In this article, I’m going to look at some of the best crypto loan providers today. With the increase in popularity of offering digital assets, crypto borrowing has become a quick and easy way to get access to funds without selling off your assets.

I will be focusing on platforms that allow users to get quick, flexible, and secure loans so that you can have the tools needed to pick the provider that best meets your loan needs and investment strategy.

Key Points & Best Crypto Loan Providers List

| Crypto Loan Provider | Key Points / Features |

|---|---|

| Figure | Offers blockchain-backed loans, fast approval, competitive interest rates, regulated in the US. |

| Milo | User-friendly interface, flexible loan terms, supports multiple cryptocurrencies, quick disbursement. |

| Ledn | Focuses on Bitcoin and stablecoin loans, interest-earning accounts, high security, globally accessible. |

| CoinRabbit | Instant crypto loans, easy online application, supports BTC, ETH, and other popular coins. |

| Nexo | Instant crypto credit lines, up to 12% interest on deposits, insured custodial wallets, flexible repayment. |

| Aave | Decentralized lending protocol, supports numerous tokens, variable/fixed interest rates, community-driven. |

| Alchemix | Self-repaying loans using yield farming, fully decentralized, innovative DeFi mechanism. |

| Summer.Fi | Focuses on stablecoin loans, low-interest rates, integrates with multiple wallets, DeFi-based. |

| YouHodler | Multi-crypto support, flexible loan-to-value ratios, crypto savings accounts, instant approval. |

| Wirex | Combines crypto loans with payment cards, seamless fiat conversion, easy mobile management. |

10 Best Crypto Loan Providers 2025

1. Figure

Figure is a trustworthy regulated blockchain-backed lending platform. It provides borrowers in the U.S. and across the world rapidly computed and secure crypto loans.

Users can take loans against their crypto holdings. Figure provides streamlined access to loan processing and reduced paperwork and approval times by utilizing blockchain technology.

Figure provides borrowers with flexible repayment options and loans against crypto holdings at competitive interest rates.

As a crypto loan platform and blockchain technology innovator, Figure puts a premium on compliance and transparency. Figure is for users who prefer uncomplicated applications for compliant crypto loans.

Pros And Cons Figure

Pros:

- Regulated and compliant platforms guarantee safety and trust.

- Quick approval with little documentation.

- Reasonable interest rates with crypto backed loans.

- Loan process transparency with blockchain’s reliable loan process.

Cons:

- Compared to decentralized platforms, their offering crypto is rather limited.

- US and regulated markets primarily.

- Compared to purely decentralized protocols, their DeFi features are fewer.

- Identity verification may be needed, slightly hampering access for some users.

2. Milo

Milo is an easy-to-use lending platform for cryptocurrencies. It is designed for both beginners and more seasoned investors.

It features easy crypto loans. It offers flexible loan terms which borrows can modify and adjust depending on their situations.

By loans, we mean loans for Bitcoin, Ethereum, and some select altcoins. Milo loans provides borrowers with several loans options. Each loan provides quick and fast access to emergency funds.

There is fast approval for quick access to budget funds which is great for urgent situations. For security, we use cold storage and two-factor authentication. Milo loans offers a smooth, fast, and flexible quick crypto loan experience.

Pros And Cons Milo

Pros:

- Suitable for beginners, their interface is designed with simplicity.

- Generously flexible terms and repayment options for loans.

- Multiple crypto options for loans.

- Quick loan approval and fund disbursement.

Cons:

- Global presence is limited due to being a smaller platform.

- Basic DeFi elements are offered.

- Rates may change based on crypto type.

- Customer service may be slow and unresponsive mainly during busy hours.

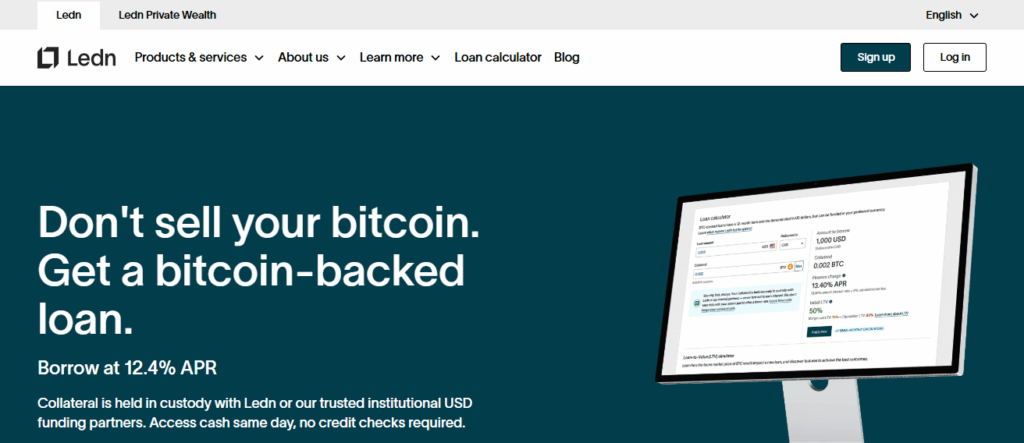

3. Ledn

Ledn is a crypto lending and savings platform, and focuses on Bitcoin and stablecoins. It provides services all over the world with Bitcoin and stablecoins for loans and savings with great safety.

Borrowers can access loans by using crypto assets and also keep the assets during the loan period. Ledn also has savings accounts where users can keep Bitcoin and USDC and earn interest on stabilized crypto.

The platform is fully compliant, meaning it follows all required laws and is transparent. This is for investors looking for loans and also looking to save using the platform.

Ledn is a good option for anyone who wants to borrow or grow their crypto safely, as it has an easy-to-use system and great customer support. It also offers regulatory compliant savings.

Pros And Cons Ledn

Pros:

- Provides loans with Bitcoin and stablecoins.

- Passive income is available with their interest-earning loan.

- High security, compliant with regulations.

- Most users are able to access them.

Cons:

- More support with smaller altcoins is limited.

- Unlike competitors, they are less focused on instant loan offerings.

- The savings accounts interest rate can change depending on the market.

- Mostly focused on conservative crypto market participants.

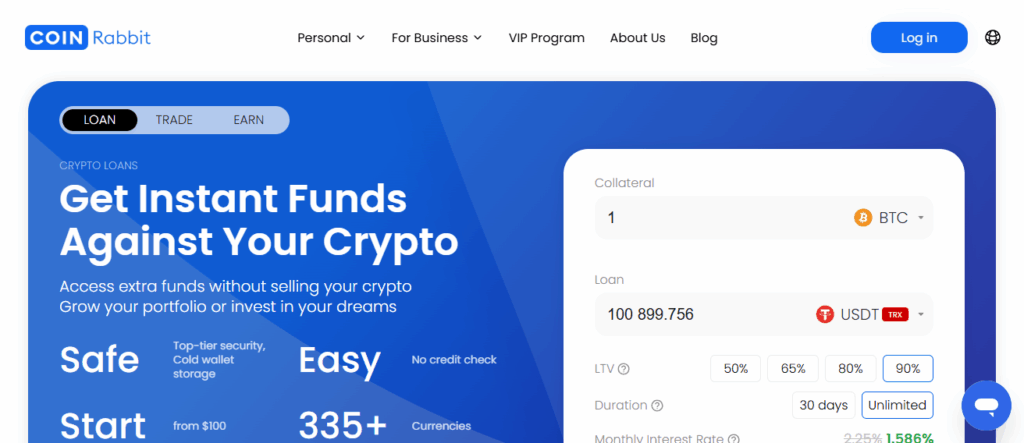

4. CoinRabbit

CoinRabbit focuses on providing instant, fully online crypto loans. It works with primary cryptocurrencies: Bitcoin, Ethereum, and some popular altcoins.

CoinRabbit is perfect if you need fast liquidity, as approval processes don’t take long. It is user-friendly, with a straightforward interface, and fast account verification helps users within urgent timeframes.

CoinRabbit promises your crypto will be safe with encrypted transactions and safe storage. There are customizable loan repayment terms.

CoinRabbit stands out in crypto lending because their service provides all the key necessities: speed, easy access, and safe flexible loan terms.

Pros And Cons CoinRabbit

Pros:

- Crypto loans with instant approval.

- Worked with major cryptocurrencies like BTC and ETH.

- Simple application on web.

- Adjustable LTV and other parameters on the loan.

Cons:

- Loans are offered without other advanced financial instruments.

- Less advanced due to loan smaller liquidity.

- Security based on custodial control of the platform.

- Less of regulatory control compared to other loaning institutions.

5. Nexo

Nexo is among the largest crypto lending platforms. Users can obtain instant credit lines using Bitcoin and Ethereum (as well as a number of other tokens) as collateral.

Loans can be obtained without liquidating crypto assets. Nexo presents flexible repayment plans and competitive interest rates.

Users can earn interest of up to 12% on their crypto deposits through Nexo’s accounts. His wallets are insured.

Nexo supports clients on retail and institutional sides, and crypto-linked credit cards enable users to spend crypto-backed loans.

For users who want to borrow, earn interest, and manage their assets securely, Nexo is a one-stop shop.

Pros And Cons Nexo

Pros:

- Access to liquid assets without selling crypto.

- Loans that can be paid back easily at any time.

- Captured wallets that are insured.

- Catering accounts for institutional and retail.

Cons:

- Control of the Nexo’s crypto assets.

- Interest rate on some crypto loans is significantly high.

- Some crypto and normal activities are charged.

- Legal complications to some countries.

6. Aave

Aave is a decentralized finance protocol this is a open for user peer to peer the the crypto scope. Crypto borrowing and lending does not need brokers and interested individuals can chose crypto.

Offered tokens have a wide scope for consumers and the design is user adjustable with fixed and flexible options.

The plus the user has being offered is being able to interact with a smart contract. A smart contract is a trustless mechanism that self executes when access rules are fulfilled.

Aave has features of self adjustable, decentralized, and fully autonomous design of the loan contract.

Aave being smart compliant decentralized also does not require traditional brokers. Varied Aave services is supported by a governance decentralized autonomous organization enabling umbrella of services to varied users.

It is the most pigment offered for sophisticated users and self compliant for most crypto borrowing and lending.

Pros And Cons Aave

Pros:

- Complete control and access to the loaned crypto.

- Loaned currency is pegged and can be changed to other currencies.

- Unique collateral swapping and flash loans.

- Community governance.

Cons:

- Control of the Nexo’s crypto assets.

- Ethereum network has high gas fees and can be cost prohibitive to use.

- There are always risks with smart contracts, even when audits are completed.

- There is no customer service, in the traditional sense.

7. Alchemix

Alchemix has changed the way crypto lending works. The loans are self-repaying, which means borrowers having loans against deposited assets don’t need to worry about making manual repayments.

Because the loans are paid through the yield created from deposited assets, the risk of default is eliminated.

Alchemix works on decentralized protocols and supports multiple tokens. Alchemix is ideal for DeFi users who want a ‘set and forget’ self-repaying system and a seamless integration of lending, borrowing, and yield generation in one place.

Alchemix is perfect for users looking to yield passively. They are employing innovative strategies to autonomy to finance, and are perfect for customers looking for yield farming.

Pros And Cons Alchemix

Pros:

- The self-repaying loan feature almost eliminates default risk.

- The entire loan system is decentralized, automated, and seamless.

- Great integration with yield farming.

- Provides multiple tokens as collateral, giving the user plenty of choice.

Cons:

- The system may be overwhelming for people just getting into DeFi.

- The loan will self-repay only if the yield achieves the positive performance.

- There is not a lot of established use.

- There is a lack of smart contract security.

8. Summer.Fi

Summer.Fi focuses on loans that are backed by stablecoins offering low interest rates and uncomplicated structures.

DeFi provides the platform with liquidity and quick loan approvals without the need for traditional credit checks.

It connects with several crypto wallets for easier asset management. Services are also value-adding, because market risks are minimized with stablecoins and there is still market access.

It is ideal for borrowers who need reliable loans. DeFi risks are also minimized because price volatility is low, while the borrower has the advantages of DeFi.

Pros And Cons Summer.Fi

Pros:

- Loans are easy to repay and earn interest with no risk.

- Loans are established quickly with DeFi and paid.

- Wallet integration is seamless and multiple wallets can be linked.

- Provides protection against unexpected losses in the market and risk.

Cons:

- Because you only deal with coins that are stable, the system will not work for high risk borrowers, particularly those who deal with coins that are not stable.

- The system has basic lending and not much else.

- The system has basic lending and not much else.

- Knowledge of DeFi is important if someone wants to get the most use out of it.

9. YouHodler

YouHodler provides crypto loans which lets customers borrow by putting their cryptographic currencies as collateral.

YouHodler is able to provide loans secured by collateral of various cryptocurrencies like Bitcoin and Ethereum,

While customers are even able to open crypto interest accounts and save accounts secured by cryptocurrencies. Customers can also pay their loans at any time.

YouHodler is optimized for customers who wish to maintain their cryptocurrencies and not sell, and for customers and crypto investors who wish ease of access to quickly endorse and borrow secured crypto loans, and for customers

Who even wish to save cryptocurrencies. Customers are also able to open saving accounts secured by cryptocurrencies.

Pros And Cons YouHodler

Pros:

- Euphoric borrowing is possible with multiple types of cryptocurrencies.

- LTV ratios are flexible and loans are ready instantly.

- Funds can be saved with cryptocurrencies and interest can be earned.

- The user can borrow and still own their assets.

Cons:

- Centralization of the system will lose a bit of DeFi.

- The type of collateral will depend on how high the loan interest will be.

- There are countries where the platform access is limited.

- It will take a long time for customer service to respond.

10. Wirex

Wirex combines crypto loans with innovative payment solutions. It offers seamless fiat and crypto conversion.

Borrowers can take out loans with Bitcoin and other cryptocurrency Wirex cards and use them to pay for everyday purchases.

They aim for user-friendly experiences with mobile-optimized interfaces, fast approval processes, and comprehensive tools for personal financial management. Active and passive crypto assets also let users manage assets in their Wirex accounts.

They also promote safety with 2FA, cold storage, and abiding by financial regulations. Self-managing crypto assets can promote flexibility for everyday crypto transactions.

They streamline borrowing, spending, and wallet management all in one app to simplify crypto everyday use.

Pros And Cons Wirex

Pros:

- Merges payment solutions with crypto loans.

- Effortless spending and conversion between fiat and crypto.

- Managing your finances is easy from your mobile.

- Loans are approved quickly and you get wallet features.

Cons:

- Only the listed cryptocurrencies can be used.

- Interest on loans is higher compared to DeFi.

- Autonomy is limited because it is centralized.

- Cards have daily spending limits.

Conclusion

In conclusion, top crypto loan providers prioritize speed, adaptability, and safety while accommodating different requirements.

For instance, Nexo and YouHodler are great for immediate loan access and support for multiple cryptocurrencies

While Aave and Alchemix are pioneers in decentralized and inventive services. Selecting a provider primarily depends on your priority – the regulated security offered with low-interest rate stablecoins, or complex DeFi aspects.

FAQ

A crypto loan allows you to borrow fiat or stablecoins using your cryptocurrency as collateral.

Yes, if you use regulated or reputable platforms with secure custody and insurance.

Popular options include Bitcoin, Ethereum, and select altcoins, depending on the platform.

Some platforms like CoinRabbit and Nexo offer instant approvals, while others may take 1–3 days.

Rates vary from 5% to 15% annually, depending on crypto type, LTV, and platform.