In this post, I will analyze and find the top stablecoin yield bridging aggregators and how they can maximize the yield returns for users.

I will focus on the aggregators that allow users to perform quick, secure, and reasonably priced cross-chain transfers and access several liquidity pools. Find out which aggregators provide the most yield and the best stablecoin conversion routes.

How To Choose Best Bridging Aggregator for Stablecoin Yield

To maximize yield returns, picking the right bridging aggregator is crucial. Here’s what to keep in mind:

Chains Supported – Check the included blockchains for the stablecoins you utilize.

Fee Structure – User fees, network gas, and the overall cost of the transaction should be checked for efficiency.

Safeguards – Focus on audited and efficient bridging protocols using LayerZero or Wormhole.

Liquidity & Speed – Higher liquidity and closed slippage gaps result in faster transfers.

Usability – Simple and intuitive interfaces can make the difference in a novice’s mistake.

User & Community Support – Quick resolutions can be gained by using active community and customer support.

Key Points

| Bridging Aggregator | Key Points |

|---|---|

| Rango Exchange | Multi-chain liquidity aggregator, supports fast stablecoin transfers with low fees. |

| Find My Bridge | Search engine for bridging routes across multiple chains, simplifies cross-chain yield opportunities. |

| Portal Token Bridge | Enables token transfers with minimal slippage, optimized for stablecoins. |

| Across Protocol | Focuses on secure and gas-efficient cross-chain transfers for Ethereum and L2s. |

| Stargate Finance | LayerZero-based liquidity transport, real-time settlement, strong for stablecoin farming. |

| Synapse Protocol | Cross-chain swaps with native stablecoin support, smooth UI, and high liquidity pools. |

| Arbitrum Bridge | Direct bridging to Arbitrum, optimized for low fees and fast stablecoin movement. |

| Orbiter Finance | Fast L2 transfers, low-cost bridging, ideal for stablecoin yield strategies. |

| Hop Protocol | Instant liquidity across L2s and Ethereum, popular for stablecoin yield farming. |

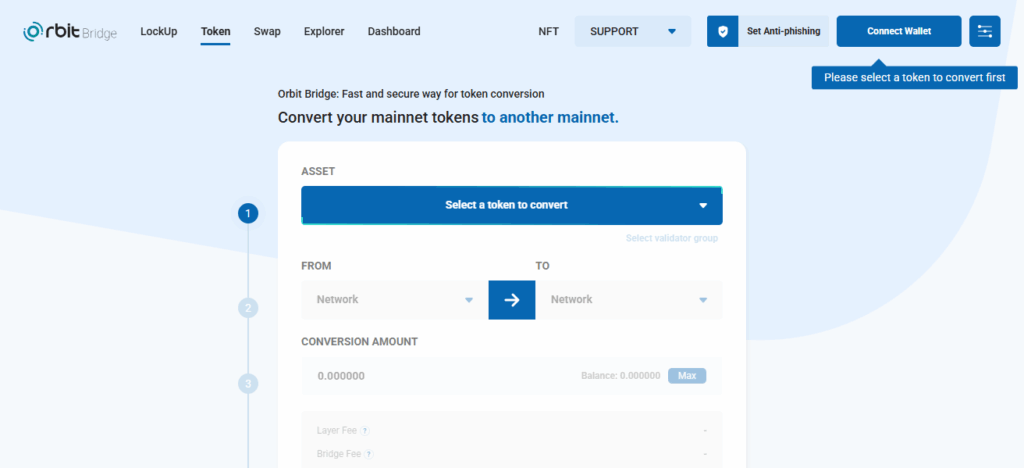

| Orbit Bridge | Cross-chain bridge with multi-chain support, strong security and stablecoin compatibility. |

10 Best Bridging Aggregator for Stablecoin Yield

1. Rango Exchange

Rango Exchange is a cross-chain DEX and DEX aggregator based in Istanbul, Turkey. Founded in August 2021 by Vahid Kaya, it supports over 130 DEXs and bridges across 75+ blockchains for seamless asset swaps.

The platform’s smart routing engine provides optimal trading paths with minimized slippage. Rango Exchange charges a base fee of approximately 0.15% for every trade, set by the specific blockchain and type of asset.

Additional network fees, which are set high during routing, are refunded if not used. As of 2025, Rango has over 6.37 million swaps and facilitated over $5.35 billion worth of transactions.

| Feature | Description |

|---|---|

| Multi-chain support | Supports over 75 blockchains for token swaps. |

| Low transaction fees | Base fee around 0.15% with overestimates refunded. |

| Aggregated liquidity | Integrates 130+ DEXs and bridges. |

| Smart routing engine | Ensures optimal trading paths and minimal slippage. |

| User-friendly interface | Easy for beginners to execute cross-chain swaps. |

2. Find My Bridge

Find My Bridge is a leading ‘bridging’ aggregator for stablecoin yield optimization which lets users compare various cross-chain bridge routes with great ease.

It was launched in 2023 by 0xNikhil, a DeFi developer with an interest in interoperability. 0xNikhil focused on combining data from bridge services such as Stargate, Synapse, and Across, so users could effortlessly find the most effective and lowest-cost stable coins.

It has no platform fees, so users only pay the transaction fees for the native bridge which vary based on the network and liquidity. Its easy-to-use interface, coupled with its fee comparison, is a highly effective yield optimization tool.

| Feature | Description |

|---|---|

| Bridge search engine | Compare 90+ bridges across 230+ chains. |

| Real-time fee data | Provides gas and bridge fees before transfer. |

| Transfer time estimates | Shows expected duration for each route. |

| Community tools | Telegram bot and other utilities for users. |

| Beginner-friendly | Simplifies decision-making for cross-chain transfers. |

3. Portal Token Bridge

Portal Token Bridge, a product of Wormhole Labs, was created at 2022. As a decentralised cross-chain platform, it allows users to move assets between various blockchains with ease.

To carry out transactions between Ethereum, Solana, and other supported chains, it uses Wormhole’s secure messaging and a consortium of custodial validators dubbed Guardians.

Transactions are charged a mere $0.01, which is significantly cheaper than average and allows users to carry out cross-chain transfers seamlessly and in a timely matter. The platform itself is designed to provide fast and secure token transfers, catering to users and developers in the blockchain ecosystem.

| Feature | Description |

|---|---|

| Multi-chain support | Transfers between Ethereum, Solana, and other chains. |

| Low fees | Transactions as low as $0.01. |

| Secure messaging | Uses Wormhole protocol with trusted validators. |

| Fast transactions | Optimized for stablecoin and token transfers. |

| Developer-friendly | Integrates easily into dApps. |

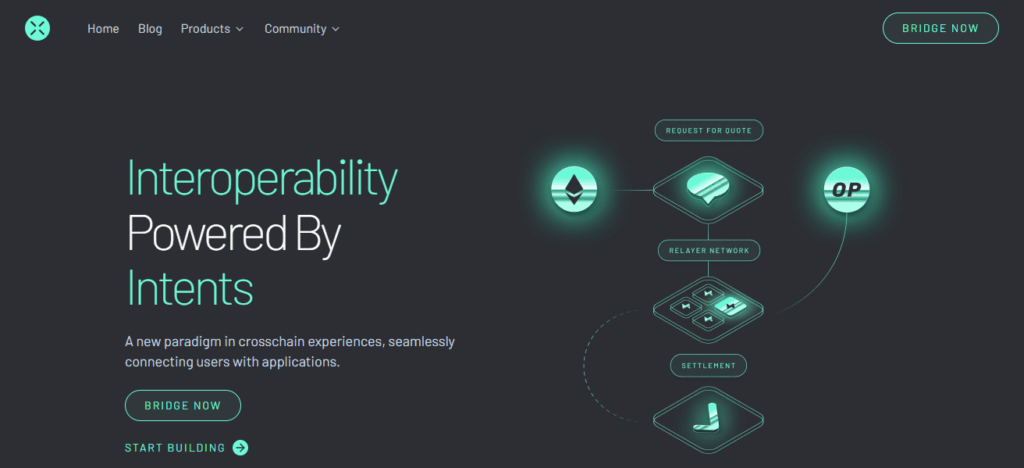

4. Across Protocol

Across Protocol is a decentralized bridge that allows the transfer of assets from Ethereum to layer 2 and vice versa without custody. The cross-chain bridge was developed in 2021 by Hart Lambur and John Shutt.

The protocol uses no-slippage fee model and allows set relayer fees which are like gas fees on other blockchains.

The protocol utilizes the optimistic oracle developed by UMA which allows the transfer to be settled quickly. As of 2025, Across Protocol records over $1.27 billion bridge volume over the past 30 days, earning approximately $90,536 annually.

| Feature | Description |

|---|---|

| Layer 2 focus | Bridges Ethereum to Layer 2 networks. |

| Security | Utilizes UMA optimistic oracle for fraud protection. |

| Capital efficiency | Single liquidity pool for transfers. |

| No-slippage model | Users set relayer fees instead of fixed fees. |

| Governance | ACX token holders manage protocol decisions. |

5. Stargate Finance

Stargate Finance was initiated in 2022 March by Bryan Pellegrino, Caleb Banister, and Ryan Zaric and developed by LayerZero Labs.

Snapshots of assets can be crossed and safely transmitted across more than 80 different blockchains using the single liquidity pool and LayerZero’s omnichain messaging.

Stargate charges a liquidity provider and protocol’s treasury fee of 0.045% and 0.015% respectively. Fees are drawn for non-STG token transfers for 0.06%, of which Stargate takes 0.015% for servicing the protocol’s treasury.

Holders of Stargate can run the protocol and govern at the same time due to their ability to stake tokens and earn rewards.

| Feature | Description |

|---|---|

| Omnichain liquidity | Connects 80+ blockchains through a unified pool. |

| Low fees | 0.06% per non-STG token transfer. |

| Real-time settlement | Immediate cross-chain transactions. |

| Governance | STG token holders can stake and vote. |

| LayerZero integration | Enhances security and interoperability. |

6. Synapse Protocol

The cross-chain protocol synapse was instituted in 2021 by Pawel Laskarzewski and Michal Domarecki. Since then, Synapse has employed a decentralized cross-chain liquidity protocol that enables effortless asset transfers across multiple blockchains.

Built on a modular messaging architecture and a robust consensus mechanism, Synapse enables interoperability among an array of blockchain systems, including monolithic base layer blockchains and roll-ups, as well as application-specific chains.

The protocol levies a default bridge fee of 0.05% for asset transfers between blockchains. Also, based on the type of transaction, users can pay additional network fees for area fees, transaction, and swap fees.

| Feature | Description |

|---|---|

| Multi-chain support | Transfers across multiple blockchains. |

| Low fees | Bridge fee ~0.05% per transaction. |

| Secure consensus | Ensures safe cross-chain communication. |

| Extensible messaging | Connects monolithic, rollup, and app-specific chains. |

| Interoperability | Facilitates swaps between various blockchain implementations. |

7. Arbitrum Bridge

The Arbitrum Bridge came out in August 2021 and is a product of Offchain Labs. It is a decentralized cross-chain bridge that helps with the transfers of digital assets from Ethereum to Arbitrum’s Layer 2 network in a quick and secure manner.

It uses optimistic rollups to scale Ethereum without sacrificing security. Users can bridge ETH and ERC-20 tokens for a fee of around $0.25, which is a bargain compared to what users pay on Ethereum’s mainnet.

As for the Arbitrum Bridge, it has a fee system that charges 0.1% of the outbound bridge volume captured on the Mayan WH Swap Fee on each chain gates through a source chain. These fees only apply to source chain connection transactions.

| Feature | Description |

|---|---|

| Layer 2 focus | Bridges Ethereum to Arbitrum network. |

| Optimistic rollups | Increases scalability with Ethereum-level security. |

| Low fees | Typical transfer fee ~$0.25. |

| Fast transactions | Quick deposit and withdrawal between chains. |

| ERC-20 support | Transfers ETH and all standard tokens. |

8. Orbiter Finance

Orbiter Finance was created in November two-thousand twenty one. It is a distributed cross-roll bridge allowing smooth movement of Ethereum-native assets across different Layer 2 networks.

The architecture is designed in a unique way to allow transfers to occur directly between user wallet addresses.

This improves speed and efficiency. Transaction fees usually cost between 0.02 and 0.2 percent of the asset value and depends on the target network. Also, a withholding fee is charged, determined by the amount of the transfer and the target location.

| Feature | Description |

|---|---|

| Cross-rollup transfers | Direct wallet-to-wallet transfers on L2s. |

| Low fees | 0.02–0.2% depending on asset and network. |

| Fast transfers | Reduces waiting time compared to standard bridges. |

| Multi-chain support | Works with over 70 networks. |

| User-friendly | Designed for both beginners and advanced users. |

9. Hop Protocol

Hop Protocol is a general token bridge created by Whinfrey, Fontaine, and Mota in 2021 for Ethereum rollups with a scalable rollup-to-rollup system.

Integrating a unique functionality, Hop allows for instant rollup-to-rollup token transfers without the waiting time for the challenge period. This functionality is a huge leap in the speed and cross-chain effectiveness of Ethereum transactions.

| Feature | Description |

|---|---|

| Rollup-to-rollup bridging | Transfers between Ethereum rollups. |

| Low AMM fees | ~0.04% per swap. |

| Bonder incentives | Fees 0.06–0.25% depending on asset and route. |

| Instant transfers | Avoids long rollup challenge periods. |

| Destination chain gas | Users pay gas fees on target chain. |

10. Orbit Bridge

Orbit Bridge was created by Ozys and launched on October 2020. Since this time it is helping a decentralized cross-chain bridge that helps moves And transfers asset across block chains. 19 blockchains are currently compatible: Ethereum, Klaytn, Polygon Ethereum, and more.

It uses positive technology to keep transactions safe and efficient. It uses Inter-Blockchain Communication. Each bridge and transaction has its own fees, and those fees are sent to the destination chains.

An example would be the bridging done from Klaytn to Ethereum, where the KLAY sends a fee. Users also need to consider the gas fees from the source chains.

| Feature | Description |

|---|---|

| Multi-chain support | Bridges 19 blockchains including Ethereum and Polygon. |

| Secure | Uses IBC technology for safe cross-chain transfers. |

| Variable fees | Fees depend on destination chain; e.g., 40 KLAY. |

| Gas management | Users cover source chain gas fees. |

| High volume | Processes billions in transactions across supported chains. |

Conclusion

In summary, the major players in stablecoin yield optimization are Rango Exchange, Stargate Finance, and Hop Protocol, due to their low-cost cross-chain interoperability, instant, and secure transfers.

Among other route optimization tools, Find My Bridge and Across Protocol improve efficiency. The best yield optimization bridge has the most favorable fees, supported networks, and fast transaction verification to minimize yield slippage.

FAQ

A platform that connects multiple blockchains, enabling users to transfer assets and access cross-chain yield opportunities.

Rango Exchange, Stargate Finance, Hop Protocol, Across Protocol, and Synapse Protocol.

Fees vary by platform, asset, and network; typically 0.02%–0.25% plus gas fees.