This article will cover the best crypto exchanges for business payments (B2B crypto), focusing on the ones that make global transaction cost-effective, flexible, and easy.

With the rise of crypto adoption in businesses, the importance of picking the most crypto payment exchanges to ensure swift and secure payments

That are compliant to regulations has become paramount in facilitating and optimizing cross-border trade.

Key Points & Best Crypto Exchanges for Business Payments (B2B Crypto)

Kraken – Known for its fortress-like security and regulatory compliance, ideal for businesses that prioritize trust and transparency.

Binance – Offered unmatched global liquidity and a vast selection of crypto assets, perfect for companies with international partners.

Coinbase – A favorite among U.S.-based firms, thanks to its strong regulatory standing and seamless fiat-to-crypto conversions.

ChangeNOW – Enabled fast, non-custodial crypto swaps with easy API integration, ideal for automating vendor payments.

Bybit – Excelled in derivatives and hedging tools, helping ByteBridge manage crypto volatility in cross-border deals.

WhiteBIT – Delivered low transaction fees and a user-friendly interface, especially attractive to small and mid-sized enterprises.

BitPay – Specialized in crypto payment processing, allowing ByteBridge to accept crypto from clients with ease.

Gemini – Provided insured custody and strong compliance, making it a secure choice for storing large crypto reserves.

Uphold – Stood out with transparent pricing and easy cross-border payments, simplifying global supplier transactions.

OKX – Provided advanced trading tools and global reach, making it a go-to for businesses with complex payment needs.

10 Best Crypto Exchanges for Business Payments (B2B Crypto)

1. Kraken

Kraken provides corporate clients the facility of a dedicated Business Account for businesses to deposit fiat, trade digitally, and enjoy business level compliance.

They have also introduced Kraken Pay, which facilitates the sending and receiving of payments in over 300 crypto and fiat currencies, thus making possible cross-border and crypto-powered transactions.

Kraken provides businesses with an integrated offering that covers trading, treasury, and payments, all with robust security features.

However, depending on the relevant jurisdiction, local regulations and the availability of fiat currencies will still need to be examined closely.

Features Kraken

| Feature | Details |

|---|---|

| Security | Industry-leading security with proof-of-reserves and cold storage |

| Regulatory Compliance | Fully regulated in multiple jurisdictions |

| Fiat Support | Supports major fiat currencies (USD, EUR, GBP, etc.) |

| API Access | Advanced API for automated trading and payments |

| Business Accounts | Tailored services for institutions and businesses |

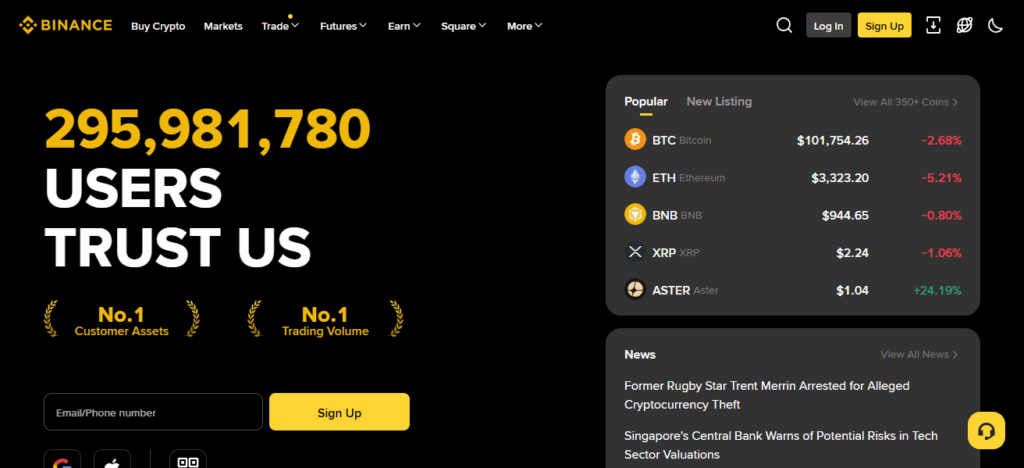

2. Binance

The “Binance Pay” option lets merchants use Binance for business payments. It is geared toward online merchants, online platforms, and even brick-and-mortar stores.

Merchants can register, use APIs/SDKs to accept cryptocurrency or stablecoin payments, and gain access to a huge worldwide user base.

The offerings include a variety of cryptocurrencies, and the scale is advantageous. However, just like with other big exchanges, regulatory and jurisdictional concerns need to be identified and managed for B2B treasury transactions.

Features Binance

| Feature | Details |

|---|---|

| Global Liquidity | One of the highest trading volumes globally |

| Wide Asset Support | Supports hundreds of cryptocurrencies |

| Binance Pay | Enables crypto payments between businesses and customers |

| Customizable API | Ideal for integrating into business systems |

| Multi-Language Support | Accessible to global teams and partners |

3. Coinbase

Coinbase offers businesses the use of “Coinbase Business” and “Coinbase Commerce,” where they can accept crypto payments and send payouts in stablecoins like USDC.

By focusing on automation using APIs and providing a broad global reach with low fees and avoiding chargebacks, they work quite well with B2B payments and vendor payments.

Being regulated in the U.S. provides some compliance peace of mind, but it will probably mean greater KYC/AML scrutiny and slower onboarding that may be more expensive.

Features Coinbase

| Feature | Details |

|---|---|

| Regulatory Strength | SEC-compliant and publicly traded in the U.S. |

| Coinbase Commerce | Accept crypto payments directly from customers |

| Fiat On/Off Ramps | Easy conversion between crypto and fiat |

| Insurance Coverage | Digital assets insured against breaches |

| User-Friendly Interface | Simple dashboard for finance teams |

4. ChangeNOW

ChangeNOW is centered on equipping companies with payment gateway tools for accepting crypto (and fiat) through APIs, cross-chain interactions, and integration with e-commerce systems.

It’s particularly geared for SMEs or online businesses wanting to add crypto payment options without the complete setup of a large exchange.

The downside is that while the gateway service is robust, the rest of the surrounding ecosystem, including institutional-grade services and liquidity, is not as deep as large exchanges.

Features ChangeNOW

| Feature | Details |

|---|---|

| Non-Custodial Swaps | No account needed; instant crypto-to-crypto swaps |

| API Integration | Easy to embed into business platforms |

| No KYC for Small Transactions | Fast onboarding for small B2B payments |

| Wide Asset Range | Supports 900+ crypto assets |

| Transparent Fees | No hidden charges |

5. Bybit

Bybit has introduced “Bybit Pay”, a payment solution intended to integrate traditional fiat with crypto payments (online, point-of-sale, worldwide).

Bybit provides a flexible platform for enterprises wishing to utilize crypto payments and access customers worldwide.

However, in terms of B2B (vendor payments, treasury), region-specific regulatory clarity, and product maturity within their tier of exchange (compared to the largest exchanges) product set is likely less mature.

Features Bybit

| Feature | Details |

|---|---|

| Derivatives Trading | Futures and options for hedging business risks |

| Institutional Services | Dedicated support for corporate clients |

| Advanced Trading Tools | Real-time analytics and automation |

| High Liquidity | Fast execution for large transactions |

| Security Infrastructure | Multi-signature wallets and cold storage |

6. WhiteBIT

WhiteBIT provides on-/off-ramp payments, SEPA, and mass crypto payouts for businesses within their B2B institutional/enterprise features.

It is designed for Europe/nearby region firms wishing to add crypto payments or treasury flows.

The advantages is the more specialized “business/enterprise” focus; the downside is perhaps lesser global coverage/brand recognition compared to the very biggest players, so due diligence is required especially on support, liquidity, and the fiat-rail limitations.

Features WhiteBIT

| Feature | Details |

|---|---|

| Low Fees | Competitive trading and withdrawal fees |

| Business-Friendly UI | Clean interface for finance teams |

| AML/KYC Compliance | Fully regulated in the EU |

| Staking Options | Earn passive income on idle assets |

| Multi-Currency Support | Supports fiat and crypto pairs |

7. BitPay

BitPay is a very popular crypto payment processor (crypto payment provider) allowing firms to accept cryptocurrency payments. While not an “exchange,” it is very important for merchant processor B2B payments.

Businesses incorporate BitPay so they can accept crypto, convert to fiat (if they choose), and lessen reliance on traditional payment card systems.

For companies with a payments focus (instead of crypto trading), BitPay is a viable option. However, integrating trading, treasury management, and exchange functions will take extra work.

Features BitPay

| Feature | Details |

|---|---|

| Crypto Payment Gateway | Accepts crypto payments from customers |

| Invoice Management | Generate and track crypto invoices |

| Settlement in Fiat | Receive payments in local currency |

| Wallet Integration | Works with BitPay Wallet and others |

| Global Reach | Supports payments in 200+ countries |

8. Gemini

Gemini has crypto solutions aimed at institutions and businesses (“Gemini Institutional / Gemini for Business”) catering to corporations, trusts, and family offices.

Gemini is a feasible option for businesses that require a high-compliance, regulated platform for crypto payment, treasury, and custody access.

However, on the payment-gateway side, their emphasis is more on institutional treasury, custody, and trading rather than merchant checkout integration, thus its compatibility will vary based on your business’s payment/treasury structure.

Features Gemini

| Feature | Details |

|---|---|

| Regulated Exchange | Licensed in New York and other jurisdictions |

| Gemini Custody | Insured cold storage for institutional clients |

| Business Accounts | Tailored services for corporate users |

| Secure Transfers | SOC 2 Type 2 certified infrastructure |

| Earn Program | Interest on idle crypto balances |

9. Uphold

Uphold offers a multi-asset platform that allows companies to accept payments in cryptocurrencies and traditional currencies and allows for direct checkout or business flow integrations.

For companies requiring a payments layer that offers a blend of traditional and crypto assets, Uphold is a good option.

You should, as with any platform, consider local regulations, compliant settlements, and whether their business payments features, such as vendor payouts and mass disbursements, fit your B2B payment scenario.

Features Uphold

| Feature | Details |

|---|---|

| Multi-Asset Platform | Trade crypto, fiat, and precious metals |

| Cross-Border Payments | Send payments globally with low fees |

| Transparent Pricing | No hidden spreads or markups |

| Business API | Automate payments and conversions |

| Instant Transfers | Real-time settlement between Uphold users |

10. OKX

Regarding business payments, OKX ranks among the top crypto exchanges. It provides a strong platform for B2B needs. With a large number of digital assets, cross-border transactions become easy for OKX clients.

Enterprises gain access to OKX’s advanced trading tools, enabling the use of futures and options for effective market volatility hedge.

For companies dealing with high-volume crypto transactions, OKX lends API technology for automated payments and settlements.

OKX boasts strong market and operational security. Growing regulatory compliance makes OKX even more reliable for businesses wanting to integrate crypto into their payment systems.

Features OKX

| Feature | Details |

|---|---|

| Global Exchange | Serves businesses in 100+ countries |

| Advanced Trading Suite | Spot, margin, and derivatives trading |

| OKX Wallet | Web3 wallet for DeFi and NFT integration |

| API & SDKs | Developer-friendly tools for automation |

| Security & Compliance | Regular audits and robust risk controls |

Conclusion

In conclusion, the ideal crypto exchanges for B2B payments incorporate safety, international accessibility, and effortless integration.

BitPay, Coinbase, and Binance are top players when it comes to merchant facilities. Kraken, Gemini, and Uphold provide excellent institutional and treasury services.

OKX and WhiteBit link payments and trading and are perfect for companies that need fast, compliant, and borderless crypto transactions.

FAQ

Exchanges with strong security, regulatory compliance, API access, and support for fiat/crypto conversions are ideal for business use.

Yes. Platforms like Coinbase Commerce, BitPay, and Binance Pay allow businesses to accept crypto from customers and partners.

Coinbase and Gemini are top choices due to their regulatory clarity and U.S. licensing.

Absolutely. Exchanges like OKX, Uphold, and Binance offer global reach and multi-currency support.

Exchanges like Kraken and Gemini offer insured custody and cold storage, but using dedicated wallets is often safer for long-term storage.