This article will investigate the crypto exchanges with the highest liquidity, focusing on the platforms where traders get speedy order fulfillment with narrow spreads and low slippage.

Liquidity is important even in crypto and the right exchange ensures better trading. I will examine the top exchanges in the world for reliable volume and strong market access.

How We Choose the Most Liquid Crypto Exchanges

Trading Volume & Order Book Depth High daily trading volumes and deep order books guarantee near instantaneous execution with little slippage. We evaluate trades on BTC/USDT and ETH/USDT pairs as benchmarks since they are the most actively traded.

Spread & Execution Speed Strong liquidity will manifest as narrow bid/ask spreads. Exchanges with narrow spreads and quick order execution provide better trading efficiency, especially on larger orders.

Crypto Support Liquidly in the market involves trading volumes, liquidity and BTC/ETH – altcoins count too. We ask if the exchange supports multiple counters with ample liquidity in the spot and derivatives markets.

Global Market Coverage A liquid exchange will serve traders across the globe. We focus on the number of supported countries and the strength of local liquidity (e.g., Upbit in Korea, Coinbase in the U.S.).

Trading Fees: More volume and liquidity will be attracted with lower fees. Exchanges with 0.1% fees or lower (that also offer token-based discounts) are prioritized.

Institutional & Retail Adoption Retail and institutional traders on a single platform (Binance, Coinbase, Kraken) derive a steady stream of liquidity from a balanced base of traders on the platform.

Security & Trust Trust is a prerequisite. Without it, liquidity is meaningless. Exchanges that offer strong security, exhibit proof-of-reserves, and retain regulatory compliance usually enjoy higher volumes and deeper liquidity.

Key Points & Most Liquid Crypto Exchanges List

| Exchange | Key Liquidity Highlights |

|---|---|

| Binance | Leads global liquidity with ~40% of spot market share and highest liquidity scores (>95) |

| Bybit | Strong spot and derivatives volume, high inflows, second rank in overall trading activity |

| Bitget | Recorded ~US$2.08 trillion in Q1 2025 volume, rapid growth, strong altcoin liquidity |

| Coinbase | US market leader with ~13% global liquidity; regulated custody boosts trust |

| OKX | Top 4 in liquidity, global reach, broad fiat |

| Kraken | Highly liquid and trusted; strong compliance, second-highest liquidity score after Binance |

| KuCoin | High liquidity in mid-cap and altcoin markets; large number of listings |

| Gate.io | Rising liquidity scores (~71.9 to 80+), strong reserves, expanding user base |

| MEXC | High trading volume (~$5.2 bn), broad coin listings, growing liquidity |

| Upbit | Significant Korean market liquidity, ~24-hour volume ~$4.1 bn |

| Crypto.com | Within top-10 by market share (~6.16%), strong liquidity footprint |

| HTX | ~5.4% market share; still liquid despite recent volume drop |

| Bitfinex | Deep orderbook depth, longtime liquidity provider for professionals |

| Coinex | Stable liquidity, broad listings, decent orderbook depth |

| Phemex | Steady liquidity in spot and derivatives; consistent performance |

| Deepcoin | Provide aggregated liquidity across multiple DEXs for optimal trade execution |

| Weex | Largest DEX, ~23% of daily DEX volume, multi-chain deployment, huge liquidity pools |

| Luno | At times surpasses Uniswap in daily volume; top DEX on Cosmos |

| BingX | Known for copy-trading, high spot/derivatives liquidity in Asia/Latin America |

| WhiteBIT | One of the oldest exchanges; reliable liquidity and infrastructure |

20 Most Liquid Crypto Exchanges

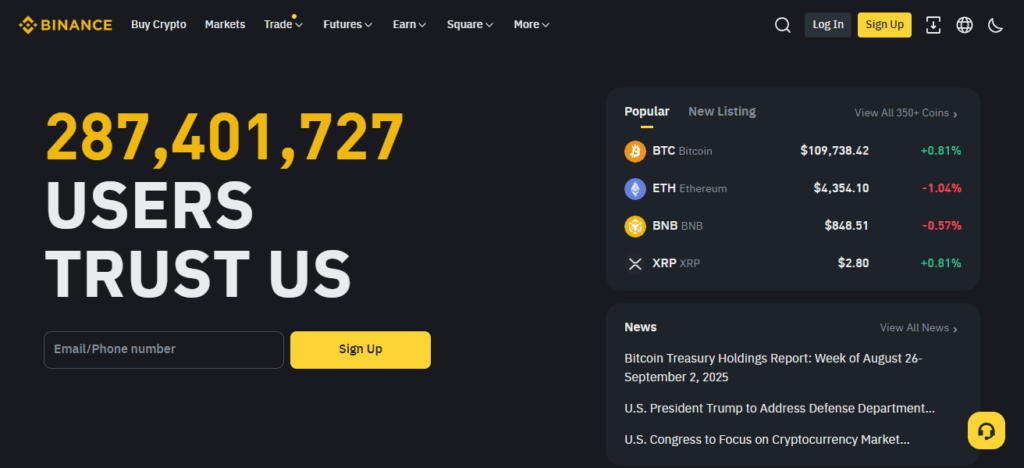

1. Binance

Founded in 2017, Binance became the foremost crypto exchange due to its immense liquidity and volume, supporting the trading of 600+ cryptocurrencies and 350+ trading pairs with a primary txn fee that starts at 0.1% and is further reducible via BNB.

While dominated in the US, Binance has a global reach in 180+ countries, where the exchange is tailored with support for 30+ languages such as English, Spanish, Chinese, Hindi, and Turkish.

Other features include options, futures, and spot trading, along with launchpad staking and new token launch features. As the most liquid exchange parallel with minimal slippage, Binance is cherished by countless institutional and retail traders.

| Feature | Details |

|---|---|

| Founded | 2017, by Changpeng Zhao |

| Supported Cryptos | 600+ |

| Trading Fees | 0.1% (lower with BNB) |

| Country Support | 180+ (restricted in U.S.) |

| Language Support | 30+ languages (English, Hindi, Turkish, Chinese, etc.) |

| Key Features | Spot, futures, options, staking, launchpad, huge liquidity |

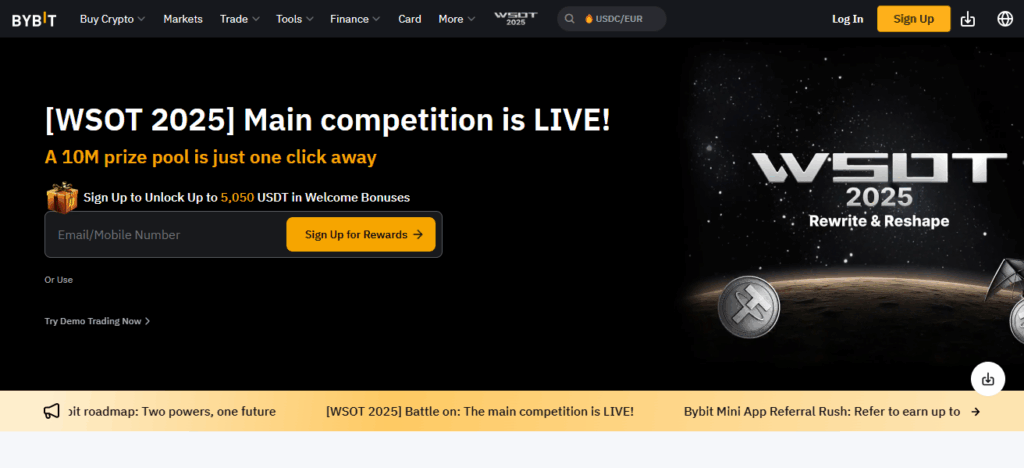

2. Bybit

Bybit was founded in 2018 and has, within a short period, become a top derivative exchange with ample liquidity, particularly in perpetual futures. Bybit has 400+ listed currencies and offers up to 100x on certain pairs.

The trading fees are 0.1% for spot and 0.01% maker / 0.06% taker for derivatives. It has multilingual support for 15+ languages such as English, Japanese, Russian, and Korean.

It is available for use in 160+ countries (excluding U.S., Canada, and a few others) and is largely recognized for its strong trading system with 99.99% uptime.

Its platform also has potential for copy trading, staking, launchpool, and an NFT marketplace, which in turn makes Bybit a favorable option for active traders.

| Feature | Details |

|---|---|

| Founded | 2018 |

| Supported Cryptos | 400+ |

| Trading Fees | Spot: 0.1% |

| Country Support | 160+ (restricted in U.S., Canada, etc.) |

| Language Support | 15+ languages (English, Japanese, Russian, Korean, etc.) |

| Key Features | Perpetual futures, copy trading, staking, NFT marketplace, high leverage |

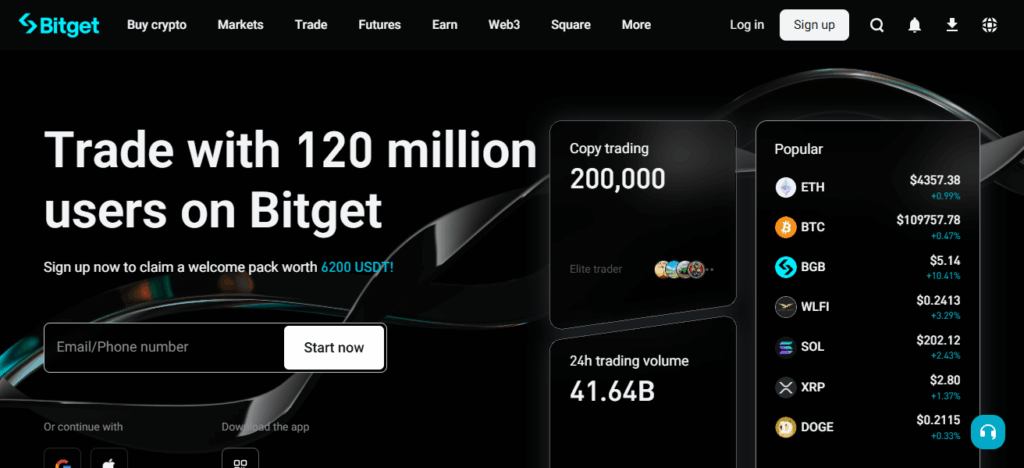

3. Bitget

Established in 2018 and based in Singapore, Bitget has become one of the most liquid derivatives exchanges and copy trading platforms in the world. It offers more than 600 cryptocurrencies in the spot and futures markets.

The trading fees are also reasonably priced: 0.1% for spot trading and 0.02% maker / 0.06% taker on futures. Bitget has a presence in more than 100 countries (with the U.S. and certain other areas being the exceptions).

The company also offers more than 15 languages on the platform, such as English, Vietnamese, and Spanish. The company is well known for its copy trading platform that allows users to trade like professional traders.

Rising liquidity coupled with strong security and an active global community make it a strong exchange competitor.

| Feature | Details |

|---|---|

| Founded | 2018, Singapore |

| Supported Cryptos | 600+ |

| Trading Fees | Spot: 0.1% |

| Country Support | 100+ (restricted in U.S.) |

| Language Support | 15+ (English, Vietnamese, Spanish, etc.) |

| Key Features | Copy trading, derivatives, staking, robust global community |

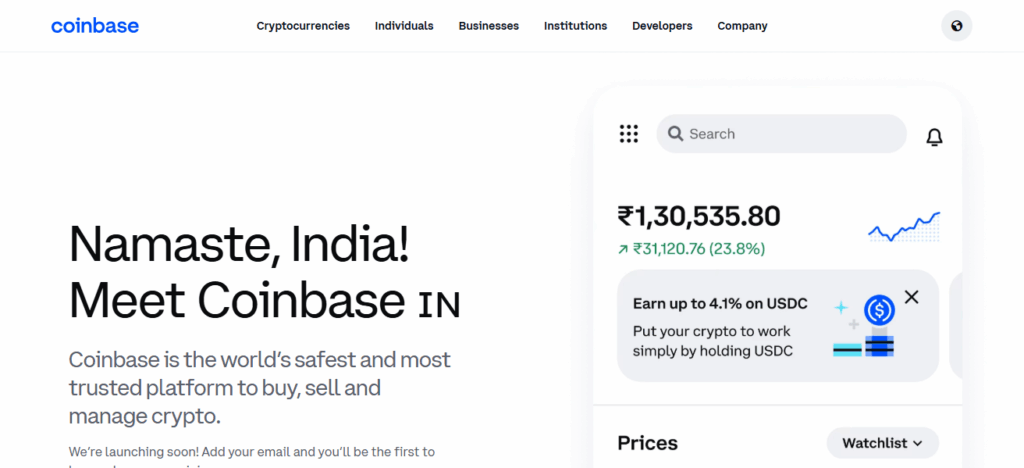

4. Coinbase

Founded in 2012 in the **US, Coinbase is among the first, best, and most reputable crypto exchanges. Coinbase is publicly listed on NASDAQ and services over 250 cryptocurrencies, especially liquidity in heavy traded pairs like BTC, ETH, and USDC.

Coinbase is at the higher end when it comes to trading fees, averaging 0.4% maker / 0.6% taker but Coinbase offers Coinbase Pro (Advanced Trade) which comes with decreased fees. Coinbase is in compliance with over 100 countries and supports 15+ languages. Coinbase is instructive and is easy to use which is why so many people use it.

Coinbase is known for being sensitive to the satisfaction of customers with the great amount of liquidity enjoyed in the BTC, ETH, and USDC pairs. Because Coinbase is extra cautious about its reputation as well as its compliance with laws, they are favored by traders in the United States and Europe.

| Feature | Details |

|---|---|

| Founded | 2012, United States |

| Supported Cryptos | 250+ |

| Trading Fees | 0.4% maker / 0.6% taker (lower on Advanced Trade) |

| Country Support | 100+ (focus on U.S. & Europe) |

| Language Support | 15+ (English, Spanish, French, etc.) |

| Key Features | Publicly listed on NASDAQ, beginner-friendly, institutional services |

5. OKX

OKX is located in Seychelles and, like all other exchanges, has grown exponentially during the boom in interest in cryptocurrency, earning some of the top rankings globally in volume alongside other exchanges since its conception in 2017.

OKX also has very competitive fees, like any other top-tier exchange, offering both spot and derivatives. Cross the speed of these trades during volatile market periods, and the deep liquidity of the order books and traders have a dream scenario.

In addition to this, many are drawn to the english and Arabic-speaking support alongside its multilingual team and accessible web and mobile app, which also supports 350+ cryptocurrencies.

OKX makes services available to 180+ countries via a tiered account system. It is also one of the trustworthy exchange offers. Users speak for OKX.

| Feature | Details |

|---|---|

| Founded | 2017, Seychelles |

| Supported Cryptos | 350+ |

| Trading Fees | 0.08% maker / 0.10% taker |

| Country Support | 180+ (restricted in U.S.) |

| Language Support | 20+ (English, Chinese, Arabic, French, etc.) |

| Key Features | Web3 wallet, DeFi ecosystem, advanced derivatives, strong liquidity |

6. Kraken

Founded in San Francisco in 2011, Kraken is among the oldest and most reputable crypto exchanges in the world. It boasts strong liquidity for more than 220 supported cryptocurrencies, especially fiat pairs such as USD, EUR, GBP, and JPY.

Kraken offers competitive trading fees at 0.16% maker / 0.26% taker with larger volume discounts. In more than 190 countries (Afghanistan and North Korea are notable exceptions.

Kraken is available in 12+ languages, such as English, Spanish, Japanese, and French. It is also known for being the most secure exchange, as they have never been hacked, earning the trust of retail and institutional investors alike.

Like many exchanges these days, KuCoin knew to begin building its ecosystem with professional trading features, and the “People’s Exchange” label has become very popular in the crypto realm.

KuCoin’s fees are extremely competitive, starting at a 0.1% trade fee, and 0.1% KCS (KuCoin Token) stakers earn on their participation.

| Feature | Details |

|---|---|

| Founded | 2011, United States |

| Supported Cryptos | 220+ |

| Trading Fees | 0.16% maker / 0.26% taker |

| Country Support | 190+ (restricted in a few regions) |

| Language Support | 12+ (English, Spanish, Japanese, etc.) |

| Key Features | Strong security, fiat pairs, futures, staking, regulatory compliance |

7.KuCoin

KuCoin as a crypto trading platform exchange used as people and was founded in 2017. It enabled users to trade over 700 cryptocurrencies. It was accessible in more than 220 nations as the trading platform specialized in crypto.

Almost all users received a zero percent exchange fee discount if they held KCS tokens. It supports trading over twenty currencies and two hundred different countries. Users were able to choose from a wide range of products, especially those in spot trading, margin trading, lending, as well as futures.

A strong altcoin user community supported KuCoin Spotlight. Therefore, it has quickly become popular and well-known as a reliable platform in altcoin trading.

| Feature | Details |

|---|---|

| Founded | 2017 |

| Supported Cryptos | 700+ |

| Trading Fees | 0.1% (discounts with KCS) |

| Country Support | 200+ (restricted in U.S.) |

| Language Support | 20+ (English, German, Portuguese, etc.) |

| Key Features | Altcoin variety, futures, KuCoin Earn, launchpad |

8.Gate.io

Gate.io, which was established in 2013, is one of the longest-running cryptocurrency exchanges, famed for the broadest range of primary platforms – supporting over 1,700 cryptocurrencies.

It has relatively low trading fees of 0.2% spot with discounts for GT token holders and multiple VIP tiers. It offers services in 15+ languages such as English, Russian, Turkish, and Japanese and spans operations in over 200 countries, though US access is restricted.

It also offers futures and margin trading, altcoin staking, and the launching of startup tokens, and is well-known for its deep liquidity in altcoins. It is widely used for the unique features it offers, such as advanced security and Proof-of-Reserves, as well as the plentiful coin listings for altcoin hunters.

| Feature | Details |

|---|---|

| Founded | 2013 |

| Supported Cryptos | 1,700+ |

| Trading Fees | 0.2% spot |

| Country Support | 200+ (restricted in U.S.) |

| Language Support | 15+ (English, Russian, Turkish, Japanese, etc.) |

| Key Features | Widest coin listings, futures, staking, startup token launches |

9. MEXC

Founded in 2018, the company MEXC has managed to become one of the biggest exchange platforms in the world due to its low transaction fees and high volumes of liquidity in new tokens. MEXC has one of the largest portfolios in the world with 1,600+ cryptocurrencies.

Its spot fees are 0% (limited promotion) while futures fees are 0.02% maker / 0.06% taker. MEXC operates in 170+ countries, with the United States and a few other countries being the only exceptions.

The platform has 15+ languages available, including English, Spanish, Korean and Arabic. MEXC is recognized for its sophisticated trading services, including fast listings of altcoins, altcoin liquidity, and ETF-like leveraged products.

All of the aforementioned is supported with its very low fees. The unique combination of fast growth and low fees helps MEXC maintain its high popularity.

| Feature | Details |

|---|---|

| Founded | 2018 |

| Supported Cryptos | 1,600+ |

| Trading Fees | 0% spot (promo) |

| Country Support | 170+ (restricted in U.S.) |

| Language Support | 15+ (English, Spanish, Korean, Arabic, etc.) |

| Key Features | Fast listings, leveraged ETFs, deep altcoin liquidity |

10. Upbit

Upbit is the largest crypto exchange in South Korea and is considered to be the one of the largest and most liquid exchanges in Asia. The company supports over 200 cryptocurrencies, has strong KRW trading pairs, and with a spot trading fee of 0.25%.

The company operates in Korea, Singapore, Thailand, and Indonesia, and has more than 5 language support, including Indonesian, English, and Korean. Due to its compliance and financial partnerships, the exchange is one of the most top-ranked globally in both trading volume and liquidity.

| Feature | Details |

|---|---|

| Founded | 2017, South Korea |

| Supported Cryptos | 200+ |

| Trading Fees | 0.25% |

| Country Support | South Korea, Indonesia, Singapore, Thailand |

| Language Support | 5+ (Korean, English, Indonesian, etc.) |

| Key Features | Strong KRW liquidity, regulated partnerships, dominant in Korea |

11.Crypto.com

Started in 2016 in Hong Kong, Crypto.com today is a brand spanning the globe and is known for its Exchange, app, DeFi wallet, and Visa card services. It is capable of handling trading fees of 250+ cryptocurrencies, the fees also starting at 0.075.% and getting cheaper if paid through CRO tokens.

Crypto.com is used in 100+ countries and supports 20+ languages such as English, Spanish, French, and Korean. Crypto.com is also known for its heavy sport partnerships and sponsorships and offers great liquidity on the main coins.

Some of its other services include staking, NFT marketplace, and crypto debit cards. Its global regulatory focus, along with its user-friendly ecosystem, makes the site one of the most trusted and accessible exchanges worldwide.

| Feature | Details |

|---|---|

| Founded | 2016, Hong Kong |

| Supported Cryptos | 250+ |

| Trading Fees | From 0.075% (lower with CRO token) |

| Country Support | 100+ |

| Language Support | 20+ (English, Spanish, Korean, etc.) |

| Key Features | Visa crypto card, staking, NFT marketplace, heavy branding |

12. HTX

HTX (previously known as Huobi) is one of the first significant exchanges along with Binance, having opened its doors in 2013 in the People’s Republic of China before shifting its headquarters to Seychelles.

As one of the first exchanges, it also boasts strong liquidity in Asia with a trading volume of $5 million. Currently, HTX serves over 150 countries, the US and some select territories being the only exceptions.

The exchange is compatible with 15+ languages, including Chinese, English, Russian, and Turkish. HTX also offers advanced trading services with deep liquidity on altcoins and futures while trading HTX tokens for a 0.2% trading fee. With its rich token support and an active user base, HTX remains one of the top liquidity providers in the world.

| Feature | Details |

|---|---|

| Founded | 2013, China (now Seychelles) |

| Supported Cryptos | 500+ |

| Trading Fees | 0.2% (discounts with HTX token) |

| Country Support | 150+ (restricted in U.S.) |

| Language Support | 15+ (Chinese, English, Russian, etc.) |

| Key Features | Strong Asia presence, derivatives, staking, altcoin liquidity |

13. Bitfinex

Established in 2012 and located in Hong Kong, Bitfinex is one of the first exchanges in the world and is acclaimed for its sophisticated trading functions and high levels of liquidity. Users can trade for 170+ cryptocurrencies and the exchange offers strong liquidity and trading pairs for BTC and ETH.

The exchange’s trading fees are very competitive at 0.1 maker / 0.2 taker and are even discounted further if users hold any UNUS SED LEO tokens. Bitfinex is accessible in 100+ countries; however, users from the U.S. are unfortunately unable to use the exchange due to regulatory issues.

Also, Bitfinex is available in 10+ languages, including English, Spanish, and even Russian and Chinese. In addition to these features, Bitfinex also offers margin trading, lending markets, and even derivatives.

Although the exchange is very controversial, in recent years it has also become one of the most trusted exchanges for both retail and institutional large volume traders due to its high liquidity.

| Feature | Details |

|---|---|

| Founded | 2012, Hong Kong |

| Supported Cryptos | 170+ |

| Trading Fees | 0.1% maker / 0.2% taker (discounts with LEO) |

| Country Support | 100+ (restricted in U.S.) |

| Language Support | 10+ (English, Spanish, Russian, Chinese, etc.) |

| Key Features | Advanced margin trading, lending markets, institutional liquidity |

14. Coinex

CoinEx, as of October, is based out of Hong Kong and was founded in 2017. They are known for the low fees and wide range of listings on their platform. They are, of course, the most attractive alternative for altcoin traders the world over as they deal in almost 700+ cryptocurrencies.

They have a 0.2% flat fee, and over that, CET token holders can get a discount. They are available in 200+ countries with the exception of a few restricted areas such as the U.S. It has 15+ language support, including Spanish and English, Arabic, and even Chinese.

CoinEx is known for its user-friendly interface and stable services, but also offers spot, futures, margin, and even staking services. Provided the deep liquidity in altcoins, global coverage, and transparent operations, CoinEx seems to be the most attractive to a diverse range of retail traders.

| Feature | Details |

|---|---|

| Founded | 2017, Hong Kong |

| Supported Cryptos | 700+ |

| Trading Fees | 0.2% (discounts with CET token) |

| Country Support | 200+ |

| Language Support | 15+ (English, Chinese, Arabic, Spanish, etc.) |

| Key Features | Altcoin variety, spot + futures, staking, transparent operations |

15. Phemex

Phemex is a derivatives and futures exchange headquartered in Singapore and has been operational since 2019, the year in which former executives of the prestigious Morgan Stanley established it. Spot fees amount to 0.1%, with derivatives fees set at 0.01% maker/0.06% taker.

It has a presence in over 150 countries around the world except for the US. Phemex is capable of using over 10 languages, some of the major ones being English, Spanish, Japanese, and Korean.

For having a zero financial spot trading membership service and institutional-grade matching engines, Phemex has attracted the interest of many professional traders. It has a well-established mobile app, which has made it a favorite for professional futures traders around the globe who want quick and easy execution.

| Feature | Details |

|---|---|

| Founded | 2019, Singapore |

| Supported Cryptos | 300+ |

| Trading Fees | Spot: 0.1% |

| Country Support | 150+ (restricted in U.S.) |

| Language Support | 10+ (English, Japanese, Spanish, etc.) |

| Key Features | Zero-fee membership, institutional-grade matching engine, futures focus |

16. Deepcoin

Founded in 2018 and based in Singapore, Deepcoin is an exchange in Asia that is starting to focus on derivatives. He has already implemented more than 100 cryptocurrencies and is focusing on over-the-counter and futures trading with a leverage of up to 125x %. The Spot fee is 0.1% and the fee on derivatives is 0.02% maker / 0.06% taker.

Deepcoin has over 100 countries of users, with some restrictions in the U. It has over 10 language interfaces, like English, Chinese, Vietnamese, and Korean.

Apart from focusing on USDT futures and options, Deepcoin is also known for providing liquidity and advanced 24/7 trading tools and customer service. As a result, the company has attracted active traders who focus on derivatives and high leverage.

| Feature | Details |

|---|---|

| Founded | 2018, Singapore |

| Supported Cryptos | 100+ |

| Trading Fees | Spot: 0.1% |

| Country Support | 100+ |

| Language Support | 10+ (English, Chinese, Vietnamese, etc.) |

| Key Features | Derivatives focus, high leverage, 24/7 support, USDT-margined products |

17. Weex

Weex was established in 2018 and is among the upcoming crypto derivatives exchanges that target the Asia-Pacific region. It has over 150 cryptocurrencies on the platform and focuses on perpetual contracts with 200x leverage.

It has 0.1% for Spot trading and 0.02% maker / 0.06% taker for derivatives. With its strong user bases in China and Southeast Asia, it has also expanded to over 50 countries.

It has over 8 languages on the platform, which include English, Chinese, and Vietnamese. One of the reasons it is popular among retail traders is due to its user-friendly copy trading platform.

It is gradually gaining a strong foothold in derivatives trading thanks to its growing liquidity, strong referral system and competitive leverage options.

| Feature | Details |

|---|---|

| Founded | 2018 |

| Supported Cryptos | 150+ |

| Trading Fees | Spot: 0.1% |

| Country Support | 50+ (Asia-Pacific focus) |

| Language Support | 8+ (English, Chinese, Vietnamese, etc.) |

| Key Features | Copy trading, social features, competitive leverage (up to 200x) |

18. Luno

Luno, which started business in South Africa in 2013, is a focused exchange on emerging markets, and is has regulatory approval. It supports 10+ major cryptocurrencies, which is a lot less than what is offered by competitors globally.

Trading ranges from 0.1% to 2% fees depending on the region and payment method used. Luno is operational in more than 40 countries with a stronger concentration in Africa, Asia and Europe.

Luno supports 8+ languages, which include English, French, Indonesian, and Malay. Luno’s strengths are in its liquidity in BTC and ETH pairs and easy access to fiat currency, even if its offered tokens are little in comparison to competitors.

| Feature | Details |

|---|---|

| Founded | 2013, South Africa |

| Supported Cryptos | 10+ (BTC, ETH, major assets) |

| Trading Fees | 0.1% – 2% (varies by region/payment method) |

| Country Support | 40+ (strong in Africa, Asia, Europe) |

| Language Support | 8+ (English, French, Indonesian, etc.) |

| Key Features | Beginner-friendly, fiat on-ramps, mobile-first design |

19.BingX

Since its creation in 2018, BingX has become the first global exchange specializing in derivatives and copy and social trading. Its current client base includes 100+ countries (U.S. excluded) and encompasses over 600 cryptocurrencies, offering both spot and perpetual futures.

Fees charged are 0.1% spot and 0.02% maker / 0.05% taker for derivatives. Clients have the option to communicate in over 15+ languages, including English, Vietnamese, Turkish, and Spanish. The exchange’s competitive tier includes deep liquidity in futures and steep community engagement.

With its deep liquidity in futures markets, competitive pricing, and effective community engagement, it has become a preferred exchange for both novice and seasoned traders. Its notable copy-trading feature, alongside integrated demo trading, has made it especially appealing to novice traders.

| Feature | Details |

|---|---|

| Founded | 2018 |

| Supported Cryptos | 600+ |

| Trading Fees | Spot: 0.1% |

| Country Support | 100+ |

| Language Support | 15+ (English, Vietnamese, Turkish, Spanish, etc.) |

| Key Features | Copy trading, demo trading, social trading ecosystem |

20.WhiteBIT

Established in 2018 in Ukraine, WhiteBIT has become one of the largest exchanges in Europe. It has strong liquidity in spot and futures markets and supports 350+ cryptocurrencies. Trading fees are competitive at 0.1%, with additional discounts for WBT token holders.

It operates in 150+ countries with the exception of the U.S. and some other regions. It supports 10+ languages such as English, Spanish, Turkish, and Ukrainian. More. WhiteBIT is known for its emphasis on compliance, fiat gateways, and strong presence in Europe.

It offers staking, futures, and a launchpad for new tokens. Due to its combination of high liquidity, security, and its expanding ecosystem, WhiteBIT is one of the most preferred exchanges in Europe and other regions as well.

| Feature | Details |

|---|---|

| Founded | 2018, Ukraine |

| Supported Cryptos | 350+ |

| Trading Fees | 0.1% (discounts with WBT token) |

| Country Support | 150+ |

| Language Support | 10+ (English, Spanish, Turkish, Ukrainian, etc.) |

| Key Features | Strong European base, fiat gateways, staking, token launchpad |

Conclsuion

In conclusion, the most liquid crypto exchanges stand out for deep order books, high trading volumes, and fast execution across spot and derivatives. Platforms like Binance, OKX, Bybit, and Coinbase lead globally, while Upbit dominates regionally.

Low fees, wide crypto support, and strong security further enhance their appeal, making them essential hubs for both retail and institutional traders worldwide.

FAQ

Binance leads globally, followed by OKX, Bybit, and Coinbase.

Liquidity ensures fast execution, tighter spreads, and better pricing for large and small trades.

Yes, low trading fees attract more traders, boosting volume and liquidity.