In this article I will cover BITmarkets, a cryptocurrency exchange that supports numerous trading forms like spots and futures contracts.

BITmarkets is unique because of its low fees, sophisticated risk management features, and large selection of altcoins. Now, let’s dig deeper into the platform’s characteristics, security policies, and its position relative to other exchanges in the industry.

Introduction

BITmarkets is a centralized cryptocurrency exchange that supports spot trading for more than 150 cryptocurrencies. It has an All-in-One order book which provides sufficient liquidity and tighter spreads which is better than other platforms.

Traders have the added benefit of engaging in futures contracts with multi-asset margins that can be settled in either USD, BTC, or other cryptocurrencies. This offers more flexibility for users. BITmarkets offers advanced risk management through an insurance fund that protects users from negative balances and an insured fund. Additionally, they utilize sophisticated liquidation engines to settle open positions.

As a long term user BITmarkets has always been driven by their management team’s experience in the investments sector.

The company is focused on transforming the digital space and provide educational content, as well as multicultural customer care services. BITmarkets plans on developing a comprehensive financial technology framework that caters to traditional finance such as commodities and securities while providing distributed ledger technology for easier governance and less red tape.

Know Quick Details About BitMarkets

| Feature | Details |

|---|---|

| Platform Type | Centralized Cryptocurrency Exchange |

| Available Markets | Spot Markets, Futures Contracts |

| Cryptocurrencies Listed | Over 150 |

| Order Book | All-in-One Order Book for deeper liquidity and tighter spreads |

| Trading Flexibility | Multi-asset margin and settlements in USD, BTC, and other cryptos |

| Risk Management | Insurance Fund protecting against negative balances, advanced liquidation engine |

| Customer Support | Multilingual support, educational resources for users |

| Focus | Risk Management, Digital Currency Education, Financial Technology Development |

| Future Plans | Building financial tech to support traditional finance infrastructure, distributed ledger solutions |

| Security Features | Negative balance protection, sophisticated liquidation process |

Some Popular Token Available On This Exchange

| Token Symbol | Token Name | Category | Key Use Case | Blockchain |

|---|---|---|---|---|

| BTC | Bitcoin | Cryptocurrency | Peer-to-peer digital currency, store of value | Bitcoin Blockchain |

| ETH | Ethereum | Cryptocurrency | Smart contracts, decentralized applications | Ethereum Blockchain |

| USDT | Tether | Stablecoin | Price stability, trading pair for volatility | Ethereum, Tron, others |

| LTC | Litecoin | Cryptocurrency | Fast, low-cost transactions | Litecoin Blockchain |

| XRP | Ripple (XRP) | Cryptocurrency | Cross-border payments and remittance | RippleNet Blockchain |

| ADA | Cardano | Cryptocurrency | Smart contracts, decentralized applications | Cardano Blockchain |

| BNB | Binance Coin | Utility Token | Pay for transaction fees on Binance exchange | Binance Chain |

| SOL | Solana | Cryptocurrency | Fast, scalable decentralized applications | Solana Blockchain |

BitMarkets Fees and Liquidity

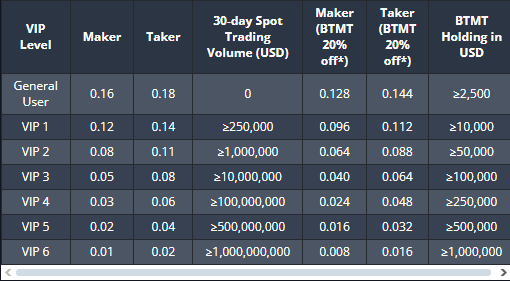

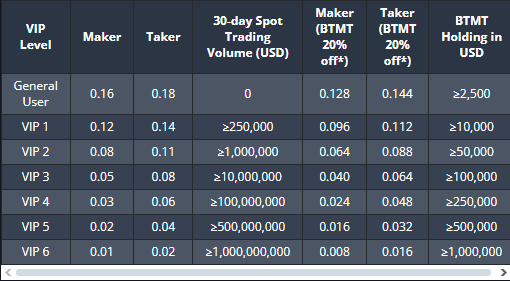

BITmarkets has lowered its spot and futures trading fees, claiming to be one of the most competitively-priced platforms in the industry. The new fee structure follows a tiered model, which reduces fees based on the user’s trading volume and BITmarkets Token (BTMT) asset holdings.

In the first tier, the fee for makers and takers in spot trading is 0.04% and 0.06%, respectively, and for futures trading, it is 0.02% and 0.04%, respectively. These changes aim at improving user experience and creating a more constructive trading atmosphere.

Trading Fees

The fees associated with your trading will be charged to the currency you receive. The account fee level is based on a rolling 30-day period of trading volume, which will be reset at midnight each day.

The trading volume calculation is done in USD only. Other currencies are converted to USD using the current market value.

Futures trading fees

You will incur trading costs for both opening and closing positions when trading futures contracts. Funds will be taken from your futures balance to pay the trading fees. The account fee tier is set based on a rolling 30-day period of a trader’s activity and will be updated once every day at midnight UTC.

Trading volume, which is measured in USD, determines the non-USD trading volume. The non-USD trading volume gets converted to USD at the current market exchange rate.

Margin Trading Fees

Trading fees would apply to both opening and closing positions in margin trading. The trading fees will be charged from your margin balance after the position is closed. Your account fee level depends on your trading volume in USD over the last 30 days and will be calculated every day at midnight UTC. Non-USD trading volume is converted into the USD equivalent volume at the spot exchange rate, and so will be calculated too.

BitMarkets Fiat Deposit and Withdrawal Fees

BITmarkets allows fiat deposits and withdrawals in various currencies, but fees may apply due to bank charges, remittance fees, or transfer fees outside the control of the platform. The supported fiat currencies include USD, EUR, INR, IDR, MYR, and VND. Below are the details of the deposit and withdrawal fees for these currencies:

| Currency | Network | Deposit Fee | Withdrawal Fee |

|---|---|---|---|

| USD | Swift | Free | 2.50% (min. fee: $100) |

| Credit Card (Mobilum) | 3.50% (min. fee of $2) | N/A | |

| EUR | SEPA | €10 + 0.2% | €10 + 2.5% |

| INR | RupeePay | 4% | 5.5% |

| Deluxepay365 | 4% | 3.25% | |

| GROWPAY | 4% | 3% | |

| IDR | VNPAY | 4% | 2% |

| MYR | VNPAY | 4% | 2% |

| VND | VNPAY | 4% | 2% |

How to Start Trading on BitMarkets

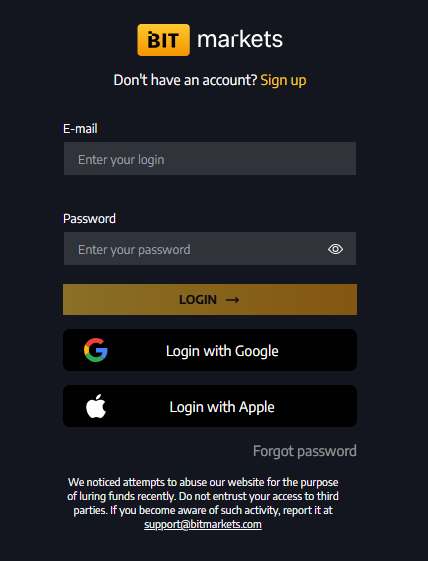

Set up an account

Go to the BitMarkets website and click on the “Register” or “Create Account” button. You will then need to fill in your first name, last name, email address, and create a password. Enter a phone number and promo codes if available. Accept the Terms & Conditions and Privacy policy, and then click the “Create Account” button.

Account Verification

Look through your email for an activation link from BitMarkets. Go ahead and click it to verify your account. You might have to finish a Know Your Customer (KYC) process by uploading identification documents.

Account Funding

After verifying, login to your BitMarkets account and find the “Deposit” menu. Select your preferred payment option, e.g., bank account, credit/debit card, or cryptocurrency. Follow through with the steps provided to fund your account.

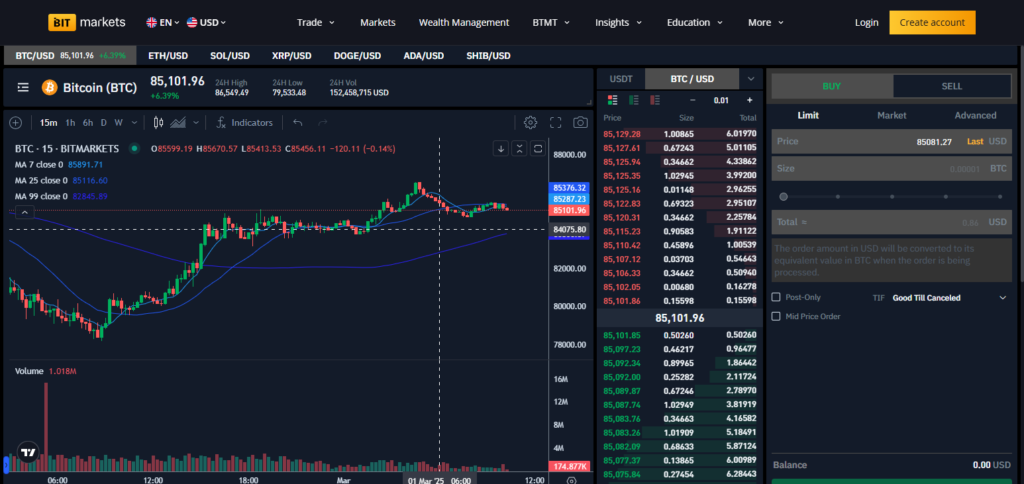

Utilize the Trading Platform

Get acquainted with the BitMarkets trading platform. The BitMarkets website contains multiple trading tutorials and guides that cover the fundamentals of trading.

Start Trading

Pick a market you’d like to participate in (spot trading, futures trading, margin trading) and the cryptocurrency pairs to trade. Provide the order type (market or limit) and the amount for trading. Validate your order and complete the trade.

Monitor Your Trades

Be sure to check daily the trades you have open and the market movements. Tools embedded in the BitMarkets platform can help you study the market and trade profitably.

Withdraw Funds

When you are ready to withdraw the funds, go to “Withdraw” and select your desired withdrawal option. Then, follow the steps provided to finalize the withdrawal.

BitMarkets Services and Features

Over 200 Crypto Assets

Users of BitMarkets can buy and sell more than 200 cryptocurrencies, with the top popular assets of Bitcoin, Ethereum, Cardano, among others.

Flexible Types of Trading

The trading options available on the platform are spot trading, futures trading, and margin trading to accommodate different trading methods.

BitMarket Grade Security

Users’ assets are safeguarded by storing 99% of funds in cold storage, whitelisting, transaction confirmation, and personal data encryption.

User Centric Design

The platform interface is built and organized in a way that is easy to navigate, therefore it is inclusive for new and skilled traders.

Multi Lingual Customer Service Support

Customer support is provided 24/7 in over 15 languages, so users can always get assistance when they require it.

Redeemable BTMT Token

BitMarkets has its own token which gives users the additional perk of reduced trading fees, exclusive content access, and reward program participations.

Investment Services

The platform assist users in managing their cryptocurrency assets through the offered investment services.

Educational Resources

BitMarkets has a variety of educational resources and tutorials that give users the options to learn the ins and outs of trading cryptocurrency.

Here’s a table showing the supported countries and banned countries for BitMarkets :

| ✅ Supported Countries | ❌ Banned Countries |

|---|---|

| United States | Afghanistan |

| Canada | North Korea |

| United Kingdom | Iran |

| Australia | Syria |

| Germany | Cuba |

| Singapore | Sudan |

| Japan | Crimea Region (Ukraine) |

| South Korea | Libya |

| Switzerland | Iraq |

| Hong Kong | Yemen |

BitMarkets PROS & CONS

| PROS | CONS |

|---|---|

| ✅ Wide range of supported cryptocurrencies | ❌ Limited fiat deposit options in some regions |

| ✅ Competitive trading fees with tiered discounts | ❌ Some regions face restrictions or bans |

| ✅ Advanced risk management tools | ❌ High withdrawal fees for certain fiat currencies |

| ✅ User-friendly interface and trading features | ❌ Futures trading requires more advanced knowledge |

| ✅ Multilingual customer support | ❌ Limited educational resources for beginners |

| ✅ Security features like negative balance protection | ❌ Not available in all countries globally |

Is BitMarkets Secure?

Indeed, BITmarkets is safe and puts high importance on security. It incorporates high-level security features like two-factor authentication (2FA), encryption, and a strong risk management system.

Moreover, BITmarkets users are guaranteed protection from negative balance through the insurance fund. Also, sophisticated liquidation engine is used to control risks and settle positions that need to be closed. Nevertheless, alost every other trading platform, BITmarkets users nust always be careful and use the platform security features.

Mobile App

Besides the primary trading platform, BITmarkets also allows traders to buy and sell funds outside of the office using the mobile app. The mobile app has all the features available on the main BITmarkets website. BITmarkets mobile app can be downloaded by users who have Android or iOS devices.

BitMarkets Customer Support

BITMarkets takes customer support issues quite seriously, which is why the exchange provides a special support line for users. Customers can access these support lines at any time of the day or night, and in over 20 different languages. According to the official website for BITmarkets, support is available in three different categories based on the customer journey.

BITmarkets provides comprehensive services, including but not limited to, assistance in Getting Started, Account setup and verification, Deposit and withdrawal, trading, security issues, and frequently asked questions. Users can solve issues related to starting an account, opening a trading account, and many other aspects of trading.

Conclusion

To sum up, BITmarkets stands out for its ease of use and security when it comes to cryptocurrency trading. Its unbeatable fees and numerous cryptocurrencies make the platform attractive for all types of traders.

Even more complex features such as spot and futures trading, as well as spot and tiered fees, are appealing to advanced traders and investors. BITmarkets provides excellent customer support and security; however, as with other international services, users need to be mindful of possible regional restrictions and additional costs. To conclude, BITmarkets is a trustworthy platform to trade digital assets in a simple and secure manner.