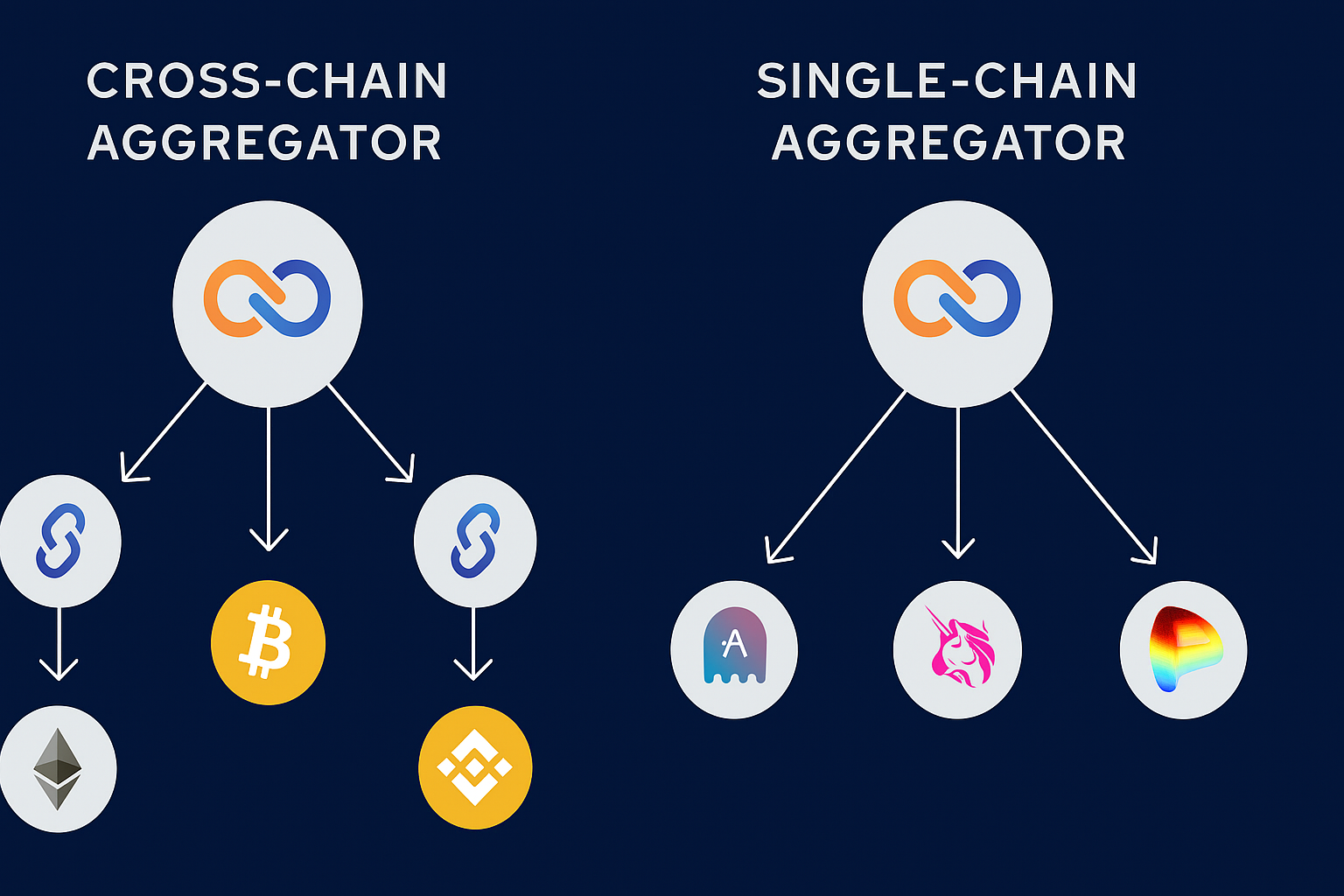

In this article, I will explain Cross-Chain Aggregator vs Single-Chain Aggregator while laying out their primary differences, pros, and cons.

I will highlight the way single-chain aggregators emphasize speed and convenience within a single blockchain

While cross-chain aggregators provide wider token options and liquidity accessibility over several chains, facilitating trader’s choices amidst the rapidly changing DeFi ecosystem.

What is a Cross-Chain Aggregator?

A cross-chain aggregator facilitates the token swap process and the access of liquidity through various blockchains, which boosts the fundamental interoperability of DeFi.

Without the need for centralized exchanges and brute-force bridging, Throchain, Multichain, and AnySwap, for the most part, only rely on the advanced bridging protocols to transfer the assets across the chains.

For the users, the advantages include access to wider liquidity pools, lower slippage, and easy cross-chain transactions.

These aggregators are also pivotal in optimizing the DeFi user experience while moving a plethora of assets and protocols on the blockchain.

Advantages of Cross-Chain Aggregators:

- A wider range of tokens for multiple chains.

- Potential better rates from aggregated multi-chain liquidity.

- More streamlined portfolio diversification without requiring multiple wallets or exchanges.

What is a Single-Chain Aggregator?

A single-chain aggregator operates within one blockchain ecosystem and sources liquidity from several decentralized exchanges (DEXs) located on that blockchain.

It maximizes user transaction value by identifying the most favorable swap rates, lending, and staking offerings available.

These systems enhance the Defi experience by efficiently consolidating information and directing trades. 1inch on the Ethereum blockchain, PancakeSwap on the Binance Smart Chain (BSC), and QuickSwap on Polygon serve this purpose.

These companies focus on a single blockchain ecosystem which guarantees swift transaction processing

Reduced costs, and a better overall experience. They also retain adequate liquidity and price competitiveness on the blockchain ecosystem.

Advantages Single-Chain Aggregator

- Improved transaction speeds that result from conducting operations on one blockchain.

- Reduced intricacy means new users encounter less difficulty.

- There are at times lower transaction fees when there is a chain with reduced gas costs.

Key Differences Between Cross-Chain and Single-Chain Aggregators

| Feature | Single-Chain Aggregator | Cross-Chain Aggregator | Which is Better? |

|---|---|---|---|

| Supported Chains | One blockchain | Multiple blockchains | Cross-Chain |

| Liquidity | Limited to one chain | Aggregates liquidity from multiple chains | Cross-Chain |

| Speed | Faster | Slower due to bridging | Single-Chain |

| Fees | Lower (depending on chain) | Higher (bridge + network fees) | Single-Chain |

| Complexity | Simple | Complex | Single-Chain for beginners |

| Token Access | Limited | Wide variety | Cross-Chain |

| Security Risks | Lower | Higher (cross-chain bridges) | Single-Chain |

Which One Should You Choose?

- In case you are looking for ease and fast execution – You will find single-chain aggregators to be most effective, particularly for newcomers or for networks with minimal gas charges.

- When you are looking for the most liquidity and the most options – You will prefer cross-chain aggregators because they can access multiple ecosystems, including assets and yields.

- For those concerned about risk – Single-chain aggregators are safer for small and medium trades because they eliminate the risks associated with cross-chain bridges.

- For advanced users and those interested in arbitrage – The cross-chain aggregators’ ability to provide arbitrage opportunities between chains is one of the most critical options for maximizing profits.

Features Cross-Chain Aggregator Vs Single-Chain Aggregator

Features of Cross-Chain Aggregator

Multi-Chain Token Access – Enables users to trade and swap tokens on different blockchains making more assets available to users compared to single-chain platforms.

Aggregated Liquidity – Draws liquidity and offers better rates for trades and lower slippage for large trades from multiple chains.

Cross-Chain Swaps – Users can exchange tokens and complete transactions on multiple blockchains without needing to go through the tedious process of bridging assets.

Portfolio Diversification – Users can control and distribute their assets from various ecosystems with a single platform.

Arbitrage Opportunities – Users can capitalize on the price differentials that exist on different chains. This is a unique advantage that is not available with single-chain aggregators.

Higher Complexity – This deploys bridge transactions and multiple network confirmations that can increase risk. Thus, requiring significant expertise to use effectively.

Features of Single-Chain Aggregator

Single-Chain Focus – This operates on a single blockchain which simplifies the trading process and lessens operational complexity.

Fast Transactions – Working on a single chain makes it possible for trades and swaps to be completed faster compared to cross-chain options.

Lower Fees – Transactions will not incur cross-chain bridge fees and will only consist of the native chain fees which makes it more economical.

User Experience – Designed for beginners with simplified navigation, fewer steps for swaps, lending, or staking.

Security Benefits – Minimal exposure to bridge vulnerabilities, optimal for users with small portfolios.

Liquidity & Assets – Due to limitations of one blockchain, customers will only receive the tokens and liquidity, which may cause considerable slippage to large traders.

Which Is Faster?

Single-chain aggregators tend to have a speedier performance because they function on a single blockchain.

This approach means that multiple networks or bridges do not handle the transactions, thus, needing fewer confirmations.

Users, therefore, experience near-instant swaps, trades, or staking operations, depending on the blockchain’s speed.

For instance, transactions on Ethereum or Binance Smart Chain take just a few seconds to a couple of minutes.

This performance scope makes single-chain aggregators favorable to users that require instant trades.

This is the core reason most new users stick to single-chain systems and disregard cross-chain systems.

Pros And Cons

| Feature | Cross-Chain Aggregator | Pros | Cons |

|---|---|---|---|

| Token Access | Multiple blockchains | Access to a wide variety of tokens | Complex for beginners |

| Liquidity | Aggregated across chains | Higher liquidity, better rates | Dependent on bridge reliability |

| Speed | Slower | Can execute large trades across chains | Longer transaction time |

| Fees | Higher | Potential for better overall deals | Bridge + network fees increase cost |

| Security | Higher risk | Can diversify across chains | Vulnerable to cross-chain bridge hacks |

| User Experience | Complex | Powerful for experienced users | Steeper learning curve |

| Arbitrage | Yes | Opportunity for cross-chain arbitrage | Riskier due to delays and fees |

Conclusion

In conclsuion, Each style of aggregator includes its benefits. Single-chain aggregators offer remarkable simplicity, enhanced security, and quick transaction speeds.

On the other hand, cross-chain aggregators provide an impressive range of liquidity, diversified tokens, and greatly enhanced cross-border trade.

Therefore, the optimum option boils down to one’s trading approach, experience, and how much risk one is willing to take.

FAQ

It’s a platform that aggregates liquidity and token swaps within a single blockchain.

It allows swaps and liquidity access across multiple blockchains using bridging technology.

Single-chain aggregators are usually faster due to fewer network confirmations.

Cross-chain aggregators provide access to tokens across several blockchains.

Yes, they have lower security risks since they avoid cross-chain bridges.