient.

Key Points & Best Aggregators To Discover Bridging Deals

| Aggregator | Key Point / Feature |

|---|---|

| Rango Exchange | Supports over 50 blockchains with deep liquidity and smart routing for best rates. |

| Jumper Exchange | Offers seamless cross-chain swaps with real-time fee and slippage comparison. |

| LI.FI Protocol | Developer-friendly API and SDK for integrating cross-chain swaps into apps. |

| Symbiosis Finance | Focuses on stablecoin and token bridging with low fees and high speed. |

| Across Protocol | Known for fast bridging with low gas fees and optimistic rollup support. |

| THORChain | Enables native asset swaps across chains without wrapped tokens. |

| Orbiter Finance | Specializes in Layer 2 bridging with minimal fees and fast confirmation. |

| Synapse Protocol | Offers secure and scalable cross-chain messaging and asset transfers. |

| Stargate Finance | Provides unified liquidity across chains with instant guaranteed finality. |

| Portal Bridge | Focuses on Solana-based bridging with fast execution and low slippage. |

10 Best Aggregators To Discover Bridging Deals

1. Rango Exchange

Rango Exchange is a user-friendly cross-chain aggregator that makes crossing vis-a-vis switching assets on different blockchains easier.

It bridges different chains, letting users move tokens across networks and allowing users to view token movement and transactions in real-time.

Rango Exchange is user-friendly for novice users, as simplicity is a design goal; however, it is also equipped for advanced users, as it aggregates and optimizes terminals.

It is also safe, as it works with different wallets. Rango offers exceptionally low fees, impressive speed, and is highly versatile. Rango helps users find and bridge tokens efficiently across blockchains.

Features Rango Exchange

Multi-Chain Support – Rango Bridge supports the transfer of assets across the major chains which helps in bridging interoperability.

Liquidity Aggregation – Rango’s algorithm collects all the disparate sources to optimize the exchange rate and minimize slippage.

User-Friendly Interface – Rango Exchange has a simple interface designed to meet the needs of all types of users which includes beginners and advanced users.

Wallet Integration – Rango Exchange can be connected with popular wallets (MetaMask, WalletConnect) and thus secured transfer of assets are made.

Live Transaction Information – Rango displays transfer fees tailored to a transaction, estimated time of arrival, and described routing alternatives to promote transactional information.

2. Jumper Exchange

Jumper Exchange specializes in cross-chain aggregation and provides quick, affordable token transfer services across a range of blockchains.

It integrates various decentralized ecosystems and merges liquidity pools to identify the best routes for token swapping.

The interface shows predictive analytics of fees, slippage, and bridge durations, ensuring users are well-informed at the time of the transaction.

Jumper Exchange also takes security seriously and integrates audit-compliant smart contracts and wallets.

The service addresses the intricacies of asset transfer linking by auto-picking the best routes to minimize user workload.

Jumper Exchange provides a user-friendly alternative to crypto users wanting to bridge token assets rapidly and reliably.

Features Jumper Exchange

Cross-Chain Swaps – Jumper Exchange is a service designed for users to effortlessly swap their assets and transfer them across the major chains.

Route Optimization – Jumper’s systems automatically calculate the bridging route which saves users the time and the hassle to find the cheapest option.

Security Audits – Jumper has systems to monitor smart contracts and the entire transaction process to make sure users are secured.

Visible Transaction Costs – Jumper Exchange helps users in budgeting by displaying all the transaction fees they need to pay before they finalize a swap.

3. LI.FI Protocol

LI.FI Protocol offers decentralized applications and individual users the bridging and swapping services they need.

This cross-chain middleware makes the token transfer process efficient in terms of both cost and time by routing transfers along the best possible paths.

Multi-chain access becomes frictionless for users as LI.FI’s customers incorporate the liquidity and bridges to bypass the need for bridging and swapping services manually.

The self-service nature of the architecture means that there is no need to operate the system, and users appreciate the clear visibility of transaction status, including fees.

For all users and dApps wanting to perform cross-chain bridging, LI.FI Protocol provides a consistent experience and interface for the transitions.

Features LI.FI Protocol

Aggregated Bridges – LI.FI Protocol is a unique bridging service which uses multiple arrangements of bridges and selects the best option.

Multi-Chain dApp Support – LI.FI Protocol assists their developers by allowing them to integrate powerful their dApps with multiple chains.

Efficient Transfers – LI.FI Protocol provides their users with the fastest transfer and the least transactional fees.

Reporting – LI.FI Protocol is unique to other bridges since they can boast of providing analytic reports on each transaction.

High Flexibility – Supports different token types and blockchain ecosystems.

4. Symbiosis Finance

Symbiosis Finance it is easy to conduct cross-chain swaps, as it is a cross-chain liquidity and bridging aggregator built on multiple chains.

All decentralized exchanges and bridges are integrated together to provide a seamless experience.

One of the best features of Symbiosis is the speed of transactions and low costs. Users do not need to worry about route optimization, as Symbiosis automatically optimizes the route for the user.

Besides the swapping and bridging functionality, Symbiosis provides traders with more advanced features, such as liquidity pooling.

It is user-friendly, safe to use, provides advanced transaction analytics, and supports a variety of wallets.

Those who need to bridge their assets will be pleased to know that Symbiosis Finance provides a low-cost solution for accessing multiple liquidity sources for cross-chain operations.

Symbiosis Finance

Cross-Chain Swaps – Moves tokens across different blockchains.

Automated Route Selection – Picks the fastest and most affordable route.

Liquidity Pool Integration – Merged DEX and bridge liquidity for improved rates.

Secure Transactions – Smart contract-based and fully auditable system.

User-Centric Interface – Simplified for beginners and advanced users.

5. Across Protocol

Across Protocol is a decentralized bridging solution focused on fast and secure token transfers between different blockchain networks.

It combines and bridges liquidity to facilitate cheap and expedited cross-chain transaction transfers.

The protocol prioritizing security implements auditable smart contracts and compliant operational frameworks.

Users can transfer a variety of assets with little price impact and developers can use Across Protocol to add multi-chain support to their dApps.

It simplifies cross-chain transfers through an aggregation approach which automatically identifies and selects the best paths.

Across Protocol is built targeting as primary users to crypto enthusiasts and projects as a dependable cross-bridging solution with multiple ecosystems.

Features Across Protocol

Low-Cost Transfers – Reduces fees by optimizing bridging.

Fast Cross-Chain Transactions – Prioritizes speed and security.

Smart Contract Security – Fully auditable and decentralized bridging system.

Wide Asset Support – Supports numerous tokens across chains.

Developer Integrations – API for bridges into apps.

6. THORChain

THORChain is a decentralized liquidity network facilitating cross-chain swaps and bypassing the use of wrapped tokens. It interlinks different blockchains and allows the transfer of native assets.

THORChain pools liquidity from different sources which guarantees efficient swaps and low transaction costs.

It’s designed to forgo the need for intermediary players which eliminates the risk of centralization and security issues.

Customers can exchange leading cryptocurrencies like Bitcoin and Ethereum and other major tokens and liquidity providers get profit.

THORChain’s network is transparent and users can track transaction flows and network performance in real time.

Users with THORChain can swap assets as freely as possible and also use the network’s innovative solutions for cross-chain transactions

Features THORChain

Native Asset Swaps – Transfers assets without the need for wrapped tokens.

Decentralized Liquidity Network – Pulled liquidity together across chains.

Minimal Fees – Optimized swapping reduces costs.

Secure Protocol – Smart contracts are audited and rights are decentralized.

Reward Incentives – Liquidity providers earn rewards for supporting the network.

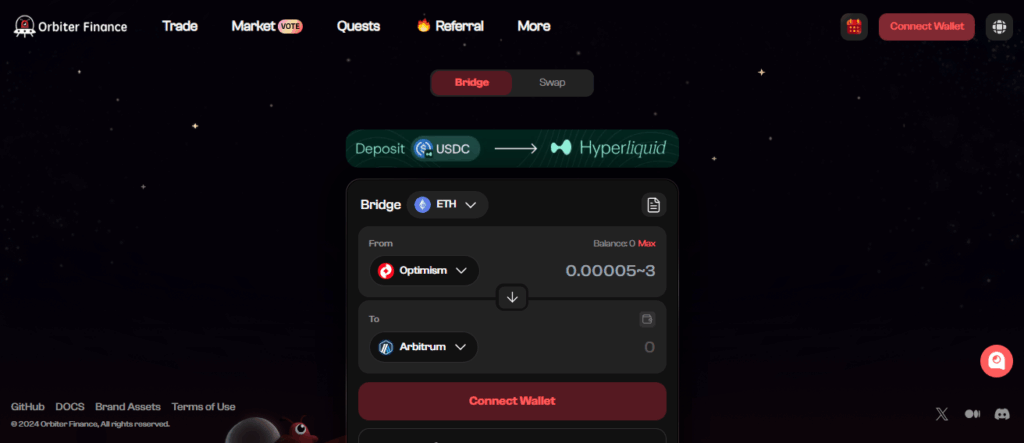

7. Orbiter Finance

Optimized for quick and inexpensive transfers, Orbiter Finance serves as a cross-chain bridge aggregator.

Because of instant or almost instant bridging between Ethereum Layer 2 networks and other chains, it prioritizes the user experience.

To determine the most efficient routes and reduce slippage and fee, Orbiter aggregates liquidity from numerous sources.

The platform’s simple and direct design, coupled with transparent metrics demonstrating the cost and time of each transaction, enhances user experience.

To facilitate asset transfers, Orbiter Finance accommodates numerous tokens and securely integrates with mainstream wallets streams.

For quick, dependable bridging solutions across Layer 2 and EVM-compatible networks, Orbiter is the most resourceful and reliable for users.

Features Orbiter Finance

Layer 2 Optimized – Quick bridging for Ethereum L2 networks plus other chains.

Affordable Transfers – Minimizes fees and slippage by aggregating liquidity.

Instant Transfers – Speed and efficiency are top priorities.

Wallet Compatibility – All major wallets are supported.

Transparent Metrics – Shows estimated time and fees and route info for every transaction.

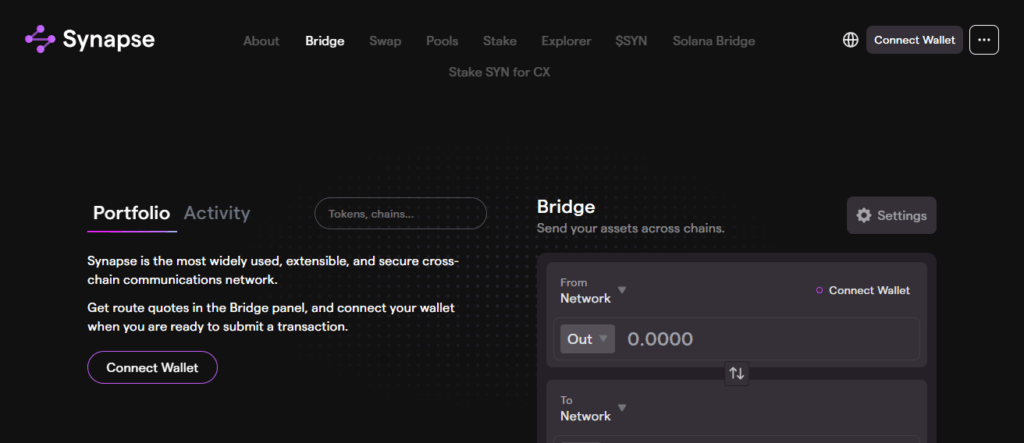

8. Synapse Protocol

The Synapse Protocol is a decentralized exchange (DEX) and bridging liquidity protocol that operates on multiple blockchains.

Synapse involves many assets and cross-chain and cost-efficient token transfer. Synapse’s smart contracts and liquidity pools determine the best routs in transactions and minimize fees and slippage. Synapse Protocol focuses on user security with multiple audited.

Synapse bridging Analytics is designed for developers and offers cross-chain functionalities for Synapse integrated dApps.

Synapse bridging Protocol is the first choice liquidity aggregator with multi-chain transfer and bridging liquidity across several blockchain networks.

Features Synapse Protocol

Multi-Chain Liquidity Aggregation – Optimizes transfers across different networks.

Token Swap Services – Swap and bridge capabilities are combined for seamless transfers.

Audited Contracts – Smart contracts are secured and asset transfers are protected.

Comprehensive Metrics – Tools for slippage analysis and fee routing are provided.

Cross Chain Access – APIs and SDKs enable dApps to integrate cross-chain access.

9. Stargate Finance

Stargate Finance is a cross-chain liquidity protocol which facilitates the transfer of assets between various chains.

It pools liquidity from various sources so that bridging can be done efficiently and with little slippage and fees.

Stargate’s security measures include audited smart contracts and strong bridging systems. Its the interface shows users important information about a transaction like the estimated transaction cost and transfer time.

It covers a broad assortment of tokens and networks to cater to individual traders and developers that are creating cross-chain systems.

Its focus on efficiency, reliability, and transparency makes it a go-to aggregator for identifying bridging opportunities across many different ecosystems.

Features Stargate Finance

Cross-Chain Liquidity – Liquidity for bridging is compiled from a range of multiple sources.

Low Cost Transfers – Swaps have reduced slippage.

Safe Operations – Their infrastructure comprises of audited smart contracts.

Extensive Support – A large variety of tokens and chains are supported.

User Transparency – Users can see transfer time, fees, and expected completion time.

10. Portal Bridge

Portal Bridge is a decentralized cross-chain aggregator Portal Bridge allows users to transfer their assets efficiently across different blockchains.

It combines and optimizes multiple liquidity sources to decrease transaction time and cut costs.

With liquidity and transaction fees minimized, users can complete operations in several blockchains with the Portal Bridge. For users security is paramount.

Smart contracts are audited, and wallets are tested for security. When users transfer assets, they can analyze the transaction in detail, including anticipated slippage and completion time.

Developers can incorporate Portal Bridge into their dApps for added multi-chain interface capability, enhancing user options for bridging.

It handles complicated cross-chain interactions, thus offering users a seamless and uncomplicated interface for bridging across multiple blockchains.

Features Portal Bridge

Seamless Cross-Chain Transfers – Allows free and easy movement of tokens across different blockchains.

Aggregated Liquidity – Ensures users get optimal rates from various sources.

Smart Contract Security – Offers comprehensive audits and is reliable for secure transfers.

Detailed Transaction Insights – Includes slippage, fees, and completion time estimates.

dApp Integration Friendly – Developers can easily integrate bridge functionality.

Conclusion

To sum up, the top aggregators to find bridging deals, including Rango Exchange, LI.FI Protocol, THORChain, and Stargate Finance, are combining liquidity, route optimization, and transfer safety All cross-chain bridge aggregators come with options for novices and developers.

They offer a rapid, affordable, and dependable approach. Using these services significantly enhances the management of assets across multiple blockchains, making the process of trading and transferring crypto far more efficient and user-friendly.

FAQ

They reduce fees, minimize slippage, and find the fastest, most cost-effective transfer routes.

Rango Exchange, LI.FI Protocol, THORChain, Stargate Finance, Jumper Exchange, Symbiosis Finance, Across Protocol, Orbiter Finance, Synapse Protocol, Portal Bridge.

Yes, most use audited smart contracts and integrate with popular wallets for secure transactions.

Absolutely, platforms like Rango and Symbiosis offer intuitive interfaces suitable for new users.

Yes, they handle a wide range of assets across various blockchains.