In this article, I will cover How to Buy Crypto on a Decentralized Exchange. A DEX, or decentralized exchange, enables users to trade cryptocurrencies directly between one another without the interference of third parties granting traders more control and confidentiality.

I will walk you through the steps to configure your wallet, connect to a DEX, choose the tokens you want, and efficiently execute your inaugural cryptocurrency transaction on these platforms.

What is Decentralized Exchange?

A decentralized exchange or DEX is a type of a platform for trading cryptocurrencies DEXs don’t rely on intermediaries and centers of authority.

DEXs are different from traditional exchanges, as they facilitate smart contracts for p2p transactions, thus providing greater privacy, control over the asset, and security.

As private keys are held by the users, the risks of losses arising from hacks and custody are significantly reduced. Examples are Uniswap, PancakeSwap, and, SushiSwap which operate on ethnereum and Binance smart and other networks.

How to Buy Crypto on a Decentralized Exchange

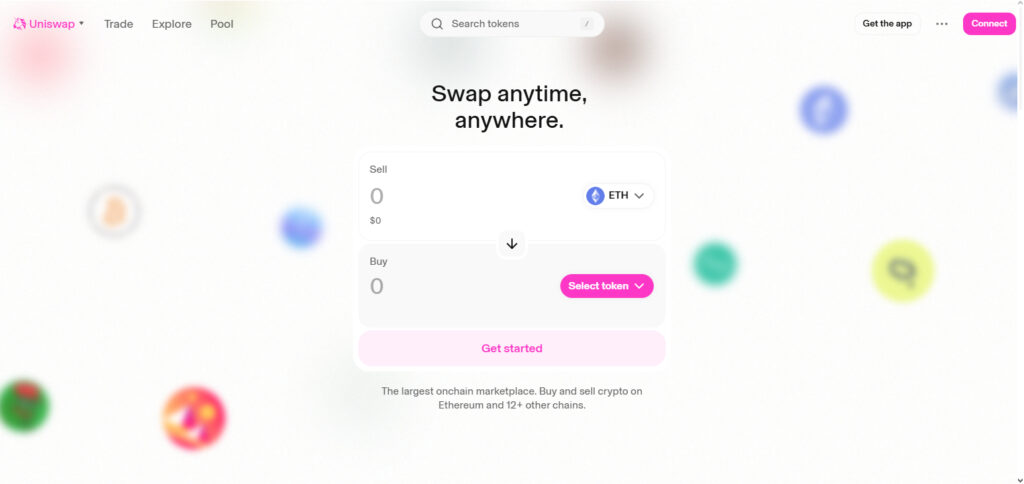

Step-by-Step Guide to Buying Crypto on Uniswap

Establish a Web3 wallet

Retrieve Trust Wallet or MetaMask, and buy some Ethereum (ETH) to place into the wallet.

Go to Uniswap

Check out the platform’s website at Uniswap and link your wallet.

Pick the token

From the trading pair list, select the cryptocurrency you wish to purchase.

Input Amount

Indicate the amount you would like to swap.

Set Slippage

Set slippage tolerance to allow flexible smooth execution of trades.

Approve the swap

After the details are checked, approve transaction details and confirm it in wallet.

Wait till Confirmed

The tokens should reflect in the wallet after some time.

Other Place Where to Buy Crypto on a Decentralized Exchange

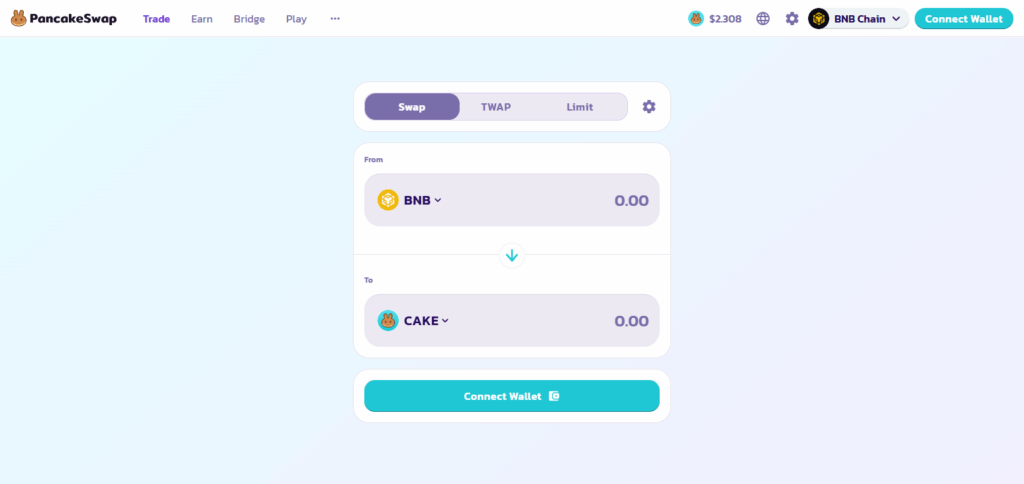

PancakeSwap

PancakeSwap is known for having one of the lowest fees and fastest transaction speeds among other decentralized exchanges on BNB Smart Chain. The exchange allows users to buy crypto hassle-free without registering or giving up their assets.

Users can buy, trade, earn, farm, or stake which makes PancakeSwap stand out in comparison to other exchanges. Users hoping to buy crypto through a decentralized exchange will find that PancakeSwap fosters an easy, token cost-effective setting where every user has full control of their tokens and there is no interference from centralized systems.

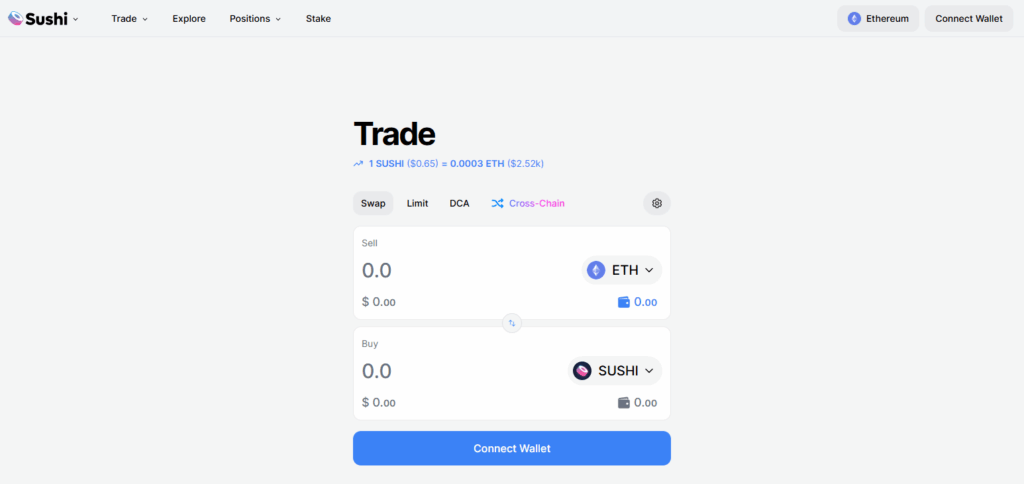

SushiSwap

SushiSwap is a decentralized exchange (DEX) that provides a multi-chain trading functionality on Ethereum, Arbitrum, and Polygon networks. Different from other DeFi exchanges, SushiSwap has an in-built DeFi ecosystem which allows users to perform token swaps and earn from yield farming, lending, or borrowing all in one place.

Purchasing cryptocurrency on SushiSwap provides users access to several tokens without losing control of their wallet. This is particularly beneficial for users who require more DeFi functionalities while still maintaining a high level of decentralization.

dYdX

dYdX is an advanced DEX with features like margin trading and perpetual contracts, which differentiates it from traditional DEXs. Users can buy and trade crypto with leverage on dYdX while controlling their funds through non-custodial wallets.

dYdX can be explored by those looking to buy crypto on a decentralized exchange since it offers a unique blend of professional trading tools with security features typical of DEXs. Beginners and seasoned traders who want more than mere swapping will find dYdX to be the perfect solution.

Benefits Of Decentralized Exchange

Complete Funds Control: Users are able to retain their private keys and cryptocurrencies without any restrictions.

No KYC Standards: Most DEXs do not enforce any form of verification which increases privacy.

Lower Hacking Risks: Funds are kept in decentralized systems which significantly lowers chances of large breaches.

Access to New Tokens: With DEXs, tokens are usually listed before centralized exchanges, including new and obscure projects.

Undiscriminating Global Access: Any possessor of a crypto wallet alongside the internet can trade irrespective of their background or location.

Less Censorship: Transactions are hard to block or freeze by central bodies.

Lower Fees: Many DEXs have cheaper transaction costs as compared to other exchanges, particularly on Layer 2 networks.

Automated Smart contracts: Trades are done directly through code, cutting back on the need for third-parties, which enhances clarity.

Tips for Safe Trading on Decentralized Exchanges

Verify Token Contracts

Always cross-check the currency token contract address to avoid con tokens.

Use Trusted DEX Platforms

Refrain from trying newly developed DEX platforms like Uniswap, PancakeSwap, or SushiSwap as they have not went through audits.

Beware of High Slippage

Ensuring precise setting of slippage cap will offer protection from losses or unplanned front-running.

Double Check URLs

Phishing scams are rampant, make certain access to DEXs is only via verified websites.

Start with Small Trades

Tokens and DEXs strategies are best approached by testing with nominal amounts prior to scaling.

Stay updated about smart contracts maintenance

Smart contracts can be changed. For updates, caution, or changes in smart contracts, monitor official social channels or community.

Keep an eye on gas fee and network traffic

Attempt to limit trading to non-peak periods to reduce transactional costs and failure rates.

Use portfolio tracker

DeBank and Zapper are good examples of monitoring and identifying irregular activities like fund shifts.

Risk & Considerations

Impediments and Backward Engineering

Smart Contracts might suffer from flaws in their execution or exploitation if not thoroughly vetted.

User Deception

Counterfeit tokens that bear impersonating names can deceive people; hence, it is paramount to validate the addresses of pertinent contracts.

Reduced Market Strength

Tokens which are not widely traded might experience slippage which might be expropriation of unintended prices.

Absence of Client Support

Customer support is lacking for a DEX due to its decentralized nature, thus there will likely be no service desk to assist with any mistakes.

Control Over Private Keys

Users need to be vigilant with the custody of private keys as losing them translates to losing access to their portfolio.

Advanced Order Placement

Front Running Orders whereby some bots find perceptions of orders that users wish to buy at then subsequently bid at higher prices.

Excess Energy on Specific Networks

Cryptocurrency users employing the Ethereum blockchain may find added fees applicable to transactions, otherwise known as gas fees rise throughout sliding ability to conduct transactions.

Exemption from Omnipotent Regulation

Trades can be executed with insufficient supervision and mechanisms to derive accountability for scenarios where trades go astray.

Pros & Cons

| Pros | Cons |

|---|---|

| Full control over funds | No customer support or recovery options |

| No KYC or identity verification required | Risk of interacting with scam or fake tokens |

| Lower risk of centralized hacks | Complex user interface for beginners |

| Access to new and emerging tokens | Slippage and low liquidity for some tokens |

| Transparent and automated via smart contracts | High gas fees on some networks (e.g., Ethereum) |

| Global access without restrictions | Vulnerable to smart contract bugs or exploits |

| Lower trading fees on some platforms | No regulatory protection in case of fraud or errors |

Conclusion

In summary, purchasing cryptocurrency on a decentralized exchange enhances your control, privacy, and the variety of tokens available. If you take the right steps—selecting an appropriate wallet, signing into a trustworthy DEX, checking token information, and setting transaction parameters—you can trade securely and efficiently.

With the growth of DeFi, knowing how to use DEXs gives you the ability to operate in an open, permissionless financial ecosystem. Remember to continuously educate yourself and keep security at the forefront of every transaction.