In this article, I explore the top cryptocurrency options trading platforms, their capabilities, and the mechanics of buying and selling cryptocurrency options for profits, risk management, and trading strategy diversification.

Whether a novice or a seasoned trader, every person needs to evaluate the top options trading platforms for cryptocurrency and make the right investment decisions in the ever-growing, competitive market and crypto blockchain world.

What is a Crypto Options Platform?

A crypto options platform allows traders to perform contracts on crypto assets, exercising the option to purchase or sell.

These contracts give the buyer the right, but not the obligation to buy or sell a to a digital asset within a certain period of time and a certain profit on the asset before the expiration date of the contract.

Traders can, at any time, manage existing open positions, anticipate future changes in asset values and crypto options. Traders can do all of this without the necessity of owning the crypto asset.

These platforms offer both profit avenues and tools for managing potential losses to beginner and advanced traders though leverage, different options on expiration dates, and contract types.

How To Choose Best Crypto Options Platforms

Security & Regulation: Look for a platform that enables 2FA, cold storage, and encryption. Obtain legal advice to ensure there will be no issues with regulatory compliance.

Supported Assets: Platforms with the cryptocurrencies you wish to trade are the best. Increased supported assets provide greater diversification opportunities.

Trading Fees: Lower maker and taker fees are preferable. Pay attention to platforms that provide fee discounts to high volume traders or to holders of native tokens.

Liquidity: Minimal slippage and rapid trade execution are benefits of high liquidity.

Trading features: Look for platforms with leverage, expiry options, risk management, and strategy builders. Enhanced features are useful for beginners and professionals alike.

Key Points

| Platform | Basic Discerptions |

|---|---|

| Binance | Spot, futures, margin, staking, NFT marketplace, mobile app |

| Bybit | Derivatives trading, perpetual contracts, spot trading, mobile app |

| Crypto.com | Exchange, wallet, debit card, DeFi, NFT marketplace |

| OKX | Spot, futures, options, DeFi, NFT marketplace |

| Deribit | Options and futures trading for BTC & ETH |

| Delta Exchange | Crypto derivatives, futures, options, leveraged tokens |

| MEXC | Spot, futures, margin, staking, ETFs, DeFi tokens |

| KuCoin | Spot, futures, margin, lending, staking, P2P trading |

| Margex | Crypto derivatives, high leverage (up to 100x), mobile app |

| BingX | Copy trading, spot, futures, social trading platform |

10 Best Crypto Options Platforms

1. Binance

Established in 2017, Binance has become the world’s largest cryptocurrency exchange in trading volume and a primary venue for trading crypto options.

Binance offers European-style BTC and ETH options, allowing users to trade flexible strategies such as hedging, speculation, and income.

Binance’s low fees and comprehensive liquidity, coupled with an easy-to-use interface, offers a great experience for newbies to professional traders.

The platform has advanced risk management tools, mobile access, and customer support that is available 24/7.

With global availability and no alternative options for restricted territories, Binance remains the go-to platform for traders and crypto derivative options offers.

Pros:

- First in the market making the Binance exchange have high volume and sufficient liquidity.

- Much lower compared to the majority of rivals.

- Target market for the spot market, futures, and anon stakers.

- Easy to use, especially for tech-savvy mobile and web users.

Cons:

- Increasing government enforcement of digital trading restrictions is making it harder to access.

- Options on alt coins are very scarce, largely restricted to BTC and ETH.

- Unfamiliar users may struggle with the advanced options interface.

- Unfamiliar users may struggle with the provided advanced tools.

2. Bybit

In just five years, Bybit has become one of the most popular platforms for crypto derivatives, including USDC-settled BTC and ETH options.

Bybit was one of the first platforms to introduce a matching engine and reflex liquidity with lightning speed. As a result, Bybit permits traders to execute any level of complicated trading strategies smoothly.

Bybit is a favorite among casual and institutional traders alike. The platform has low trading fees, a user-friendly interface, and even a mobile app for added convenience.

Thanks to the educational materials provided and the 24/7 customer support, Bybit has become one of the most popular platforms for crypto options trading for customers around the world.

Pros:

- Untangled and speedy trades.

- BTC and ETH options with USDC settles available.

- Complex in a good way

- Technical and mobile are smooth and simple

Cons:

- ETH and BTC are the only available options.

- Binance is the only accessible exchange in the US.

- Limited to mid tiers crypto traders.

- Beginners may find it a bit complex as well.

3. Crypto.com

Crypto.com was founded in 2016 and has become well-known for being a cryptocurrency exchange. Currently, Crypto.com trades multiple cryptocurrencies, including Bitcoin (BTC) and Ethereum (ETH).

Apart from trades, Crypto.com provides its users with an intuitive interface for trading European-style options, which is helpful in hedging, speculation, and diversifying trading strategies.

For options trading, Crypto.com is praised for its competitive rates, strong security, and ample liquidity.

Additionally, options traders can interface their Crypto.com DeFi Wallet or Visa Card which is quite handy.

As a reliable and easy-to-use platform for crypto options trading, Crypto.com has garnered over 80 million users globally.

Pros:

- Ascend with strength, over 80 million and still counting.

- Easy to operate BTC and ETH options.

- The DeFi wallet and Visa card are connected in a simplified way.

- Effective in Compliance, Safety and very good.

Cons:

- The least charged in the industry has a lot of competition.

- Options variety is a struggle provided (mostly majors).

- Past issue of reputation (bi till 2022).

- Long KYC processes for onboarding new users.

4. OKX

Established in 2017, OKX is well recognized among the elite crypto exchanges due to the sophisticated derivatives market created on the platform, especially for BTC and ETH options trading.

OKX is known to offer European-style options trading and has managed to maintain transparent pricing, high liquidity, flexible strategies, and liquidity for both retail and institutional traders.

Portfolio margining, risk management features, and cross-collateral tools of trading are some of the robust trading tools provided by OKX

Which makes it convenient for professional options traders. OKX has over 50 million users, and one of the crypto options platforms which is used for hedging, income, and speculation generation since it has low fees and is secured.

Pros:

- Abundant liquidity and significant volumes for trading.

- Advanced risk management with BTC and ETH options.

- Portfolio margin plus cross-collateral features.

- Cost-effective trading with the expansive platforms.

Cons:

- Options are limited to the primary digital assets.

- Geographical constraints within the United States and some other countries.

- Beginner traders may encounter some challenges within the platforms.

- Still lacking the platforms in certain areas.

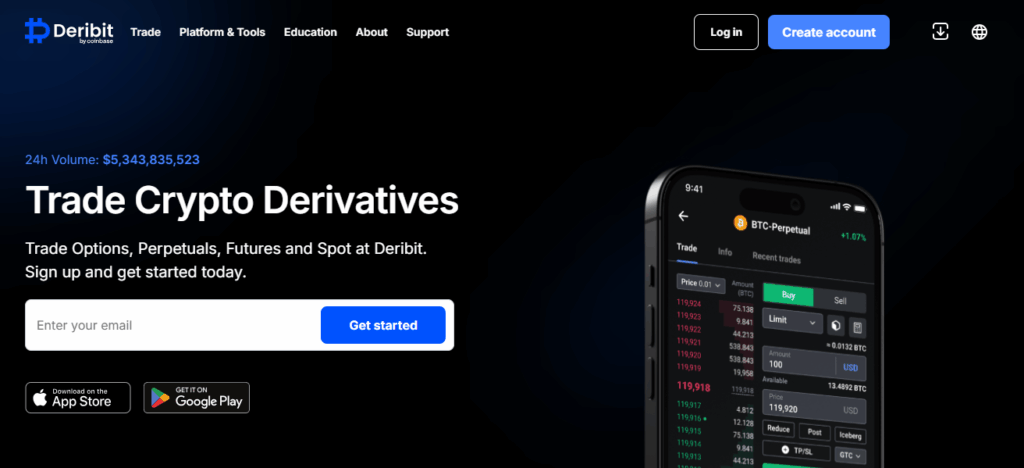

5. Deribit

Established in 2016, Deribit has gained the reputation of being the world’s foremost dedicated crypto options exchange.

Professional and institutional traders use the platform for peerless liquidity in ETH and BTC options.

Deribit’s platform exclusively provides European-style, cash-settled options, supporting hedging, spreads, volatility plays, and sophisticated strategies.

With market-leads in the s ultra-low latency, transparent pricing, and advanced risk management tools, Deribit processes 90% of the world’s crypto options volume.

Although not serviced in the U.S. and a few other regions, Deribit’s large order books, rigorous interface, and deep-set global trading infrastructure make it the benchmark platform for dedicated crypto options traders.

Pros:

- Dominates the market for crypto options (90+% worldwide volume).

- Market tools with ultra-low latency.

- Advanced expiry and varied striking prices.

- Liquidity-rich for BTC and ETH options.

Cons:

- Geographical constraints to the United States and some other countries.

- Options are restricted to BTC and ETH (no offerings for other altcoins).

- Beginner and intermediate traders may face challenges with the platform.

- No other derivatives apart from the BTC and ETH.

6. Delta Exchange

Delta Exchange was created in 2018 and is a rapidly growing platform focusing on derivative trading on BTC and altcoins.

In contrast to most of its competitors, Delta Exchange is far more extensive, offering more options to trade on, such as Bitcoin, Ethereum, and popular altcoins, including SOL, XRP, and BNB.

It is an options exchange that offers European-style options with transparent fees, USDC settlement, and features such as perpetual options and calendar spreads.

Delta Exchange is equipped with deep liquidity, an institution-level framework, and robust risk management systems which makes it suitable for retail and professional traders alike.

The platform is popular for trading options in crypto due to its extensive educational materials and 24/7 assistance that guarantee its users comfort and ease of use.

Pros:

- Extensive offerings with BTC and ETH and other altcoins.

- Innovative features such as perpetual and calendar spreads.

- Clear contracts that are USDC-settled.

- Sound structure for institutional.

Cons:

- Lower number of users founded.

- Comparatively to the major exchanges like Binance.* Less liquidity for the more unknown options for altacoins.

- Less beginner friendly.

- Less global collaboration.

7. MEXC

MEXC was established in 2018 and has been successful in gaining a number of customers globally. The exchange offers numerous products such as crypto options.

The platform provides traders with BTC and ETH options which they can use for hedging, speculative trading or diversifying their strategies.

MEXC is popular for its low trading fees, high transaction speeds, and deep liquidity which is appealing to both novice and professional traders.

The exchange offers many features such as simplistic mobile access, advanced charting tools, and 24/7 customer service to its users.

MEXC has a growing customer base of over 10 million users. Their advanced security features and flexible trading options make MEXC one of the leading crypto options platforms.

Pros:

- Provides options for BTC and ETH.

- Low fees and quick order execution.

- Over 10 million global users, strong asia presence.

- User friendly mobile application.

Cons:

- Still a small options market.

- Less advanced features compared to Deribit or OKX.

- Uncertain regulations in some areas.

8. KuCoin

KuCoin has become an established global exchange since its inception in 2017, having more than 30 million users in over 30 countries.

The provision of spot and futures trading, along with BTC and ETH European-style options, USD options

KuCoin allows traders to hedge or speculate with flexibility due to its BTC and ETH European-style options over USDT settlement.

Its low trading fees, wide altcoin support trading options, and a simple, easy-to-use mobile app make it a favorite among both beginner and advanced traders.

KuCoin’s advanced users gain additional exclusive features, such as advanced charting, margin tools, and 24/7 support functionality.

KuCoin is still held in high regard due to their strong security features, seamless user experience, and all-around functionality, retaining their reputation as one of the best option trading crypto platforms in the world.

Pros:

- Available in 200+ countries with over 30M users.

- USDT with BTC and ETH exclusive European style options.

- Support for a wide range of altcoins and low trading fees.

- Accessible for beginner phone traders.

Cons:

- Competitors have a wider options market.

- Limited in some regions by legal restrictions.

- Affected by security breaches. (Hack in 2019)

- Compared to OKX and Deribit, their order book is less liquid.

9. Margex

Margex was founded in 2020 and is located in the Seychelles. The company is a flourishing derivative exchange trading in perpetual contracts and options for cryptocurrencies like Bitcoin and Ether.

With the promise of equitable and secure trading, Margex provides artificial intelligence-powered protection against price manipulation along with transparent order books.

Margex is one of the few trading platforms with the flexibility of a minimum deposit of 10$. There is a leverage of 100x on the trading account, so the platform is suitable for both novices and professional traders.

Margex charges low fees, offers deep liquidity, and implements strong security which solidifies its position within the top tier options platforms.

Pros:

- Leverage trading is available with up to 100x.

- AI driven security with price manipulation protection.

- Transparent order book with strong overall security.

- Minimal deposit of \$10, friendly for newbies.

Cons:

- Less focus than other platforms on options trading.

- Exchange was founded in 2020, therefore is still new.

- Doesn’t have a big base of users like others.

- Trading focus is narrower than others, only BTC and ETH.

10. BingX

In 2018, BingX became a global multi-asset exchange offering crypto options trading on leading digital assets such as BTC and ETH.

Consumer are looking for a more simplistic approach, and professional traders will find value in the platform’s transparency regarding pricing and industry-low fees for European-style options.

What has been noted as a unique aspect of BingX is the ability for a user to engage in copy trading, wherein users can mimic the trades of highly ranked traders while learning options strategies.

With considerable capital, user-friendly mobile trading, and sophisticated methods for controlling trading risk, BingX ensures its users a mobile and safe trading environment.

Now, BingX has more than 10 million registered users globally, being recognized as one of the best crypto options exchange for ease of trading flexibility.

Pros:

- Offers BTC and ETH options with European-style pricing.

- Copy trading feature available to mimic pro traders.

- Good low trading fees and coverage.

- Good mobile application and customer support.

Cons:

- Options offered are underdeveloped.

- Primarily focuses on major currencies.

- Not as much liquidity as Deribit and Binance.

- Lower level of institutional adoption compared to other players.

Are Crypto Options Risky?

Sure, crypto options are highly leveraged instruments, which means traders can control much larger positions with much smaller amounts of capital.

While leverage has profit potential, it also carries the risk of losing far more than the initial investment, which happens far too easily with moves going the wrong way.

Lack of direction or misplaced trades can quickly deplete the account balance. For this reason, effective risk management approaches are critical. These can include setting stop-loss levels, capping maximum positions, and especially explaining every single contract before trading.

Conclsuion

In conclusion, the best crypto options platforms enable users to trade digital currencies within a secure, intuitive, and robust environment.

These exchanges have an extensive selection of crypto assets, reasonable commissions, and both basic and complex trading tools and services, providing instant access to traders of any experience level.

Selecting an exchange that has strong customer service, good regulatory compliance, and high trading volume ensures a safer and more efficient trading experience.

FAQ

Some platforms allow India; US users face restrictions.

Control larger positions with less capital; increases profit and risk.

Call options = buy, Put options = sell; profit from price movements without owning the asset.