In this article I am going to describe how to find and use the best traded cryptocurrency exchanges in Guinea while underscoring those which have balanced markets and low transaction fees.

This guide will help crypto novices and professionals alike to ensure that they safely execute purchases and trades for any digital currency by easily closing a deal on any exchange in the country.

What Is Crypto Exchanges?

A crypto exchange is an online trading platform that allows users to purchase and sell bits of crypto such as Bitcoin and Ethereum. The purchasing and selling process is handled by the exchange which provides secure online wallets and trading software.

Exchanges can either be decentralized, granting users complete control of their funds, or centralized, offering users numerous above average capabilities and having high liquidity.

To get funds in the digital currency market quickly, efficiently, and in a safe manner, crypto exchanges are essential.

Key Points

| Crypto Exchange | Key Point |

|---|---|

| Binance | Largest global exchange with 350+ cryptocurrencies and low 0.10% spot trading fees. |

| KuCoin | “People’s exchange” offering nearly 700 coins, P2P trading, and futures up to 125x leverage. |

| Kraken | Highly secure with proof-of-reserve audits and fiat-to-crypto trading3. |

| Deepcoin | Beginner-friendly interface with strong regulatory compliance and insurance coverage. |

| Gate.io | Offers 1,700+ cryptocurrencies and advanced trading tools. |

| MEXC | High liquidity, frequent token listings, and low trading fees. |

| Paxful | P2P marketplace supporting local payment methods in Guinea. |

| Luno | Simple mobile app for buying Bitcoin and Ethereum with local currency support. |

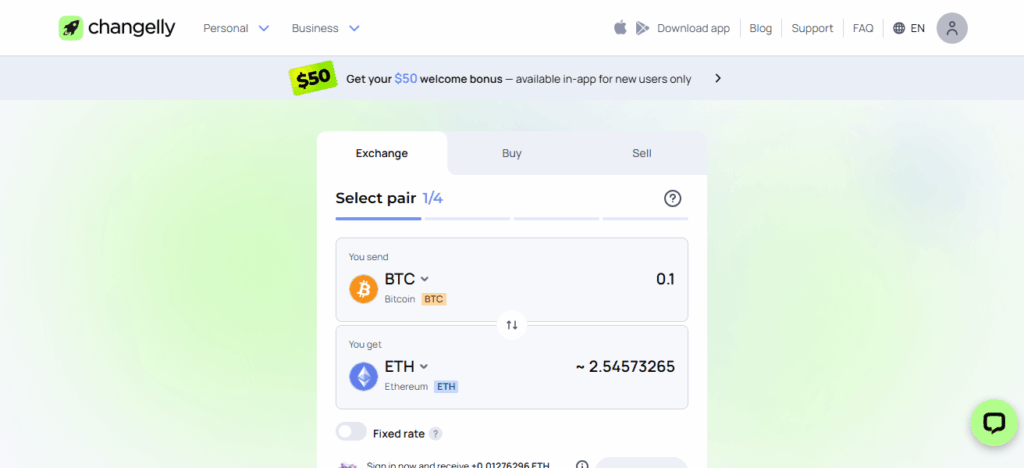

| Changelly | Instant crypto swaps with competitive exchange rates. |

| Bitstamp | One of the oldest exchanges, known for reliability and regulatory compliance. |

10 Best Crypto Exchanges In Guinea

1. Binance

One of the best cryptocurrency exchanges available in Guinea is Binance, founded in 2017 by Changpeng Zhao (CZ).

The platform launched over 350 cryptocurrencies as well as many intricate trading pairs, further benefiting both novice and professional traders alike.

Binance also offers competitive rates of 0.1%. The fees also get lower if you are using BNB. Offering P2P crypto, card services, and bank transfers, it easily enables fiat deposits and withdrawals.

Binance offers advanced trading strategies with up to 125x leverage on futures trading. Most importantly, Binance offers users uninterrupted trading with easy access to the platform due to 24/7 multilingual support

Pros:

- Supports 500+ cryptocurrencies and 1300+ trading pairs.

- Low trading fees, starting at 0.1%, for both makers and takers, are offered.

- Numerous trading options such as spot trading, futures trading, and staking services are provided.

- Available in more than 100 countries (including Guinea).

Cons:

- Complicated interface might be daunting for newcomers.

- Many countries including the U.S. and the UK are undergoing regulatory scrutiny.

- Users have to use external wallets since there are no inbuilt digital wallets.

- Certain areas have very limited options for fiat deposits.

2. KuCoin

Founded in 2017, by Michael Gan and Eric Don, KuCoin is one of the best cryptocurrency exchanges in Guinea.

Also termed as “People’s Exchange”, the platform has 700+ cryptocurrencies and thousands of trading pairs. KuCoin charges low costs, and their fees are around 0.1%.

These fees can be discounted even further by the use of KCS tokens. KuCoin provides fiat support through their P2P trading and third-party integrations.

For derivatives, KuCoin provides 100x leverage, which is attractive for advanced traders. They are a global company and offer 24/7 support in multiple languages, through email and live chat, making them a go-to for crypto traders in Guinea.

Pros:

- More than 900 cryptocurrencies and tokens are supported.

- Margin and futures trading as advanced trading features are available.

- Competitive fee structure with a maker fee of 0.0125%.

- Staking and lending services are provided.

Cons:

- Regulatory problems have restricted access to the U.S.

- Customer service tends to be inactive and slow.

- Authorization for the 2020 hack, was a huge loss of user trust.

- Certain areas have very limited options for fiat deposits.

3. Kraken

Founded in 2011, Kraken is trusted crypto exchanges even in Guinea, where it is accessible to users.

Among crypto exchanges, Kraken is one of the best in security and transparency, supporting over 200 cryptocurrencies.

Their fees are competitive, with 0.26% taker and 0.16% maker fees, which get lower the more you trade. Kraken supports deposits and withdrawals by bank transfer and cards, which makes local access easier.

Traders get access to up to 50x leverage and futures markets. Their backup of cryptocurrencies, regulatory framework, and 24/7 customer support through email and live chat makes Kraken the most trusted exchange among investors in Guinea.

Pros:

- Supports 400+ cryptocurrencies.

- Enable Futures Trading and Derivatives Trading.

- Two-factor authentication and cold storage.

- Trusted because of operating in multiple jurisdictions.

Cons:

- Fees are higher than some of its competitors.

- Available in a limited number of U.S. states.

- User does not have an overly simplistic experience.

- Response time for user queries could be better.

4. Deepcoin

Deepcoin is a global crypto exchange, available in Guinea, since it’s launch in 2018 by Ego Huang. It supports more than 100+ crypto suchs as spot, futures and options Deepcoin offers.

One of its distinguishing factors is its aggressive pricing with 0.1% maker and taker fees and even lower fees for futures trading.

Users can also send and receive funds directly via bank transfer and supported fiat currencies through third party payment systems.

Customers are served 24/7 via email and live chat, and Deepcoin has maintained outstanding crypto support. Users can also trade one of the most competitive derivatives in the industry, with leverage ranging up to 125x.

Pros:

- Spot and Derivative Trading.

- Sophisticated trading systems and interfaces.

- 24/7 support in multiple languages.

- Simple account opening procedure.

Cons:

- Withdrawals in fiat currency are not possible.

- Few cryptocurrencies are supported.

- No staking.

- Does not have some needed regulatory licenses.

5. Gate.io

Gate.io is a cryptocurrency exchange that was launched in April 2013 and created by Dr. Lin Han under the name Bter.com. Gate.io has its headquarters in George Town, The Cayman Islands, after changing its name in 2017.

The exchange has more than 3,800 cryptocurrencies which includes Bitcoin, Ethereum, and the exchanges own tokens GT.

Gate.io has a fee structure whereby both the makers and takers are charged 0.20% to a minimum fee of $1, with volume and token holders discounts.

Even Guinea which is one of the 175 countries the exchange operates in has access to 24/7 customer support via live chat and email, as well as an extensive help center.If you want to trade on any exchange, Gate.io provides a superb range of advanced trading features.

Pros:

- Supports more than 3,800 cryptocurrencies.

- Trading spot, margin, and futures.

- Provides staking and lending.

- Security is solid.

Cons:

- User experience is overly complicated and disruptive.

- Has had a breakdown in security in the past.

- User feedback shows support is lacking.

- Users in specific countries are not supported.

6. MEXC

Established in 2018 by John Chen and Jocelyn Chang, MEXC is a worldwide virtual currency trading platform with headquarters in the Seychelles.

It is home to 2800+ virtual currencies and allows trading with Bitcoin, Ethereum, and its own MX token. MEXC is very affordable with trading spot trading fees starting at 0.20%, and futures trading fees at 0% – and 0.020% for takers.

In addition, MEXC provides customer service 24/7, and operates in over 170 countries, one being Guinea. MEXC has a positive reputation for its liquid exchanges ,as well as advanced tools for trading and fulfilling the legal aspects of the business.

Pros:

- Supports a wide range of cryptocurrencies.

- No fees for spot and futures trading maker orders.

- Copy trading and staking services are available.

- Beginner-friendly and simple even for complex tasks.

Cons:

- Does not allow the liquidation of fiat universal currencies.

- Only allows limited deposits of fiat currencies.

- Unregulated in some jurisdictions.

- Customer service has been known to have slow response times.

7. Paxful

Paxful was founded back in July 2015 by Ray Youssef and Artur Schaback as a peer-to-peer (P2P) cryptocurrency exchange.

They first set it up to allow merchants to make payments in Bitcoin and shifted to a P2P exchange, securing access to buying and selling different cryptocurrencies to users with over 300 payment options, including bank transfers, mobile money, and gift cards.

The platform facilitates Bitcoin (BTC), Ethereum (ETH), Tether (USDT), and USD Coin (USDC) trading. Paxful’s trading experience is decentralized and is available in more than 140 countries including Guinea.

Paxful users enjoy a competitive and transparent P2P fee market as they only pay 1% on a given transaction that is divided between the buyer and seller. Customer support is available through live chat and email, though support is in English only.

Paxful was forced to temporarily shut down Operations in 2023 but continued to serve users worldwide after lifting the suspension later that year.

Paxful’s user-centric approach, with its support in regions with underdeveloped access to banking and multiple payment options, gives it the competitive edge over other trading services.

Pros:

- More than three hundred ways to pay.

- Free to buy, 1% selling fee.

- Flexible trading can be done on a peer-to-peer basis.

- Multiple fiat currencies accepted.

Cons:

- As a seller, you can set your own selling price to make a margin which might lead to price difference issues.

- Customer support limited.

- Available in countries.

- Needs to be careful or vigilance, can be easily scammed.

8. Luno

In 2013, Luno, formerly BitX, was founded by Marcus Swanepoel and Timothy Stranex, and it was originally based in South Africa.

The exchange has since been rebranded and released in 2017. It Luno supports various cryptocurrencies including Bitcoin (BTC), Ether (ETH), Litecoin (LTC), Ripple (XRP), Bitcoin Cash (BCH), and USD Coin (USDC).

Luno operates in more than 40 countries, including South Africa, Nigeria, Malaysia, and Indonesia. The fee structure set by Luno varies from country to country.

For example in Australia, trading fees are 0.10% while in Nigeria, there are 0.60% maker and 0.40% taker fees.

The exchange also has instant buy/sell functions and exchange trading, which are accessible at variable country-specific rates from 1.1% to 2%.

All customers are supported by email and a virtual help center with response times based on geographic location.

Digital Currency Group, a key player in the crypto area, now owns Luno. The exchange is growing in popularity as it is easy to use and has good security, but it still has a limited range of coins in addition to the uneven fee structure.

Pros:

- Easy to use; user interface designed for beginners.

- Highly secure; two-factor authentication.

- Bitcoin, Ethereum, and other cryptocurrencies enabled.

- Multiple countries.

Cons:

- Not a diverse range of cryptocurrencies.

- No margin and futures trading.

- More expensive than some options.

- Not available in other countries.

9. Changelly

Changelly is an international crypto exchange. Founded and currently run from Kingstown, St. Vincent and the Grenadines, the company has over 7 million users globally, following the flagship establishment of the firm in 2015.

Supporting Bitcoin (BTC), Ethereum (ETH), and Litecoin (LTC), the platform comprises over 100,000 crypto trading pairs with seamless over-the-counter (OTC) and direct crypto swaps.

Changelly applies KYC rules for users undertaking high fund investments and crypto purchase orders, while entirely account-less users benefiting from greater privacy.

Our support staff is reachable through emails, 24-7 overviewing service delivery in over 100 nations. Payment methods include crypto orders for 0.25% commission and fiat exchange with service provider-affected, instant principles from 5 and over.

Pros:

- More than 150 cryptocurrencies.

- Instant exchanges of crypto for crypto.

- No account sign up for simple transactions.

- Easy to use, simple for beginners.

Cons:

- Higher-than-average fees on a few exchanges.

- Limited advanced trading capabilities.

- No fiat-to-crypto transactions.

- Few customer service channels.

10. Bitstamp

Nejc Kodric and Damijan Merlak started Bitstamp in 2011 and it has always been stationed in Luxembourg.

As a very old cryptocurrency exchange, Bitstamp has a long track record history with Bitcoin, Ethereum, Litecoin, and Ripple available on the platform.

Traded volumes in the last 30 days determine whether a customer pays a premium or a discount.

The company has a payment structure that set taker fees with 0.40% to 0.03% and maker fees with 0.30% to 0% for volumes below and above $1 billion.

It has customer service members that can be reached by phone or email for support. As of June 2024, Robinhood plans to buy Bitstamp for $200 million to capture more of the global cryptocurrency market.

A large portion of digital currency traders chooses Bitstamp, due to its global operational and regulatory affiliations, and its overall dependability.

Pros:

- Wide selection of digital currencies.

- Spot trading and fiat currency transactions.

- Recognized in many countries, boosting the confidence of users.

- Has more sophisticated trading features.

Cons:

- Charges more than many of its rivals.

- Restricted access in some parts of the world.

- User experience could be quite difficult for newbies.

- Does not offer a large variety of cryptocurrencies

How We Choose Best Crypto Exchanges In Guinea

1. Security & Regulation

- Verify that the exchange has at least limited regulation in some aspect.

- Examine available security measures and protocols that include 2FA, cold wallets, and encryption.

- Choose exchanges that have still not been hacked and have maintained a positive reputation.

2. Supported Cryptocurrencies

- Verify that the exchange supports the cryptocurrencies that you wish to buy/sell (BTC, ETH, and various altcoins).

- Look for supported trading pairs that are tethered to the local fiat currency or widely used stablecoins.

3. User Fees & Trading Costs

- Review the maker and taker fees associated with spot and derivatives trading.

- Evaluate the exchange for deposits, withdrawals, and any currency conversion fees.

- Certain exchanges may have price tiering for discounts on higher volume trades, or fixed fees when using their proprietary token.

4. User Interface & User Experience

- Simple and easy to navigate platforms is essential in allowing beginners to trade effortlessly.

- Evaluate the platform’s website for mobile trading apps for convenience on the move.

- Users that trade at higher volumes may look for complex charting tools, indicators, and varied order types.

5. Payment Options & Withdrawal Methods

- Verify that the exchange site accepts and supports deposits and withdrawals in Guinean Franc, and other currencies (USD, EUR, etc.).

- Identify several payment methods: banking, cc, mobile payments.

Is cryptocurrency legal in Guinea?

Cryptocurrency has no regulation in the country of Guinea. The use of crypto in the country has no legal framework restricting or regulating crypto-related practices.

Therefore, crypto is not protected nor is it banned. The government’s lack of restriction creates a risk for traders and investors which exposes them to a large risk of fraud or the possibly volatile market.

People in Guinea have no option but to be cautious and protective about the crypto they purchase and use because unregulated usage of crypto is prone to scams. People must use crypto through well-known and highly secure infrastructures.

Is it safe to trade crypto in Guinea?

Staying safe while trading crypto depends on using reliable exchanges with robust security features. Two-step verification (2SV) should always be activated by users for their accounts and their privacy.

Beyond security measures, wallets are safer than exchanges for holding capital to avert future hacks and thievery or unanticipated problems with trading platforms.

Conclsuion

To wrap things up, the best crypto exchange in Guinea fulfills the criteria of safety, costs, supported crypto coins, and ease of use.

Platforms such as Binance, KuCoin, and Kraken have compelling features such as inexpensive costs, a wide range of crypto offerings, and responsive support.

Assessing these features ensures users have peace of mind knowing that the platform they have selected provides optimal efficiency, security, and trustworthiness during trading.

FAQ

Binance, Kraken, and Bitstamp are known for strong security and regulatory compliance.

Yes, most exchanges like Binance, KuCoin, and Paxful support Bitcoin and major altcoins.

Fees vary; spot trading typically ranges from 0.1% to 0.2%, with discounts on high-volume trades.

Some exchanges, like Paxful and Luno, allow deposits via local payment methods, while others support USD/EUR transfers.

Most top exchanges provide 24/7 support via live chat, email, and help centers.