In this article, I will research the best Ethereum and Bitcoin ETF and examine the assets that give dividend payouts.

Irrespective of the ETF’s focus, the cryptocurrency alongside dividend income will help any investor looking for additional income.

These crypto ETF with dividends help you actively earn returns, while also having the potential for stable and growth assets.

Key Point & Best Crypto Etf With Dividends Detailed

Bitwise Trendwise BTC/ETH and Treasuries Rotation Strategy ETF (BTOP): Balanced exposure to BTC & ETH; rotates into Treasuries during downturns; ~48.89% yield

ProShares Bitcoin Strategy ETF (BITO): Most liquid U.S. Bitcoin futures ETF; ~48.54% dividend yield; monthly distributions

CoinShares Bitcoin and Ether ETF (BTF): Invests in CME-traded BTC & ETH futures; ~42.61% yield; actively managed

Bitwise Trendwise Bitcoin and Treasuries Rotation Strategy ETF (BITC): Uses momentum-based rotation; combines crypto upside with Treasury income

YieldMax Bitcoin Option Income Strategy ETF (YBIT): Covered call strategy on BTC; lower yield (~24%) but consistent income

Simplify Bitcoin Strategy PLUS Income ETF (MAXI): Uses options overlay on BTC futures; targets income generation with volatility management

Global X Blockchain & Bitcoin Strategy ETF (BITS): Combines BTC futures with blockchain equities; modest dividend yield

VanEck Bitcoin Strategy ETF (XBTF): Actively managed BTC futures exposure; occasional distributions

Volatility Shares 2x Bitcoin Strategy ETF (BITX): High-risk leveraged BTC futures; includes income-generating strategies

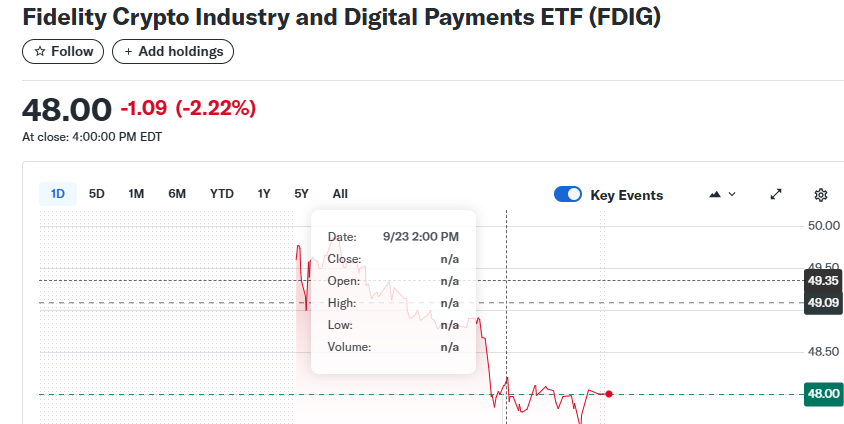

FIAT ETF (Fidelity Crypto Industry and Digital Payments ETF): Indirect crypto exposure via equities; dividend from underlying holdings

10 Best Crypto Etf With Dividends

1. Bitwise Trendwise BTC/ETH and Treasuries Rotation Strategy ETF (BTOP)

BTOP is a foreign ETF that includes crypto and hybrid Treasuries. It rotates among Bitcoin, Ethereum, and treasury securities to minimize market volatility and achieve some level of market growth.

It aims to achieve growth while receiving income from US treasury securities, which stabilizes volatility. Investors who are interested in some level of capital gain appreciation, and relatively safe dividend income will find this enticing.

BTOP makes use of algorithmic trend analysis in the market to determine velocity of momentum. It is active crypto price momentum that yields dividends, adjusted for market dynamics.

| Feature | Details |

|---|---|

| Strategy | Rotates between Bitcoin, Ethereum, and U.S. Treasuries based on market trends. |

| Underlying Assets | BTC, ETH, U.S. Treasuries. |

| Income/Dividends | Primarily from treasury yields; dividends may vary with allocations. |

| Risk Level | Moderate – crypto exposure mitigated by treasuries. |

| Suitable Investors | Those seeking crypto growth with lower volatility and some income. |

2. ProShares Bitcoin Strategy ETF (BITO)

BITO remains one of the first Bitcoin futures ETFs approved in the U.S. It mostly holds Bitcoin futures contracts, bypassing direct exposure to Bitcoin, and still providing indirect exposure to its price movements. BITO does not invest in cryptocurrencies directly.

Instead, it tracks CME Bitcoin futures, providing investors a more regulated avenue to gain exposure to Bitcoin. It has the ability to earn money from futures trading and can pay out dividends sourced from collateral yield.

It does offer investors the ability to invest in Bitcoin at a brokerage at Bitcoin prices, investors should expect management fees and tracking errors regardless. Investors wanting a liquid, regulated Bitcoin position and low income potential can look at BITO.

| Feature | Details |

|---|---|

| Strategy | Invests in Bitcoin futures contracts for indirect BTC exposure. |

| Underlying Assets | CME Bitcoin futures, collateral cash. |

| Income/Dividends | Potential from futures collateral yields; modest payouts. |

| Risk Level | High – tied to Bitcoin price and futures market volatility. |

| Suitable Investors | Traditional investors wanting regulated Bitcoin exposure. |

3. CoinShares Bitcoin and Ether ETF (BTF)

BTF is the world’s first ETF and is based in Europe. It integrates Bitcoin and Ethereum exposure into one fund. It is constructed to allow exposure to cryptocurrency without physically holding the assets.

It seeks to grow capital and pay out any yields generated from income during staking and lending. It balances the stability of Bitcoin and the Ethereum flux in the decentralized finance ecosystem.

It offers exposure to crypto in a regulated structure in which investors can earn income from crypto collateral yield strategies. It offers investors transparency and flexibility in asset allocation.

| Feature | Details |

|---|---|

| Strategy | Provides combined exposure to Bitcoin and Ethereum. |

| Underlying Assets | BTC, ETH. |

| Income/Dividends | Possible from staking or lending of crypto holdings. |

| Risk Level | High – crypto market volatility. |

| Suitable Investors | Investors seeking diversified crypto exposure in a single ETF. |

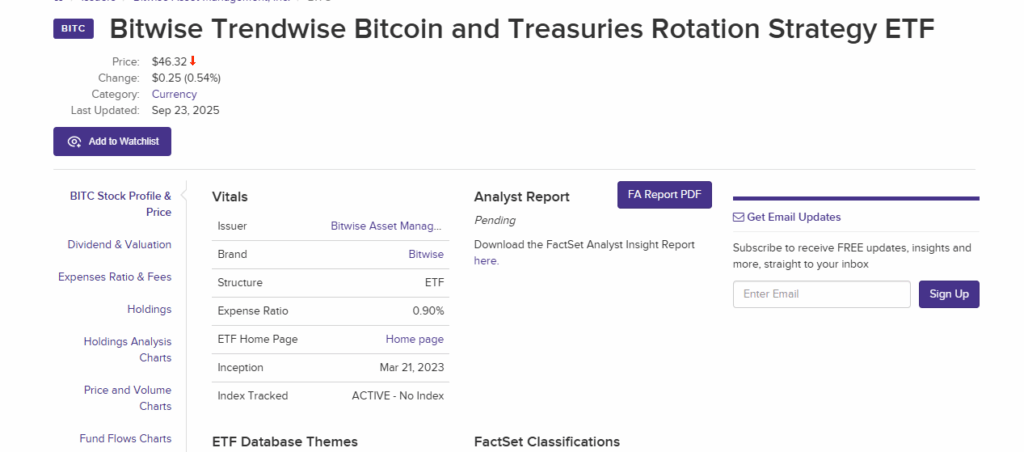

4. Bitwise Trendwise Bitcoin and Treasuries Rotation Strategy ETF (BITC)

BITC employs a trend-following algorithm to switch between Bitcoin and U.S. Treasuries. This approach aims to optimize risk-adjusted returns by allocating to cryptocurrencies in bullish and moving to treasuries in bearish phases.

The ETF primarily derives its dividend income from treasury yields than its crypto assets, which helps add income to capital appreciation. BITC is appealing for riskaverse investors seeking some crypto exposure.

Its systematic rotation lowers risk while maintaining upside opportunity, enhancing its appeal for hedged portfolios. Performance is greatly contingent upon algorithmic choices as well as prevailing market circumstances.

| Feature | Details |

|---|---|

| Strategy | Algorithmic rotation between Bitcoin and U.S. Treasuries. |

| Underlying Assets | BTC, Treasuries. |

| Income/Dividends | Treasury yields; dividends more stable than crypto-only ETFs. |

| Risk Level | Moderate – reduces crypto downside risk via treasuries. |

| Suitable Investors | Risk-conscious investors seeking growth plus income. |

5. YieldMax Bitcoin Option Income Strategy ETF (YBIT)

YBIT does not simply hold Bitcoin, rather, it generates income from Bitcoin by writing covered call options. The ETF does not just hold BTC, it sells options to collect premiums, thus generating cash flow for investors.

This way, income-oriented investors gain Bitcoin exposure while receiving periodic distributions.

While covered calls slow upside potential during strong bull markets, they tend to smooth returns while mitigating downside risk. YBIT is best for investors wanting crypto exposure while primarily focused on income generation.

The Income derives from the premium received for writing the options, thus, dividends paid on the fund may be more stable than holding Bitcoin and waiting for its price to appreciate. The investor’s risk in this ETF is that of Bitcoin’s price volatility

| Feature | Details |

|---|---|

| Strategy | Writes covered calls on Bitcoin to generate income. |

| Underlying Assets | BTC, Bitcoin options. |

| Income/Dividends | From option premiums; regular distributions possible. |

| Risk Level | Moderate-High – BTC volatility, limited upside due to options. |

| Suitable Investors | Income-oriented investors with BTC exposure. |

6. Simplify Bitcoin Strategy PLUS Income ETF (MAXI)

MAXI aims to achieve growth while simultaneously providing regular income, offering exposure to Bitcoin alongside income-producing tactics such as covered calls and option writing.

The use of derivatives strategies in conjunction with spot Bitcoin holdings allows MAXI to deliver less volatile returns, while also offering periodic distributions.

MAXI targets Bitcoin holders who desire exposure to its price movements, yet wish to minimize volatility and receive dividends.

It offers capital appreciation alongside option yields to Bitcoin holders who wish to focus on investment income.

The income layer on top of traditional BTC gains and the ability to capitalize on the option market volatility translate to dividend potential that changes with market conditions.

| Feature | Details |

|---|---|

| Strategy | Spot Bitcoin plus options strategies for income. |

| Underlying Assets | BTC, options contracts. |

| Income/Dividends | From covered calls and option premiums. |

| Risk Level | Moderate – reduces volatility via options. |

| Suitable Investors | Investors seeking growth plus recurring income from BTC. |

7. Global X Blockchain & Bitcoin Strategy ETF (BITS)

BITS is another ETF that gives investors diversified exposure to the blockchain industry and Bitcoin. BITS invests in blockchain-focused firms and Bitcoin futures to capture both capital appreciation and income.

This hybrid approach allows investors to immerse in the blockchain ecosystem and still earn yields from futures contracts or collateralized approaches.

The ETF balances growth and income mandates. Dividends may come from the blockchain firm’s corporate profits or yields from derivatives strategies.

For investors seeking appreciation and income having BITS in the portfolio will make it a hybrid addition. It will balance the portfolio which focuses on crypto or technology due to it’s long-term growth potential.

| Feature | Details |

|---|---|

| Strategy | Invests in blockchain companies and Bitcoin futures. |

| Underlying Assets | Blockchain stocks, BTC futures. |

| Income/Dividends | From corporate dividends and futures yields. |

| Risk Level | Moderate-High – exposure to equities + BTC derivatives. |

| Suitable Investors | Diversified crypto/blockchain exposure with income potential. |

8. VanEck Bitcoin Strategy ETF (XBTF)

XBTF targets Bitcoin targets Bitcoin futures contracts and associated derivatives in order to follow the performance of Bitcoin prices. For ETF investors, it’s the first practical and compliant way to gain exposure to BTC.

It can be held in retirement and brokerage accounts. Income is generated from the yield on collateral, strategic derivatives, and investment income, but for the most part is insignificant.

XBTF is effective for investors wanting bitcoins in regulated and liquid frameworks under the professional management of futures contracts.

It minimizes overall risk while providing a positive return through futures position XBTF’s focused approach to crypto investing is through derivatives and not direct bitcoin purchase and holding.

| Feature | Details |

|---|---|

| Strategy | Bitcoin futures-based ETF for regulated BTC exposure. |

| Underlying Assets | BTC futures contracts, collateral. |

| Income/Dividends | Collateral yields; modest dividends. |

| Risk Level | High – tied to BTC futures price volatility. |

| Suitable Investors | Traditional investors seeking liquid, regulated BTC exposure. |

9. Volatility Shares 2x Bitcoin Strategy ETF (BITX)

BITX ETF has a 2x leverage factor and captures Bitcoin futures. Like other 2x ETFs, it tries to increase profits- positive and negative, Bitcoin moves.

It has a serious downside, excessive price volatility which elevates risk. Returns accumulate from collateral yields, but it’s a growth focused strategy and a secondary source of income.

BITX is ideal for side or swing traders and investors who prefer aggressive strategies on Bitcoin. Because of compounding, daily rebalancing, BITX holders for the long term, operate on a price multiple which is worst case.

Returns from futures as leased collateral are a small portion of BITX income, income primarily paid from dividends on stock, but the BITX appeal is from leveraged capital losses.

| Feature | Details |

|---|---|

| Strategy | 2x leveraged Bitcoin futures ETF. |

| Underlying Assets | BTC futures contracts. |

| Income/Dividends | Minimal; focus on capital gains. |

| Risk Level | Very High – amplified BTC price volatility. |

| Suitable Investors | Short-term traders or aggressive BTC investors. |

10. FIAT ETF (Fidelity Crypto Industry and Digital Payments ETF)

FIAT takes a different approach and invests into companies involved in cryptocurrency, blockchain technology, and digital payments.

In contrast to BTC-specific ETFs, FIAT ETFs invests in equities of companies participating in crypto asset adoption, including cryptocurrency exchanges, payment facilitators, and blockchain technology developers.

Income distribution of these firms provides investors with capital appreciation and positive cash flow. FIAT ETF provides indirect exposure to cryptocurrency with much lower volatility than holding the digital assets.

It targets investors wanting upside exposure to the crypto economy while receiving consistent cash flow. The FIAT ETF is driven by corporate profits, adoption of digital payments, and general market correlation rather than prices of cryptocurrency assets.

| Feature | Details |

|---|---|

| Strategy | Invests in crypto, blockchain, and digital payment companies. |

| Underlying Assets | Stocks of crypto and fintech companies. |

| Income/Dividends | Dividends from underlying companies; stable compared to BTC ETFs. |

| Risk Level | Moderate – stock market risk plus tech/crypto sector volatility. |

| Suitable Investors | Investors seeking indirect crypto exposure with dividend income. |

How We Pick Best Crypto Etf With Dividends

Analyze Underlying Assets – Determine whether the ETF holds Bitcoin, Ethereum, or other cryptocurrencies and blockchain companies to help achieve your crypto exposure goals.

Evaluate Dividend yield – Review the dividend history of the ETF to assess the reliability of the income stream.

Evaluate Fund Strategy – Determine whether the ETF implemented covered calls, futures, or rotation strategies, since these will affect the returns and risk.

Evaluate Expense Ratio – Lower fees are more beneficial for the net returns of an investment, especially with long-term holdings.

Evaluate Risk & Volatility – Determine how much the ETF will lose if the crypto market takes a downturn.

Check Liquidity & Trading Volume – Ensure the ETF can be easily bought and sold without significant price spreads.

Assess Performance – Determine how the ETF’s past returns stack up to other crypto ETFs and benchmarks.

Evaluate Investment Strategy – Ensure the ETF meets your needs for balancing risk and income, or core income and growth, based on your investment goals.

Conclsuion

In conclusion, dividend-paying crypto ETFs exhibit a radically different approach in framing continue crypto growth with passive income.

After rigorous analysis on asset allocation, strategy, consistency in dividends and the corresponding risks, crypto investors can find ETFs tailored to their investment porfilio.

Be it the propensity for risk or the need for stability, the crypto ETFs provide access to the digital assets market and pay out dividends.

FAQ

It’s an exchange-traded fund that invests in cryptocurrencies or blockchain companies and distributes regular income to investors.

Dividends come from yields on underlying assets, options strategies, or treasury allocations within the ETF.

They carry risk like all crypto investments, but those combining treasuries or stocks may be less volatile than pure crypto ETFs.

Yes, some ETFs are available internationally via brokerage platforms, but availability may vary based on regulations.

Some ETFs hold actual crypto, while others invest in futures, options, or related stocks for indirect exposure.