In this HTX review, we delve into everything one needs in order to understand what is in the context of one of the significant cryptocurrency exchanges. If you are wondering, “Is HTX safe?” or “How safe is HTX with my assets?”, then you are in the right place. HTX impressive combination of strong security measures, improved trading tools and a large number of supported cryptocurrencies is serving to be the center of choice for both novice and professional traders.

We’ll evaluate HTX functionality, its fees, security measures and customer relations so that you may assess whether it is one of the most useful exchanges in the cutthroat world of bitcoin trading.

Introduction

HTX is composed of various blockchain economic activities, which include digital asset dealing, financial derivatives, wallets, research, investments, incubation and others.

HTX has institutional and retail customers in about 160 countries over five continents including institutions, market makers, brokers and individual users.

More than $4 trillion of daily transactions are carried out and more than 45 million accounts are recorded on its platform which has over 700 virtual assets.

Its offers spot trading, futures trading, margin trading, earn products, custody services, trading bots, and more, backed up with multiple channels and contacts for the support service which is available 24/7.

HTX’s mission is “Accomplishing Financial Capability For Eight Billion People on Earth’. HTX expansion strategy ‘”Global Expansion, Thriving Ecosystem, Wealth Effect, Security & Compliance” is established to further meet its aim and growth as one of the leading onramps in Web 3.0.

Know Quick Details About HTX

| Attribute | Details |

|---|---|

| Founded | 2013 |

| Headquarters | Seychelles |

| Supported Cryptocurrencies | Bitcoin (BTC), Ethereum (ETH), Tether (USDT), Ripple (XRP), Litecoin (LTC), and many others |

| Services Offered | Spot trading, Futures trading, Margin trading, Staking, P2P trading, Crypto loans, Institutional services, Advanced order types |

| Supported Countries | United States (partial), Canada, Australia, United Kingdom, Germany, Japan, Singapore, India, South Africa, UAE, Brazil, and more |

| Notable Exclusions | United States (specific regions), Hong Kong, North Korea, Iran, Cuba, Crimea, Syria, OFAC-sanctioned countries |

| Security Rating | High (cold storage, two-factor authentication, regular security audits) |

| Recent Developments | Launched new staking programs, integrated additional cryptocurrencies, enhanced institutional services, and improved security protocols |

Is KYC Required At HTX?

Yes, it is correct that HTX requires KYC (Know Your Customer) but with some degree of convenience as it is not compulsory and there are different stages of verification. Here are the particulars:

HTX has four tiers for KYC verification:

- Level 1 (Basic Permissions): No verification is necessary. You get auto verified with basic permissions after signing up. It’s a very simple process.

- Level 2 (Basic Verification): This requires submission of a government ID, passport, driver’s licence or resident permit along with a selfie.

- Level 3 (Advanced Verification): Selfie and document submission is not enough, this requires complete us of facial recognition through HTX app.

- Level 4 (Investment Capability Assessment): Submit a proof of funds where you will require; bank statements, tax returns or dividend certificates.

Now each level allows you to withdraw more and more which allows for higher limits and unlocking more features. Although, you can trade in level one without being verified, I must say the higher levels offer more security and vast trading options.

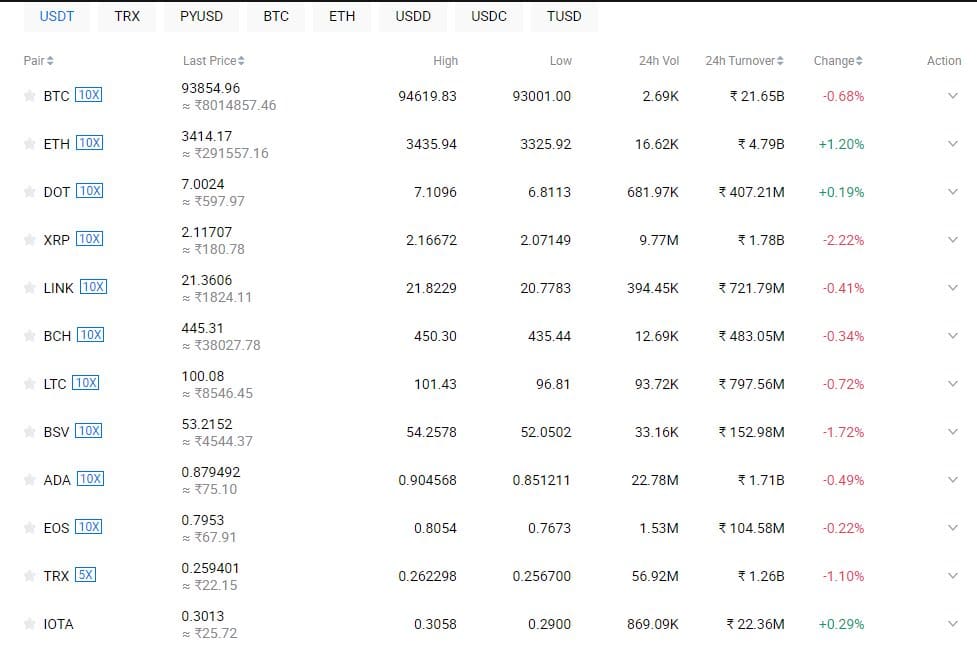

Some Popular Token Available On This Exchange

Here is some popular token which is available on this exchange more found here

| Token | Symbol |

|---|---|

| Bitcoin | BTC |

| Ethereum | ETH |

| Polkadot | DOT |

| XRP | XRP |

| Chainlink | LINK |

| Bitcoin Cash | BCH |

| Litecoin | LTC |

| Bitcoin SV | BSV |

| Cardano | ADA |

| EOS | EOS |

| TRON | TRX |

| IOTA | IOTA |

| Ethereum Classic | ETC |

| USD Coin | USDC |

| Pax Dollar | USDP |

| TrueUSD | TUSD |

HTX Fees

Here is a well-organized table summarizing the Prime Levels based on the provided data:

| Prime Level | 30-Day Spot Trading Volume (USDT) | 30-Day Futures Trading Volume (USDT) | Previous Day Total Assets (USDT) |

|---|---|---|---|

| Prime 0 | < 10,000 | < 100,000 | < 2,000 |

| Prime 1 | ≥ 10,000 | ≥ 100,000 | ≥ 2,000 |

| Prime 2 | ≥ 80,000 | ≥ 5,000,000 | ≥ 10,000 |

| Prime 3 | ≥ 500,000 | ≥ 30,000,000 | ≥ 30,000 |

| Prime 4 | ≥ 3,000,000 | ≥ 100,000,000 | ≥ 50,000 |

| Prime 5 | ≥ 9,000,000 | ≥ 200,000,000 | ≥ 80,000 |

| Prime 6 | ≥ 15,000,000 | ≥ 300,000,000 | ≥ 100,000 |

| Prime 7 | ≥ 30,000,000 | ≥ 500,000,000 | ≥ 300,000 |

| Prime 8 | ≥ 120,000,000 | ≥ 600,000,000 | ≥ 500,000 |

| Prime 9 | ≥ 300,000,000 | ≥ 700,000,000 | ≥ 2,000,000 |

| Prime 10 | ≥ 900,000,000 | ≥ 1,500,000,000 | — |

| Prime 11 | ≥ 1,800,000,000 | ≥ 3,000,000,000 | — |

Here’s a table summarizing the crypto loan interest rates based on the provided data:

| Prime Level | Spot Fee Rate (Maker) | Spot Fee Rate (Taker) | 25% Off with HTX (Maker) | 25% Off with HTX (Taker) | 25% Discount with TRX (Maker) | 25% Discount with TRX (Taker) |

|---|---|---|---|---|---|---|

| Prime 0 | 0.2000% | 0.2000% | 0.1500% | 0.1500% | 0.1500% | 0.1500% |

| Prime 1 | 0.1600% | 0.1700% | 0.1200% | 0.1275% | 0.1200% | 0.1275% |

| Prime 2 | 0.1400% | 0.1500% | 0.1050% | 0.1125% | 0.1050% | 0.1125% |

| Prime 3 | 0.1000% | 0.1000% | 0.0750% | 0.0750% | 0.0750% | 0.0750% |

| Prime 4 | 0.0800% | 0.1000% | 0.0600% | 0.0750% | 0.0600% | 0.0750% |

| Prime 5 | 0.0650% | 0.0900% | 0.0487% | 0.0675% | 0.0487% | 0.0675% |

| Prime 6 | 0.0550% | 0.0700% | 0.0412% | 0.0525% | 0.0412% | 0.0525% |

| Prime 7 | 0.0450% | 0.0550% | 0.0337% | 0.0412% | 0.0337% | 0.0412% |

| Prime 8 | 0.0320% | 0.0388% | 0.0240% | 0.0291% | 0.0240% | 0.0291% |

| Prime 9 | 0.0224% | 0.0318% | 0.0168% | 0.0238% | 0.0168% | 0.0238% |

| Prime 10 | 0.0168% | 0.0268% | 0.0126% | 0.0201% | 0.0126% | 0.0201% |

| Prime 11 | 0.0126% | 0.0218% | 0.0094% | 0.0163% | 0.0094% | 0.0163% |

30-Day Cumulative Trading Volume:

Calculations of such 30-day trading volume shall be conducted at 00:00 (GMT +8), whereby the cumulative trading volume of all asset trades for the past 30 days shall be aggregated. All trading volume shall be calculated in USDT and the value of USDT shall be the price of USDT as at the time of the calculation.

How to Start Trading on HTX

Here’s a step-by-step procedure of how to get started with trading on HTX:

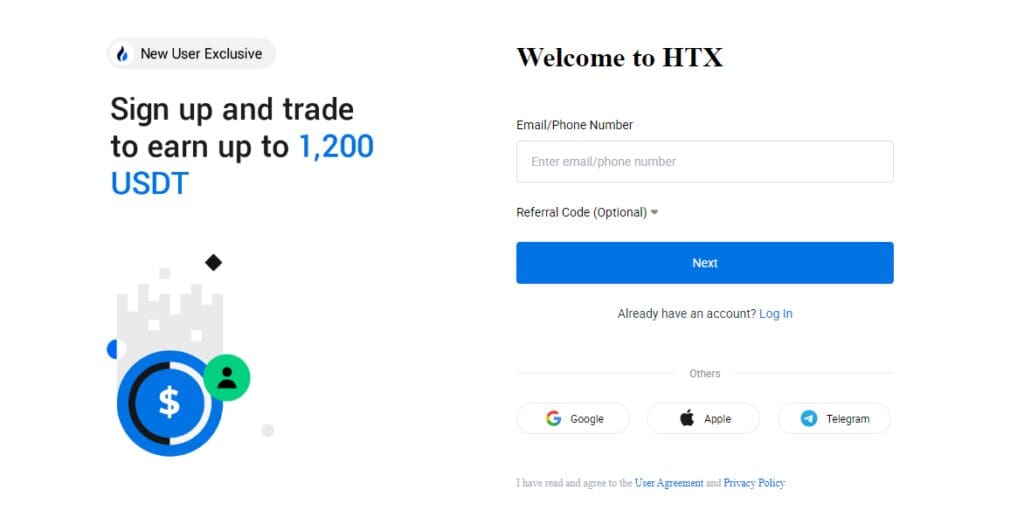

Create an Account

Go to HTX’s official website. Find and click on Sign Up or Register Now. Select which way you would like to verify your account, whether email, phone number, Google, or Telegram.

Deposit Funds

Once your account is verified, you may move on depositing funds via bank transfer, credit card, or other cryptocurrencies.

Explore the Platform

Next, familiarize yourself with the HTX interface, check out various options available for you like spot trading, margin trading, and futures trading.

Place your first Trade

You’re now ready to place your first trade. Choose the trading pair, determine your order specifications, including order types (whichever is applicable such as buy/sell orders), price, and amount, and launch the trade.

Monitor and Manage

Watch your opened trades and control your portfolio in the HTX dashboard, and see the options provided in the Earn section for making money via staking or other options.

HTX Deposit and Withdrawal Options:

| Method | Supported Currencies | Availability | Notes |

|---|---|---|---|

| Crypto Transfer | BTC, ETH, USDT, XRP, DOT, and others | 24/7 | Ensure the correct network is selected for the cryptocurrency deposited. |

| Bank Transfer | Fiat currencies (e.g., USD, EUR) | Region-specific | May incur fees; processing times vary depending on the bank. |

| Credit/Debit Card | Fiat currencies (e.g., USD, EUR) | Region-specific | Available through third-party payment gateways; fees may apply. |

| Peer-to-Peer (P2P) | USDT, BTC, ETH, and other cryptos | 24/7 | Direct transactions between users; no fees on HTX for P2P trades. |

| E-Wallets | Fiat currencies (e.g., INR, VND) | Limited regions | Supported via local payment partners; instant deposits in some cases. |

Who Are the HTX Founders?

Huobi Global, HTX’s predecessor, was founded in 2013 by Leon Li in Beijing, who graduated from Tsinghua University in 2013 with a degree in Automation.

Prior to Huobi Global, Li worked as a computer engineer at Oracle Corporation, one of the largest US-based software companies. In September 2022, Huobi Global rebranded to HTX.

The HTX Global Advisory Board guides HTX’s strategies and development and boosts HTX’s global development. The members include H.E. Justin Sun, founder of TRON, Ted Chen, CEO of About Capital Management (HK) Limited, Du Jun, co-founder of HTX, Leah Wald, CEO of Valkyrie Investments, and more.

HTX Services and Features

Spot Trading

Users get to buy or sell a number of cryptocurrencies in seconds.

Futures Trading

HTX offers its clients future contracts in which the trader gets to buy or sell an asset at a given price but at a future date.

Options Trading

Users are offered the possibility to buy or sell an asset on some fixed rate through an options contract.

Staking

Users are rewarded by the platform for just holding some of the cryptocurrencies on it.

Margin Trading

Users get to trade at higher risk by using borrowed funds and if all goes well they achieve a greater return.

Advanced Order Types

HTX has a diverse range of order types including but not limited to: limit, market, stop, trailing stop, fill or kill, iceberg orders etc.

High Liquidity

Platform provides high competitiveness in the bid and ask prices resulting into low transaction costs that all impact active traders and institutions.

Security Measures

MULTIPLE security layers protocols such as cold storage for most user funds, two-factor authentication (2FA), cold storage, regular security audits.

User-Friendly Interface

It aims to satisfy a variety of traders. Tools for complete beginners and a professional interface for advanced traders.

Fiat and Stablecoin Support

This platform enables its users to withdraw and deposit fiat currencies as well as stablecoins.

Here’s a table showing the supported countries and banned countries for HTX:

Here’s a table showing the supported and banned countries for OKX

| Supported Countries | Banned Countries |

|---|---|

| ✅ United States (partial) | ❌ United States (specific regions) |

| ✅ Canada | ❌ Hong Kong |

| ✅ Australia | ❌ North Korea |

| ✅ United Kingdom | ❌ Iran |

| ✅ Germany | ❌ Cuba |

| ✅ Japan | ❌ Crimea |

| ✅ Singapore | ❌ Syria |

| ✅ India | ❌ OFAC-sanctioned countries |

| ✅ South Africa | |

| ✅ UAE | |

| ✅ Brazil |

HTX PROS & CONS

| Pros | Cons |

|---|---|

| ✅ Wide range of cryptocurrencies | ❌ Restricted in certain countries |

| ✅ High liquidity and tight spreads | ❌ High fees for some withdrawal methods |

| ✅ Advanced trading tools (spot, futures, margin) | ❌ Limited fiat on-ramp options in some regions |

| ✅ Competitive fees, especially with HTX token | ❌ Complex interface for beginners |

| ✅ Strong security features (2FA, cold storage) | ❌ Customer support can be slow during high demand |

| ✅ Staking and passive income options | ❌ Withdrawal limits for non-verified accounts |

| ✅ P2P trading options with zero fees | ❌ Limited educational resources for new traders |

| ✅ Mobile app and responsive interface | ❌ Some features not available in all regions |

| ✅ Institutional services and API support | ❌ Regulatory uncertainty in some regions |

Security – Is HTX Safe?

HTX claims to protect users’ assets and upload KYC verification documents to comply with relevant regulations. Therefore, as an exchange, HTX poses no risk to clients.

Digital finance deals with great risk as HTX monitors its developments, measures and ensures that it always remains relevant. Their security infrastructure is designed to provide users with peace of mind while safeguarding them through multiple security measures against unauthorized access/any form of hacking.

User assets are secured by features like two-factor authentication and encryption while regular security audits are also conducted. In addition, strict bank security standards compliance makes HTX an appealing option for traders seeking security for their assets.

HTX Customer Support

Every service has customer service as one of its main components, and for HTX, customer service isn’t just an important part of their business – it is part of their pride. Regardless if it pertains to a question on the transaction, a technical question, or even questions regarding the user account — the support team can tackle a great number of questions for a more satisfying user experience.

Fully aware of how critical customer support is, HTX goes to great lengths to make sure that their customers receive support when it is needed. The market is very dynamic and can change very abruptly therefore, our support team is ready to help with the triggering of Bank Transfer/SEPA transactions as well as explaining an airdrop event in detail.

Such an approach to support services demonstrates HTX’s commitment to ensuring that every trader has a positive experience whenever they use the platform, fully aware that there is someone standing by all the times to attend to their needs.

Conclusion

Conclusion: HTX (Huobi)

HTX is more comprehensive and has numerous features, designed for all kinds of traders as it allows trading via spot, futures, margin and options. It has robust security like 2FA and cold wallets which makes the platform very secure.

Furthermore, HTX is very cost effective, close to or equally cost effective, when compared to other tokens, high in liquidity and provides advanced trading tools making it great for both novice as well as professional traders.

Although, the platform is also prone to problems such as availability in certain countries, network problems and limited customer assistance. The trading platform has several useful services which may not assist beginners fearing that it may as well be complex, features of the platform may also face global restrictions due to norms and regulations of few countries.

Given the above, HTX provides a reliable and multi functionality trading platform that is highly secure for those who are looking for vast variety of trading options.

The platform is particularly ideal for seasoned traders and institutional investors as it takes time to get used to it, especially in certain areas where there are restrictions.