In this article, I will discuss the How to Buy Altcoins on Decentralized Exchanges. You’ll discover how to create a cryptocurrency wallet, link it to a DEX, and privately trade altcoins without the use of centralized services. Regardless of your experience level, this guide aims to streamline decentralized trading for you.

What Are Decentralized Exchanges (DEXs)?

A decentralized exchange (DEX) is a blockchain technology trade with cryptocurrency which transact directly, without the use of an intermediary.

Unlike a centralizex exchange, DEXs resort to The intelligent contracts used in Exchanges to allow Peer to Peer dealings. Some common examples are Uniswap, PancakeSwap and SushiSwap.

While increasing paypal and privacy security provided by usd greatly intelligent stance in decetnralized exchanges comes with the altagonumatic use and deal with complex systems making suitable for experts in cryptocurrency.

How to Buy Altcoins on Decentralized Exchanges

Purchasing altcoins on a Decentralized Exchange (DEX) offers a simple method of purchasing new digital currencies as DEXs let users trade cryptocurrencies peer-to-peer without a broker. Let’s use one of the most popular DEXs, Uniswap, as an example:

Step-by-Step Instruction on Buying Altcoins on Uniswap

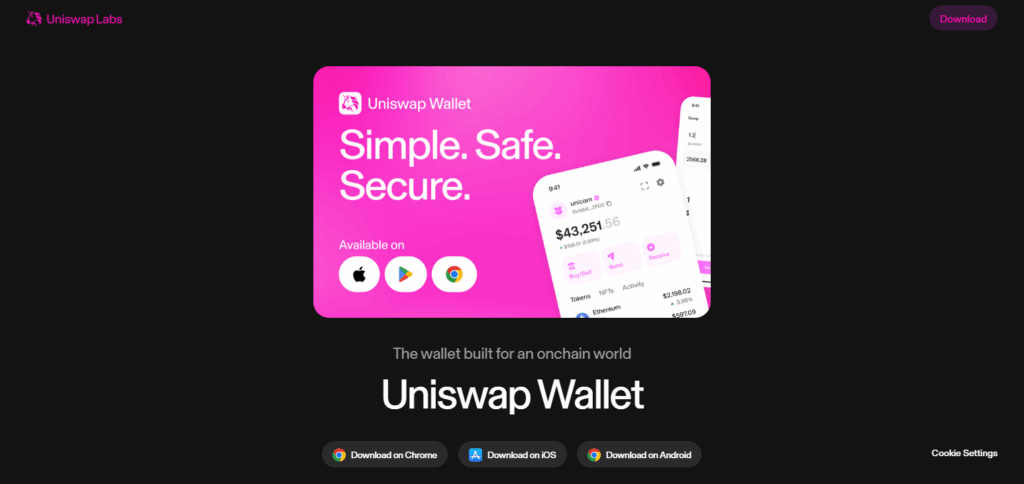

Create a Web3 wallet

Download a compatible wallet, e.g. Trust Wallet or MetaMask, then buy ETH and send it to your new wallet.

Connect your Wallet with Uniswap

Click on this Uniswap link, and make sure you have access to your wallet.

Pick An Altcoin

From the available currencies on the market, select the altcoin you wish to purchase.

Provide The Quantity To Be Swapped

Indicate exactly how much you want to trade.

Change the Slippage Settings

Set slippage level so that transactions can be executed without complications.

Confirm Details & Approve Transactions

Based on the details provided, confirm and sign the necessary contract through your wallet.

Check the Wallet for the Tokens

In due time, the blockchain will finalize the transaction, and the tokens will be reflected in your wallet.

Other Place Where to Buy Altcoins on Decentralized Exchanges

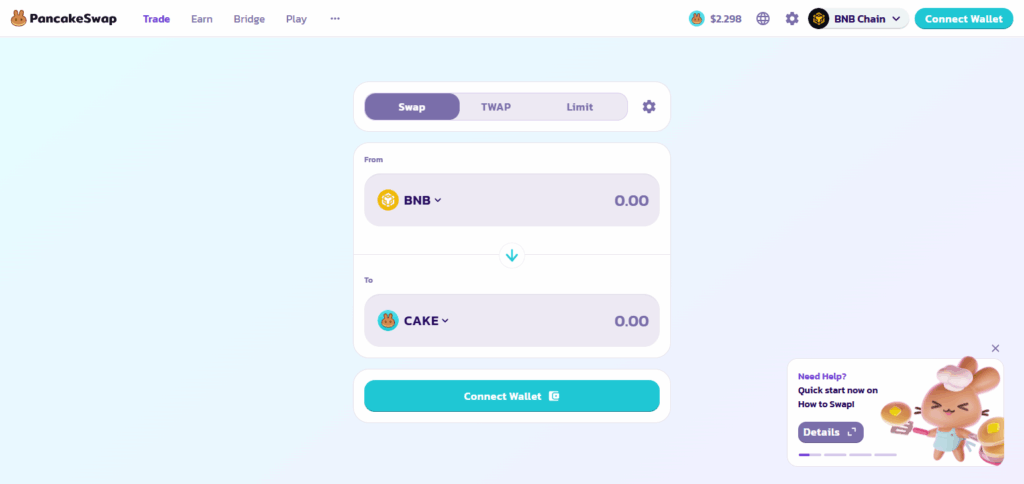

PancakeSwap

PancakeSwap is one of the most popular decentralized exchanges (DEXs) on BNB Smart Chain due to its fast and cheap trading options for altcoins.

Its robust user-friendly interface, makes it easy to navigate for beginners, and, at the same time, allows seasoned users to engage in liquidity farming and token staking.

PancakeSwap has one of the most extensive lists of BEP-20 tokens, giving the users early access to new altcoins. the DEXs made on Ethereum blockchain, offers significantly lower transaction fees which is one of its main advantages, this is what uni swap and other her sister are lacking.

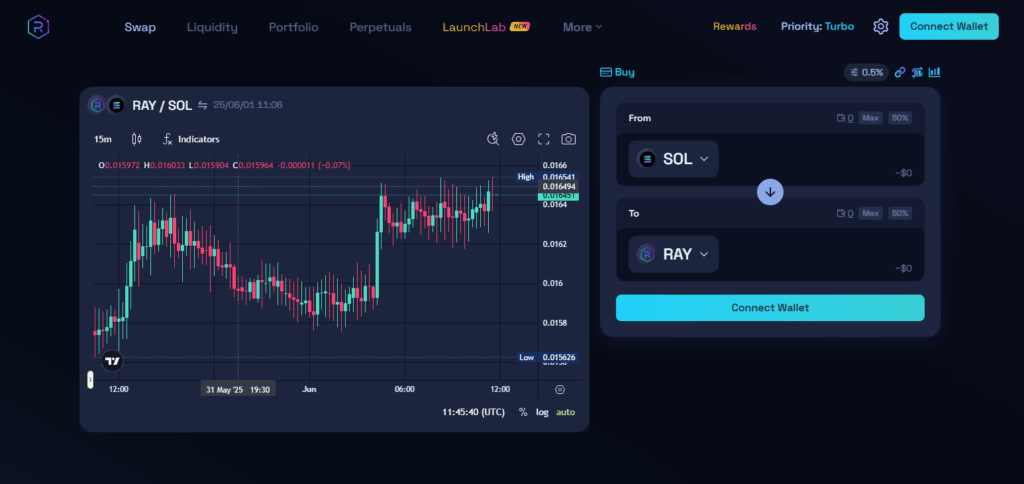

Raydium

Raydium is a decentralized exchange located on the Solana blockchain, providing astonishingly rapid trades and negligible fees for altcoin trades. What sets Raydium apart is its linkage to Solana’s central order book via Serum, which merges the advantages of centralized trading speed with the safety of DeFi.

Now users can tap into greater liquidity and improved price execution for new and popular altcoins. For users looking for effortless, inexpensive, and rapid trade on a decentralized exchange throughout the Solana ecosystem, Raydium is perfect.

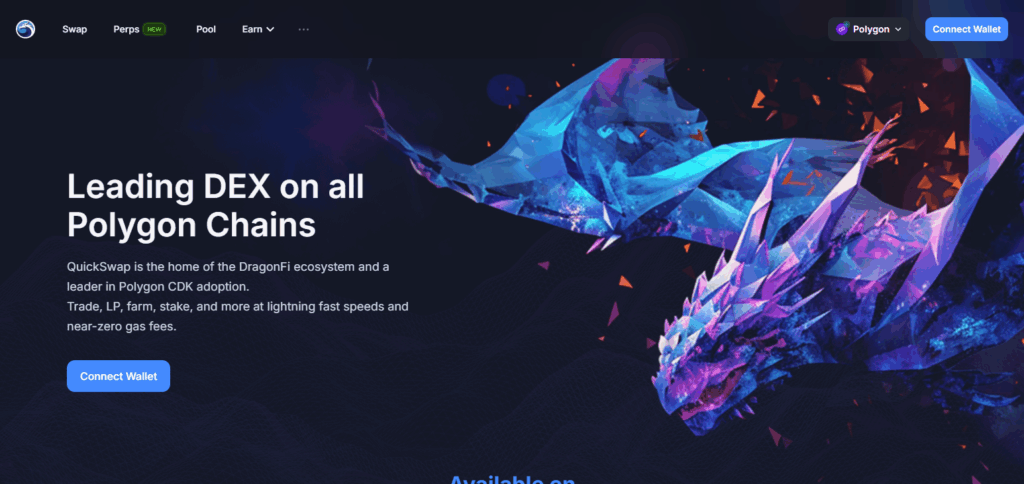

QuickSwap

QuickSwap is a decentralized exchange based on the Polygon network, distinguishing itself with its fast and affordable altcoin trading. It stands out because of the superior convenience it provides to traders due to Polygon’s scalability because they do not have to pay a lot of gas fees on Ethereum.

In addition to supporting a myriad of altcoins, QuickSwap is particularly beneficial for those seeking to trade inexpensive new or low market cap tokens. Accessible interface and rapid transaction speeds make QuickSwap ideal for low-cost trading in a decentralized environment.

Why Choose Altcoins on Decentralized Exchanges

Improved Access to New and Niche Tokens: Traders get earlier access to emerging projects because DEXs frequently list altcoins prior to CEXs.

Complete Control Over Your Assets: Trades from a DEX are made straight from your pocket, meaning your funds are in your custody and not with a third-party custody.

More Inclusionary Criteria To Join: With no KYC procedures on many DEXs, there is faster, private, and permissionless entry to the altcoin markets.

Increased Options for Providing Liquidity: Users are able to offer liquidity, support the ecosystem and earn rewards while trading in the pools.

Absolute Trading Freedom Without Restrictions: Anyone with a wallet, connection to the internet, and interest in trading has unfettered access to trade altcoins on DEXs anywhere in the world.

Tips for Safe and Smart Trading

Always Verify Token Contract Addresses

Always confirm that you are using the correct token by checking it on reliable platforms like CoinGecko and not on untrusted sources.

Use Reputable Wallets and Keep Your Seed Phrase Safe

To keep your private keys safe, store them offline and make sure to never disclose your seed phrase to anyone—even customer support.

Start with Small Trades

Test the waters first by executing a small trade if you are using a DEX for the first time or trying out a new token.

Be Cautious with Slippage Settings

Always be careful, as high slippage can wipe out lots of value—only adjust it when absolutely necessary, such as when dealing with high volatility.

Watch out for Rug Pulls and Fake Tokens

Perform thorough research of projects across social networks and websites before sinking money into them.

Use Token Aggregators When Possible

DEXs such as 1inch or Matcha will lower your expenses and slippage, allowing you to find the best possible trading rates and execute trades with multiple DEXs.

Avoid Clicking Suspicious Links

Remain cautious of DApps, Airdrops, and links that you are unfamiliar with especially when sent through emails or social media.

Monitor Gas Fees and Network Activity

Wait for when the network is congested to save on fees and avoid transaction failures.

Do Not Forget To Update

Always keep your browser extension or wallet application up to date as new versions include additional improvement and security features.

Only Invest What You Are Prepared To Lose

With alternative coins, the market is extremely volatile. So, exercise caution because trading on impulse can be disastrous.

Managing Your Altcoins After Purchase

Store Altcoins In A Non-Custodial Wallet: Keep your assets in your full control by using a non custodial wallet like MetaMask, Trust Wallet, Ledger.

Store Your Wallet’s Recovery Phrase: Make sure you take a physical and digital format of your wallet seed phrase and keep the information in a safe place.

Monitor Portfolio Progress: Monitor performances and values of your altcoins using portfolio trackers such as DeBank, Zerion, or Zapper.

Join Yield Farming Or Staking: If available, stake your altcoins or become a part of liquidity pools to earn rewards passively.

Follow News across social media and Websites: Tracks your social media and official websites of your altcoins projects to fågetfork, merget, or other updates.

Avoid Transferring Too Often: Skip unecessary wallet changes to minimize the risk of potential security problems along with gas fees.

Store Coins In Hardware Wallets: For short term investments or large amounts of holdings, use a hardware wallet to improve security for your altcoins.

Limitations & Security

Limitations

Lower Liquidity: Trading volume is often lower on DEXs compared to centralized exchanges which can result in higher price slippage during large trades.

Complex User Experience: Setting up a digital wallet alongside transaction processes could be daunting for beginners.

Limited Customer Support: The absence of a centralized support system means that users have to deal with problems on their own.

Token Risks: A token could easily turn out to be a scam as there is little verification available which could lead to losing funds.

Security

User-Controlled Funds: The risk of centralized exchange hacks is minimized because you control your assets.

Smart Contract Risks: Exploitable gaps in smart contracts can result in the loss of one’s assets.

Phishing Attacks: Make certain to avoid dubious links to maintain the integrity of your wallet credentials as URLs need to be verified.

Private Key Protection: Offline storage of seed phrases and private keys means guarding them against unauthorized access.

Pros & Cons

Pros

Complete autonomy of one’s funds (no custody by a third-party)

Access to an entire spectrum of new or niche altcoins.

No KYC requisites which protects privacy.

Reduced fees on some blockchains e.g., BNB Chain and Polygon.

Access for anyone with a wallet, making it permissionless and global.

Cons

Lesser liquidity, leading to slippage of prices.

Advanced difficulty for novices.

Lack of comprehensive support on issues of customer service or resolution of disputes.

Possibility of engaging with scam or spoofed tokens.

Possible vulnerabilities within smart contracts.

Conclusion

To summarize, purchasing altcoins on decentralized exchanges enables access to an extensive range of tokens while retaining full autonomy over one’s assets in a safe and flexible manner.

Equipping a trusted wallet and properly funding it enables smooth navigation through the DEX’s interface which guarantees efficient and cost-effective trading.

As with any transaction, security should be prioritized by confirming tokens and securing private keys. By taking these measures, decentralized exchanges can be leveraged to revolutionize self-directed crypto trading.