In this article, I will cover the Best Crypto Exchanges for No KYC Under $100 Limit best suited for individuals who cherish their privacy and need fast transactions.

These platforms offer the possibility of buying, selling, and swapping assets without identity checks, which caters to people who prefer small transactions.

Find safe, easy-to-use exchanges that focus on the most important part of their service for every crypto user: the right to operate without KYC requirements.

Key Points & Best Crypto Exchanges for No KYC Under $100 Limit

Bisq – Decentralized P2P exchange with no central authority; ideal for privacy-focused users.

Hodl Hodl – Non-custodial P2P platform; supports Bitcoin and stablecoins with escrow-based trading.

PancakeSwap – Popular DEX on Binance Smart Chain; no KYC for swaps under $100.

Uniswap – Leading Ethereum-based DEX; no KYC required for small trades.

MEXC – Centralized exchange with no mandatory KYC for deposits and withdrawals under $100.

TradeOgre – Privacy coin-focused exchange; no KYC for small trades.

BitShares – Decentralized exchange with built-in wallet; no KYC for small trades.

OpenOcean – Aggregator of DEXs; no KYC needed for trades under $100.

SimpleSwap – Swap service with no account or KYC required for small amounts.

Raydium – Solana-based DEX; no KYC for swaps under $100

10 Best Crypto Exchanges for No KYC Under $100 Limit

1. Bisq

Bisq is a decentralized, peer-to-peer Bitcoin exchange where users can trade crypto without KYC. As open-source software, it directly connects traders, using multisignature Bitcoin addresses and security deposits for transaction safety.

Bisq facilitates both fiat-to-crypto and crypto-to-crypto trades under $100, perfect for users who prioritize privacy. Bisq doesn’t have centralized control, so it doesn’t have your funds or your private information.

As all transactions are conducted over Tor, one’s anonymity is guaranteed and censorship is effectively resisted. Privacy during crypto trades is ensured through the plateforme’s low trading limits and strong community governance. No identification is required.

| Feature | Description |

|---|---|

| Type | Decentralized peer-to-peer exchange |

| KYC Requirement | None |

| Supported Assets | Bitcoin and fiat currencies |

| Privacy | High – Tor integration and no central server |

| Limit | No enforced limit, but trades are manual and slow |

| Security | Non-custodial with multi-sig escrow |

2. Hodl Hodl

Hodl Hodl, a global, peer-to-peer Bitcoin exchange, features no KYC for trades under $100. It non-custodial escrow means users control funds.

Hodl Hodl users can negotiate crypto and crypto trades, while limiting the personal information shared. Hodl Hodl is resistant to hacks, with no KYC, and privacy.

It features a transparent reputation system, govern dispute resolution and light fees. Users can remain private with no decentralization.

| Feature | Description |

|---|---|

| Type | Non-custodial P2P Bitcoin exchange |

| KYC Requirement | None |

| Supported Assets | Bitcoin, stablecoins |

| Privacy | High – no identity verification |

| Limit | No hard limit, but small trades are common |

| Security | Escrow-based smart contracts |

3. PancakeSwap

PancakeSwap operates on the Binance Smart Chain as a decentralized exchange (DEX) and provides the option to trade crypto tokens anonymously with no registration or KYC requirements.

For users transacting under a $100 value, the platform provides a cost-effective solution as all trades are executed from the users’ crypto wallets.

PancakeSwap employs an automated market maker (AMM) that allows users exchange crypto tokens instantaneously and provides liquidity.

In addition to trading, users can utilize PancakeSwap for yield farming, staking, and even participating in a lottery.

The combination of low fees, privacy, the ability to make small crypto trades, and versatility makes PancakeSwap an excellent decentralized exchange for users looking to make quick transactions.

| Feature | Description |

|---|---|

| Type | Decentralized exchange (DEX) on BNB Chain |

| KYC Requirement | None |

| Supported Assets | BEP-20 tokens |

| Privacy | Full anonymity |

| Limit | No enforced limit; wallet-based access |

| Security | Smart contract-based swaps |

4. Uniswap

Uniswap operates on the Ethereum blockchain as a decentralized exchange providing the option to trade ERC-20 tokens anonymously, with no KYC requirements, and wallet-based trading.

The platform is particularly user-friendly for trades under the $100 mark as all transactions are executed without the user providing personal information, and secured, and no Ethereum-based transaction is required.

The platform employs Smart Contracts to execute asset transactions and eliminate intermediaries, therefore providing a trustless system to users.

In contrast to other platforms, the crypto exchange provides users with liquidity and offers a variety of tokens even though they will have to incur Ethereum gas fees.

This feature provides users with the option to make small crypto transactions securely and anonymously, all while retaining complete control of their assets.

| Feature | Description |

|---|---|

| Type | Ethereum-based DEX |

| KYC Requirement | None |

| Supported Assets | ERC-20 tokens |

| Privacy | Full anonymity |

| Limit | No enforced limit; wallet-based access |

| Security | Smart contract-based swaps |

5. MEXC

MEXC is a centralized exchange that does not do complete KYC verification for small trades—usually under $100.

It’s recognized for its diverse offering of cryptocurrencies, and considerable liquidity in spot and futures markets.

It only takes a simple email registration for users to get started, a feature for privacy-conscious traders.

MEXC is fully aware of the interest and volume of trades, offers fast execution and a large number of earn products such as staking and futures.

In case users do need verification, it is only for larger withdrawals as most trades in a day and for volume do not require ID checks. MEXC is one of the best for crypto trading without KYC.

| Feature | Description |

|---|---|

| Type | Centralized exchange |

| KYC Requirement | Optional for small trades |

| Supported Assets | Wide range of cryptocurrencies |

| Privacy | Moderate – no KYC under $100 |

| Limit | ~$100 withdrawal without KYC |

| Security | Custodial with 2FA and cold storage |

6. TradeOgre

TradeOgre is the most simple exchange for privacy and has a focus on small altcoins as well as not requiring KYC for trades under $100.

It is a popular choice for people looking for altcoins and anonymity. TradeOgre has a very simple interface which is why it is tailored for fast trading and users crypto wallets is where deposits and withdrawals are made.

The service provided is crypto only which adds to privacy and cuts back on regulations. TradeOgre is a good choice for people looking for easier methods of trading smaller amounts of crypto. Providing no KYC, it is a quick and simple method of trading without complicated systems.

| Feature | Description |

|---|---|

| Type | Centralized exchange focused on privacy coins |

| KYC Requirement | None |

| Supported Assets | Monero, Pirate Chain, etc. |

| Privacy | High – anonymous trading |

| Limit | No enforced limit for small trades |

| Security | Custodial, basic security features |

7. BitShares

As a decentralized exchange system, BitShares enables users to trade crypto-assemblies without KYC restrictions.

It directs DEX for smart contracts to perform peer-to-peer interactions, thereby providing users complete control over their assets.

BitShares’ core principle is promptness, which is why BitShares can execute transactions is because, under the thresholds of $100, the exchange can execute thousands of transactions per second.

Moreover, the platform’s capabilities extend to the formation of versatile tokens, stablecoins, and collateralized assets, thereby providing versatility for multiple applications.

BitShares theorem users can trade without intermediation and, as a result, costlessly. The privacy of off-registered trading caps off an ideal solution for users to perform trading.

| Feature | Description |

|---|---|

| Type | Decentralized exchange and blockchain |

| KYC Requirement | None |

| Supported Assets | BTS, smartcoins, user-issued assets |

| Privacy | High – blockchain-based identity optional |

| Limit | No enforced limit |

| Security | Smart contract and blockchain-based trading |

8. OpenOcean

As a decentralized system without KYC requirements, OpenOcean provides the best crypto rates because it is interconnected to several DEXs as an aggregator.

It fully automates the optimization of trades by scanning for the best rates on Uniswap, PancakeSwap, and several others.

Privacy, low transaction fees, and convenience characterize the trading experience under <$100, which is the targeted low-scale trade.

Without flaming the wallet or invasive identification, OpenOcean trading is conduct on wallet-to-wallet transactions.

The meshed trading interfaces and cross chain capabilities will work seamlessly with outlined restrictions.

| Feature | Description |

|---|---|

| Type | DEX aggregator |

| KYC Requirement | None |

| Supported Assets | Multi-chain tokens (ETH, BNB, etc.) |

| Privacy | Full anonymity |

| Limit | No enforced limit |

| Security | Smart contract routing across DEXs |

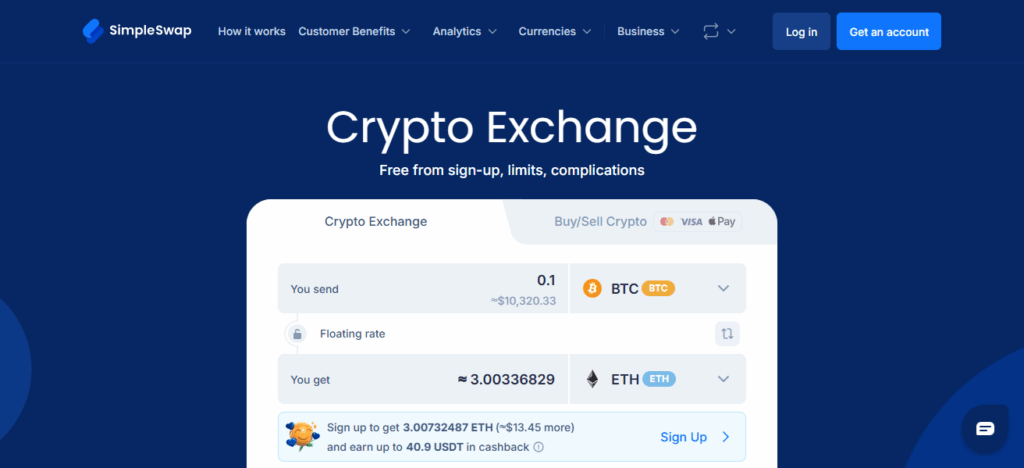

9. SimpleSwap

SimpleSwap is a non-custodial crypto exchanges that instantly token swaps without requiring KYC for under $100.

With more than 1,000 supported cryptocurrencies, SimpleSwap is quick, as every transaction is automated.

Users provide a wallet address, select the coins for the swap, and confirm the exchange. There is no registration and no verification. Since SimpleSwap is non-custodial and never stores user funds, risks are minimized.

The platform is user-friendly and supports customers around the clock. For simple, anonymous small crypto swaps, this platform offers more than enough privacy, flexibility, and security.

| Feature | Description |

|---|---|

| Type | Instant crypto swap service |

| KYC Requirement | None for small amounts |

| Supported Assets | 600+ cryptocurrencies |

| Privacy | High – no account needed |

| Limit | ~$100 for swap without KYC |

| Security | Non-custodial, partners liquidity providers |

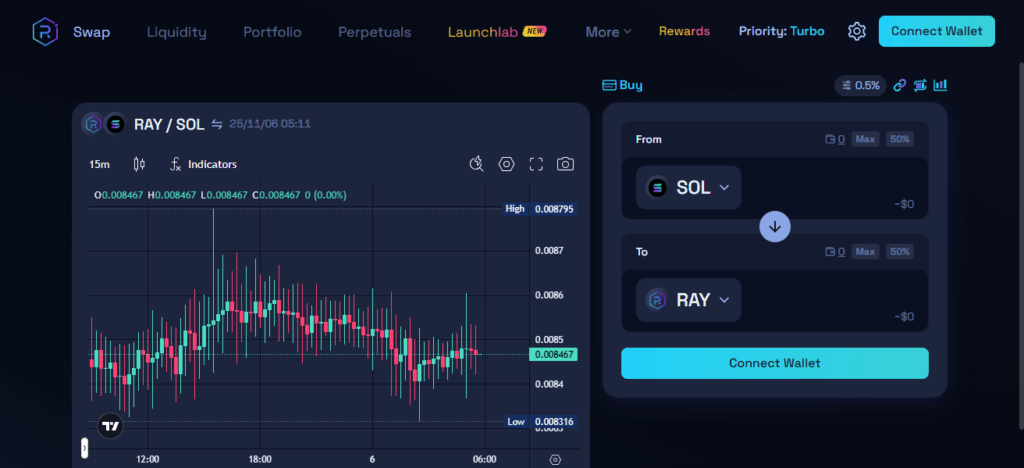

10. Raydium

Raydium is a decentralized exchange located on the Solana blockchain, allowing no-KYC crypto trades while providing quick and inexpensive exchanges.

Operating on the automated market maker (AMM) model, it works with the Solana ecosystem so customers can directly trade tokens from their wallets.

For trades under $100, it is quick and inexpensive when compared to Ethereum-based DEXs. The platform is also a DEX that offers opportunities in yield farming, staking, and other DEX activities.

Focusing on small decentralized swaps, Raydium is designed to prioritize privacy and efficiency for the small crypto trades.

| Feature | Description |

|---|---|

| Type | Solana-based DEX |

| KYC Requirement | None |

| Supported Assets | SPL tokens |

| Privacy | Full anonymity |

| Limit | No enforced limit |

| Security | Smart contract-based swaps |

Conclusion

To summarize, crypto exchanges offering no-KYC trading under $100 prioritize privacy, easy access, and low costs. Bisq, Uniswap, PancakeSwap and MEXC are all platforms that allow no verification trading.

These platforms, whether fully decentralized or semi-centralized, all provide no restrictions, full anonymity, and easy access for traders who want fast and unmonitored crypto transactions.

FAQ

A no-KYC exchange allows users to trade crypto without submitting identity documents or personal information.

They offer privacy, faster onboarding, and easier access for small traders.

Yes, but regulations vary by country, so always check local laws before trading.

Top options include Bisq, Hodl Hodl, Uniswap, PancakeSwap, MEXC, and Raydium.

Decentralized ones like Bisq and Uniswap are generally safe since users control their wallets.