In this article, I will provide a step-by-step guide on how to trade cryptocurrencies with the lowest fees possible. As a frequent trader, the cost of trading can substantially impact your profit.

Through the strategic selection of appropriate exchanges, smart trading, selection of appropriate exchanges, and fee understanding, trading costs can, in fact, be lowered to maximize returns.

What is Crypto Trading Fees?

Crypto trading fees refer to expenses incurred during the purchase, sale, or transfer of cryptocurrencies. These expenses are associated with the use of trading platforms and the respective blockchain systems.

These are the most common fee types: trading fees incurred during order execution (often divided into maker and taker fees), deposit and withdrawal fees incurred during fund transfer to or from the exchange, network fees to blockchain validators as payments for transaction processing, and conversion fees for swapping one cryptocurrency for another.

These expenses are of particular concern to active traders as they pose a serious threat to profits, thus understanding and formulating trading techniques to minimize them is crucial.

How To Trade Crypto With Minimal Fees

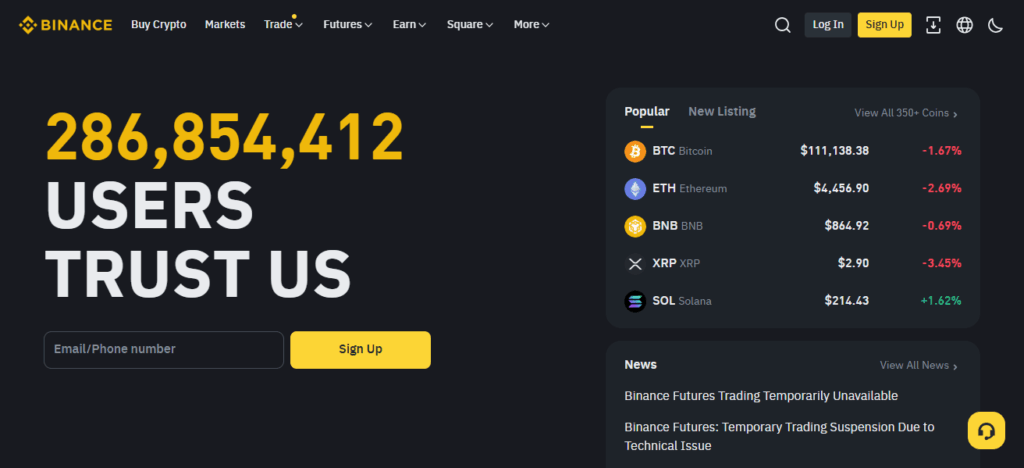

Case Study: How to Trade Cryptocurrency on Binance with Minimum Fees

Stage 1: Sign Up and Complete KYC Check

Register on Binance and complete KYC verification to unlock the full features and lower-tiered fees.

Stage 2: Smart Fund Deposit

Avoid spending fiat. Deposit crypto instead to bypass high conversion fees. Prefer USDT on Tron over Ethereum to save on network fees.

Stage 3: Utilize Limit Orders

Place limit orders instead of market orders. This makes you a maker, which usually attracts lower fees compared to taker order fees.

Stage 4: Binance Fee Discounts

Tiered trading fee discounts are accessible for higher-volume traders. Consider the 30-day trading volume for planning.

Stage 5: Auto BNB Payment Option

Enable BNB auto-payment for trading fees. This provides up to 25% discount on trading fees.

Stage 6: Fee Monitoring

Avoid retrieved transaction batching with minimal fee increments. For more customizability of the net fees paid, consolidate trades and withdraw strategically.

Which Exchanges offer The Lowest Fees For Trading?

Some exchanges known for low fees include:

1.Kraken

Kraken is a reputable exchange with transparent and competitive trading fees. Their standard fees are 0.16% for makers and 0.26% for takers.

For high-volume traders, fees are reduced as well. Kraken offers zero-fee deposits for many cryptocurrencies, which is a plus. Kraken supports multiple fiat currencies, which simplifies conversions, although network fees still apply.

Kraken is well-known for reliability and security, making it a favorable option for traders who want a reputable exchange and are looking for low fees and a public trading model, as well as no hidden costs for frequent trading.

2.KuCoin

KuCoin has a competitive offering with low trading fees starting at 0.1% per trade, which can be further reduced with KCS (KuCoin Shares). Their selection of cryptocurrencies and trading pairs is very broad, making it easy for altcoin traders.

KuCoin also has tiered discounts based on trading volume. Most deposits are free, while withdrawals are subject to network fees. KuCoin tends to balance diversity of coins with cost efficiency, making the exchange a good option for traders looking for lower costs while keeping high liquidity and divers functionality.

3.Bybit

Bybit is primarily focused on derivatives. However, it also offers spot trading with very low fees charged at 0.1% both for makers and takers, which is decently competitive among all crypto exchanges. Bybit has multiple running promotions with reduced or zero fees for new customers.

While Withdrawals do incur blockchain network withdrawal fees, deposits remain unaffected. Advanced trading tools, leverage options, and low-cost trading make Bybit supremely suitable for frequent traders and derivate users. Bybit has an intuitive interface with high-order execution efficiency, ensuring traders do not bear unnecessary costs.

4.OKX

OKX offers a competitive fee structure with standard trading fees for new users set at 0.08% for makers and 0.10% for takers. These rates are subject to decrease for high volume traders. OKX provides discounts for using its native token (OKB) to pay fees, which further lowers costs.

These OKX services are especially useful for users making a deposit in fiat currency and withdrawing in crypto, since they come with little to no network fees. All in all, OKX is suitable for traders looking to have low-fees and an all-inclusive trading experience due to its advanced features and high liquidity.

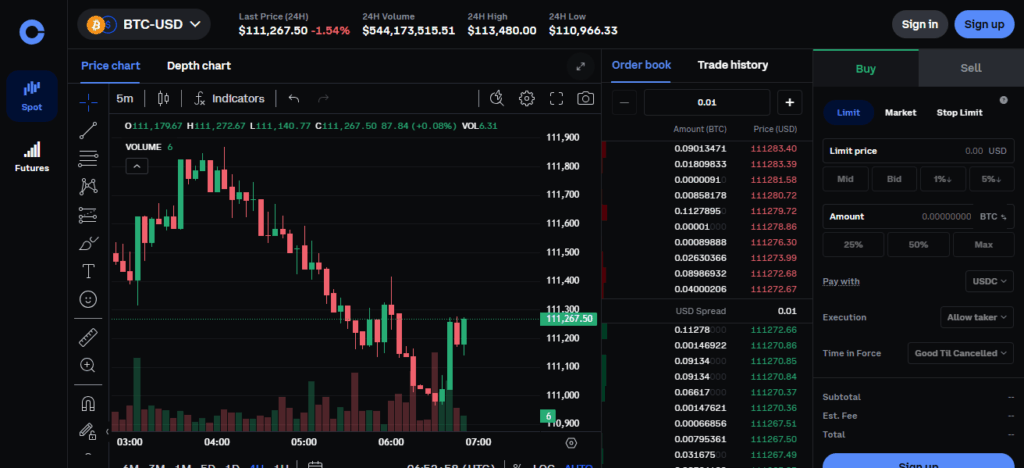

5.Coinbase Pro

The professional trading platform of Coinbase, Coinbase Pro, boasts lower fees than the standard Coinbase app. Depending on the trading volume and whether the order is a maker or taker, trading fees range from 0.04% to 0.50%.

Frequent traders will particularly benefit from Coinbase Pro due to significantly reduced costs with higher trading volumes. Deposits are mostly free, but withdrawals are subject to network fees.

Coinbase Pro is well known for security and regulatory compliance, so traders who value a platform with a solid reputation while keeping trading costs to a minimum will find it a reliable option.

What’s the best strategy to trade crypto with minimal fees?

- Research exchanges for fee structures and discounts.

- Use limit orders instead of market orders.

- Consolidate trades and avoid unnecessary withdrawals.

- Choose low-fee blockchains for transfers.

- Leverage staking or holding for passive growth instead of frequent trading.

Pros And Cons How To Trade Crypto With Minimal Fees

Pros of Trading Crypto With Minimal Fees

Enhanced Profitability Less fees translates to higher retained capital, leading to an increase in net profits. This is especially true for active traders.

Cost Efficiency for Active Traders Traders who execute multiple trades within a single day stand to gain significantly due to the lower cumulative costs associated with these activities.

Improved Capital Efficiency Reliable profits, resulting from lower fees, creates the ability to reinvest and compound, allowing for a significantly larger portfolio over time.

Freedom to Experiment With Different Trading Techniques Minimal fees allow traders to freely try out day trading, scalping, and arbitrage without the fear of losses due to excessive trading costs.

Promotes Economic Exchanges, Cryptocurrencies and Networks Strategically encourages cost-effective trading habits, therefore enabling better choices of exchanges and cryptocurrencies.

Cons of Trading Crypto With Minimal Fees

Possible Limitations on Functionality Advanced trading tools, stronger liquidity, and an expansive selection of coins are often associated with higher trading fees.

Obscured Fees Even with lower trading fees, gas fees and withdrawal costs would still apply, therefore making low trading fees inconsequential.

Restricted Earning Opportunities Fee-efficient exchanges may not offer access to staking, lending, or margin trading, which can stifle earning potential.

Compromised Security and Customer Support The lowest-priced trading platforms may offer weaker customer support, increasing risk for traders.

Native Token Price Volatility Discounts via native tokens (e.g., BNB, KCS, OKB) may require extra investment and expose users to inflation and volatility from the exchange’s price.

Conclsuion

In conclusion, strategically managing exchange order fees while using limit orders, consolidated trades, and discount tier utilization minimizes fees as does trading crypto on low-fee exchanges.

Along with low-fee exchanges, traders can minimize costs and maximize profits by understanding and sidestepping unnecessary withdrawals, selecting low-fee networks, and understanding fee structures.

Careful consideration pays off in crypto trading, enabling enhanced profitability without sacrificing security and flexibility.

FAQ

Sometimes, but network fees can be high on certain blockchains.

Rarely; most exchanges charge some fee, but smart strategies minimize costs.

Plan trades, use fee discounts, and select low-cost networks for deposits and withdrawals.