In this article, I will talk about the Most Secure Place To Buy Bitcoin from, emphasizing the ones with restrictions, strong security measures, and other user safeguards.

Your funds can be lost easily if proper care is not observed, especially given the heightened attention Bitcoin is receiving recently.

I’ll discuss the leading platforms that ensure maximum safety for Bitcoin transactions in terms of buying, selling, and storage.

Key Point & Most Secure Place To Buy Bitcoin

| Exchange | Key Security Feature |

|---|---|

| Coinbase | Insurance on digital assets stored in hot wallets and strong regulatory compliance (U.S.). |

| Kraken | Advanced cold storage with 95%+ assets offline and robust internal security protocols. |

| Binance | Secure Asset Fund for Users (SAFU) to cover losses from security breaches. |

| Gemini | SOC 2 Type II compliance and fully regulated under NYDFS. |

| Bitstamp | Full cold wallet storage with regular security audits. |

| eToro | Regulated by multiple authorities (FCA, ASIC, CySEC) and encrypted wallets. |

| Bitfinex | 99.5% of user funds stored in multi-signature cold wallets. |

| Crypto.com | ISO 27001/27701 certified with extensive cold storage and insurance coverage. |

| Pionex.US | Combines 2FA and offline storage for enhanced account and fund security. |

| CoinSpot | Australia’s most audited exchange with industry-leading security and offline storage. |

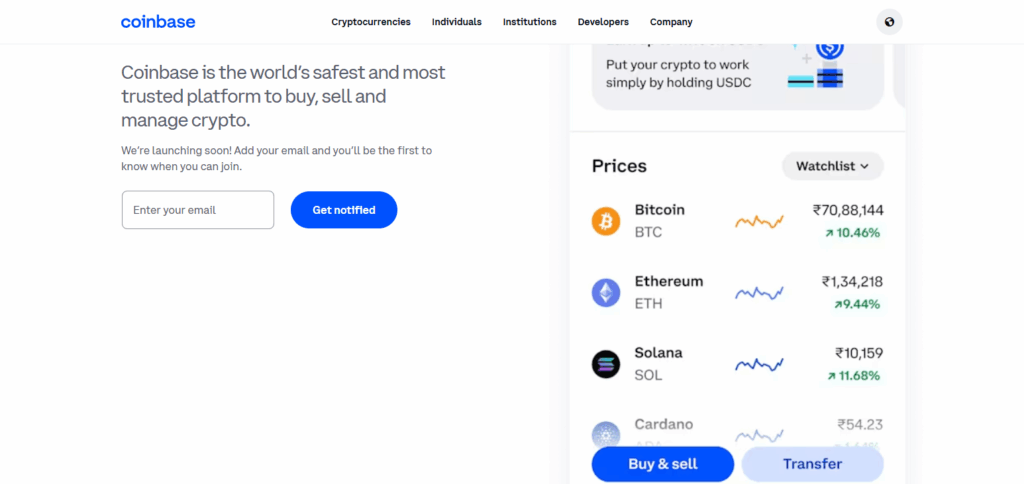

1. Coinbase (Most Secure)

Coinbase is considered the most secure platform for purchasing Bitcoin in particular, because of its extensive security measures and regulatory compliance. Active since 2012, Coinbase keeps 98% of customer funds in cold storage to protect against hacks.

It utilizes 2FA via SMS or Authenticator Apps, biometric login, and encrypts digital wallets using AES-256. Coinbase is a publicly traded company (NASDAQ: COIN) which means it complies with US regulations, including FinCEN and SEC guidelines.

Unique among exchanges, it also provides insurance cover for digital assets stored on their exchange against cyber security attacks. Coinbase has its own unique features like Coinbase Vault, which provides additional security through multi-signature access and timed withdrawals.

The platform supports over 100 cryptocurrencies, offers a beginner-friendly interface and advanced trading tools through Coinbase Advanced. Although fees can be higher (1-4% based on payment method), its opaqueness and security are ideal for new and overly cautious investors.

| Feature | Details |

|---|---|

| Platform Name | Coinbase |

| Founded | 2012 |

| Headquarters | San Francisco, CA, USA |

| Regulation | Registered with FinCEN, compliant with U.S. regulations (SEC, NYDFS) |

| Security Features | 98% of assets in cold storage, 2FA (authenticator app, SMS, biometric), AES-256 encryption, insured custodial assets, Coinbase Vault with multi-signature and time-delayed withdrawals |

| Supported Cryptocurrencies | Over 100 (including Bitcoin, Ethereum, Solana, etc.) |

| Fees | 1-4% (varies by payment method and trade type); lower on Coinbase Advanced (0.4-0.6%) |

| Trading Options | Spot trading, recurring buys, Coinbase Advanced for low-fee trading, staking |

| Unique Features | Coinbase Vault for enhanced security, publicly traded (NASDAQ: COIN), user-friendly interface, insurance against hacks |

| Best For | Beginners, security-conscious investors, U.S.-based users |

| Availability | Available in over 100 countries, with full features in the U.S. |

| Mobile App | iOS and Android apps with voice mode for Grok 3 integration |

| Customer Support | 24/7 support via email, phone, and help center |

| Drawbacks | Higher fees for small transactions, limited advanced trading features compared to competitors |

2. Kraken

Kraken ranked high on security features as one of the oldest cryptocurrency exchanges launched in 2011. Known forits robust cold storage systems, Kraken also employs two-factor authentication – including YubiKey support – and full data encryption.

Regular third-party security audits and a bug bounty program further fortify Kraken’s systems, while the lack of hacks demonstrates the firm’s security focus. Moreover, Kraken claims regulation across the US, UK, and Australia while adhering to FinCEN policies.

Unmatched in the market, Kraken claims a Global Lock Settings feature that bars setting alterations negating unauthorized changes.

Kraken also boasts over 65 cryptocurrencies with minimal fees of 16-26% on most trades alongside senior features such as margin trading and staking. Best for: Highly experienced users looking for reliable low costing services.

| Feature | Details |

|---|---|

| Platform Name | Kraken |

| Founded | 2011 |

| Headquarters | San Francisco, CA, USA |

| Regulation | Registered with FinCEN, compliant in the U.S., UK, Australia, and other jurisdictions |

| Security Features | 95% of assets in cold storage, 2FA (YubiKey, authenticator app, SMS), full encryption, Global Settings Lock, regular third-party audits, bug bounty program |

| Supported Cryptocurrencies | Over 65 (including Bitcoin, Ethereum, Cardano, etc.) |

| Fees | 0.16-0.26% for most trades; lower for high-volume traders; instant buy fees up to 1.5% |

| Trading Options | Spot trading, margin trading, futures, staking, OTC desk for large trades |

| Unique Features | Global Settings Lock to prevent unauthorized account changes, never hacked since inception, high liquidity |

| Best For | Experienced traders, institutional investors, security-focused users |

| Availability | Available in over 190 countries, with full features in supported regions |

| Mobile App | iOS and Android apps with trading and portfolio management features |

| Customer Support | 24/7 support via live chat, email, and help center |

| Drawbacks | Interface less intuitive for beginners, higher fees for instant buys |

3. Binance

Binance is the global leader in trading volume, while balancing security and liquidity on its U.S. facing product, Binance.US. The platform uses 2FA, cold storage for most assets, and device management to mitigate unauthorized access. As a U.S. based entity, Binance.US is registered with FinCEN, ensuring compliance with local regulations and a safe environment for American users.

A standout feature is its Secure Asset Fund for Users (SAFU), an emergency insurance fund geared toward user breach protection, albeit with limited coverage. The platform’s cryptocurrency availability exceeds 100 coins, with low trading costs of 0.1% on average for numerous trades.

It also offers sophisticated services such as futures trading and staking. However, the exchange’s international division has previously faced regulatory issues, so U.S. citizens are advised to limit themselves to Binance.US.

| Feature | Details |

|---|---|

| Platform Name | Binance.US |

| Founded | 2019 (U.S. version of global Binance, founded 2017) |

| Headquarters | San Francisco, CA, USA |

| Regulation | Registered with FinCEN, compliant with U.S. state-level regulations |

| Security Features | Cold storage for majority of assets, 2FA (authenticator app, SMS), device management, Secure Asset Fund for Users (SAFU) for emergency protection |

| Supported Cryptocurrencies | Over 100 (including Bitcoin, Ethereum, Binance Coin, etc.) |

| Fees | 0.1% trading fees for most trades; lower for high-volume traders; instant buy fees up to 4.5% |

| Trading Options | Spot trading, staking, futures, OTC trading for large transactions |

| Unique Features | SAFU emergency fund, high liquidity due to global Binance integration, low-cost trading options |

| Best For | Cost-conscious traders, advanced users, high-volume traders |

| Availability | Available in most U.S. states (restrictions in NY, TX, and a few others) |

| Mobile App | iOS and Android apps with full trading and portfolio management features |

| Customer Support | 24/7 support via email, live chat, and help center |

| Drawbacks | Limited availability in some U.S. states, global Binance’s past regulatory issues may concern some users |

4. Gemini

Established in 2014, Gemini is an exchange based in the United States and is known for maintaining regulatory compliance. Founded by the Winklevoss twins, Gemini is licensed by the New York State Department of Financial Services (NYSDFS) which is considered one of the toughest regulators in the United States.

Gemini maintains the majority of its assets in cold storage, implements 2FA including hardware key assistance, and provides insurance for custodial assets against theft or unauthorized access.

Its Gemini Custody solution offers exceptional collateral control alongside sub-accounts with role-based access. Gemini boasts an easy-to-use interface, while its ActiveTrader platform fosters low-cost trading (0.2-0.4%) for volume traders.

Automated purchases and a crypto rewards credit card are also available. Gemini suits users who prioritize compliance and safety, as they have a clear record in security and operational transparency. Ideal For: New users and institutional investors.

| Feature | Details |

|---|---|

| Platform Name | Gemini |

| Founded | 2014 |

| Headquarters | New York, NY, USA |

| Regulation | Licensed by New York State Department of Financial Services (NYSDFS), registered with FinCEN |

| Security Features | Majority of assets in cold storage, 2FA (authenticator app, hardware keys), insured custodial assets, institutional-grade Gemini Custody with sub-accounts and role-based access |

| Supported Cryptocurrencies | Over 70 (including Bitcoin, Ethereum, Chainlink, etc.) |

| Fees | 0.2-0.4% for ActiveTrader; convenience fees up to 1.49% for standard trades; no fees for custody services |

| Trading Options | Spot trading, recurring buys, ActiveTrader platform for low-fee trading, custody services |

| Unique Features | Gemini Custody for institutional-grade security, crypto rewards credit card, NYSDFS-regulated BitLicense |

| Best For | Beginners, institutional investors, security-conscious users |

| Availability | Available in all 50 U.S. states and over 60 countries |

| Mobile App | iOS and Android apps with trading, custody, and portfolio management features |

| Customer Support | 24/7 support via email, live chat, and help center |

| Drawbacks | Higher fees for non-ActiveTrader users, fewer advanced trading options compared to competitors |

5. Bitstamp

Established in 2011, Bitstamp is one of the oldest cryptocurrency exchanges and is considered reliable and secure. As a FinCEN registrant for US clients, it complies with EU regulations managing cryptocurrencies in Luxembourg.

Bitstamp employs two-factor authentication, performs regular third-party security audits, and uses cold wallets for 95% of its assets. It also claims an industry unique Crime Insurance, which, with some restrictions, pays for losses from theft or fraud.

With a user-friendly interface, clean design, and support for fiat-to-crypto transactions, Bitstamp is ideal for newcomers. Its tiered fee structure of 0.5% (or less for larger volumes) is beneficial for active traders.

Transparent policies and a solid history without major breaches makes Bitstamp trustworthy. Best For: Newcomers and long-term investors.

| Feature | Details |

|---|---|

| Platform Name | Gemini |

| Founded | 2014 |

| Headquarters | New York, NY, USA |

| Regulation | Licensed by New York State Department of Financial Services (NYSDFS), registered with FinCEN |

| Security Features | Majority of assets in cold storage, 2FA (authenticator app, hardware keys), insured custodial assets, institutional-grade Gemini Custody with sub-accounts and role-based access |

| Supported Cryptocurrencies | Over 70 (including Bitcoin, Ethereum, Chainlink, etc.) |

| Fees | 0.2-0.4% for ActiveTrader; convenience fees up to 1.49% for standard trades; no fees for custody services |

| Trading Options | Spot trading, recurring buys, ActiveTrader platform for low-fee trading, custody services |

| Unique Features | Gemini Custody for institutional-grade security, crypto rewards credit card, NYSDFS-regulated BitLicense |

| Best For | Beginners, institutional investors, security-conscious users |

| Availability | Available in all 50 U.S. states and over 60 countries |

| Mobile App | iOS and Android apps with trading, custody, and portfolio management features |

| Customer Support | 24/7 support via email, live chat, and help center |

| Drawbacks | Higher fees for non-ActiveTrader users, fewer advanced trading options compared to competitors |

6. eToro

eToro USA, LLC is a registered dealer under FinCEN, which supports compliance with U.S. regulations, providing a safe environment for purchasing Bitcoin. eToro employs measures such as two-factor authentication, cold storage, and insurance on custodial assets, protecting them against breaches.

eToro is known for its social trading platform which enables less experienced learners to copy the investment strategies of more seasoned investors, making it easier for them to understand the market.

eToro’s fees are straightforward and easy to understand (1% is integrated into the spread), and its diversified service offerings enable customers to purchase both stocks and cryptocurrencies.

Its security features include active monitoring, phishing detection, and response systems. Although eToro does not prioritize cryptocurrencies, it offers a user-friendly interface that, coupled with its regulated status, makes it a suitable option for anyone looking to buy Bitcoin for the first time. Best For: Social traders and beginners.

| Feature | Details |

|---|---|

| Platform Name | eToro USA LLC |

| Founded | 2007 (U.S. operations launched later) |

| Headquarters | Hoboken, NJ, USA (for U.S. operations) |

| Regulation | Registered with FinCEN, compliant with U.S. state-level regulations |

| Security Features | Cold storage for majority of assets, 2FA (authenticator app, SMS), insured custodial assets, real-time monitoring, anti-phishing protocols |

| Supported Cryptocurrencies | Over 40 (including Bitcoin, Ethereum, Cardano, etc.) |

| Fees | 1% fee integrated into the spread for crypto trades; no additional trading fees |

| Trading Options | Spot trading, social trading, copy trading, portfolio diversification with stocks and ETFs |

| Unique Features | Social trading platform allowing users to copy experienced investors, supports multi-asset trading (crypto, stocks, commodities) |

| Best For | Beginners, social traders, users interested in diversified portfolios |

| Availability | Available in most U.S. states (restrictions in NY, NV, MN, and a few others); global operations in 100+ countries |

| Mobile App | iOS and Android apps with trading, copy trading, and portfolio management features |

| Customer Support | 24/7 support via email, live chat, and help center |

| Drawbacks | Limited cryptocurrency selection compared to dedicated exchanges, restricted in some U.S. states |

7. Bitfinex

Since its inception in 2012, the Hong-Kong based exchange has focused on advanced trading with a special emphasis on security. Bitfinex employs cold storage for most assets, 2FA (including support for Universal 2nd Factor), and advanced protection features on Accounts like withdrawal IP whitelisting.

It has suffered hacks like the 2016 one, but has since overhauled its security, including frequent monitoring and auditing of its systems. Its unique feature is creating the UNUS SED LEO token, granting liquidity and discounting fees for holders.

It has support for more than 170 cryptocurrencies and charges low fees (0.1-0.2%) for high volume traders. Unlike some concerns around its historical issues, its current measures make it a transparent option. Best For: Traders that are comfortable with the history and looking for advanced trading options.

| Feature | Details |

|---|---|

| Platform Name | Bitfinex |

| Founded | 2012 |

| Headquarters | British Virgin Islands (operated by iFinex Inc., based in Hong Kong) |

| Regulation | Registered in British Virgin Islands, limited U.S. availability due to regulatory restrictions |

| Security Features | Cold storage for majority of assets, 2FA (authenticator app, U2F hardware keys), IP address whitelisting, real-time monitoring, post-2016 security overhaul, regular audits |

| Supported Cryptocurrencies | Over 180 (including Bitcoin, Ethereum, XRP, UNUS SED LEO, etc.) |

| Fees | Maker: 0.1%, Taker: 0.2% for spot trading; derivatives fees: 0.02% (maker), 0.065% (taker); UNUS SED LEO token holders get 15-25% fee discounts |

| Trading Options | Spot trading, margin trading (up to 10x leverage), derivatives, OTC trading, P2P margin funding, staking |

| Unique Features | UNUS SED LEO token for fee discounts, advanced trading tools (e.g., customizable Trade Desk), high liquidity for BTC pairs, Bitfinex Borrow and Pay |

| Best For | Professional traders, high-volume traders, institutional investors |

| Availability | Available in 100+ countries; restricted in the U.S., Bangladesh, Bolivia, Ecuador, Kyrgyzstan |

| Mobile App | iOS and Android apps with trading, reporting, and portfolio management features |

| Customer Support | 24/7 support via email, live chat, and help center |

| Drawbacks | History of hacks (2015, 2016), limited U.S. access, complex interface for beginners |

8. Crypto.com

Crypto.com is a Singapore-based platform with versatile security features suitable for its U.S. clientele. It employs cold storage for all customer funds, two-factor authentication, and it adheres to SOC 2 and ISO 27001’s requirements.

Crypto.com’s distinct characteristic is its custodial wallet providing up to $250 million worth of insurance against cyber attacks, which is unparalleled in the market.

Most Secure Place To Buy Bitcoin, the platform supports over 250 cryptocurrencies, provides a Visa card with cashback in cryptocurrency, staking, and DeFi services, and boasts a top rated mobile application.

Fees are usually 0.4% but can be lower for high volume traders. Crypto.com’s strategic focus on compliance and insurance makes it a versatile choice for users seeking diversity.

| Feature | Details |

|---|---|

| Platform Name | Crypto.com |

| Founded | 2016 |

| Headquarters | Singapore |

| Regulation | Registered with FinCEN (U.S.), compliant with Singapore’s MAS, and other global regulators |

| Security Features | 100% of assets in cold storage, 2FA (authenticator app, SMS), SOC 2 and ISO 27001 certifications, up to $250M insurance for custodial assets, anti-phishing code |

| Supported Cryptocurrencies | Over 250 (including Bitcoin, Ethereum, CRO, etc.) |

| Fees | 0.4% or lower for spot trading (based on 30-day volume); instant buy fees up to 2%; Crypto.com Visa card has no transaction fees for certain tiers |

| Trading Options | Spot trading, margin trading, staking, DeFi wallet, NFT marketplace |

| Unique Features | Crypto.com Visa card with up to 8% cashback in CRO, $250M custodial insurance, DeFi wallet for non-custodial storage, Super App for integrated crypto services |

| Best For | Beginners, mobile users, rewards seekers, DeFi enthusiasts |

| Availability | Available in 90+ countries, including the U.S. (except NY for some services) |

| Mobile App | iOS and Android apps with trading, staking, Visa card management, and DeFi wallet integration |

| Customer Support | 24/7 support via live chat, email, and help center |

| Drawbacks | Higher fees for low-volume traders, complex fee tiers, limited availability in some U.S. states |

9. Pionex.US

Pionex.US is a US-regulated exchange which draws liquidity from significant exchanges, for instance, Binance, providing security and volume. Also, it applies 2FA, hybrid hot/cold wallet storage, and complies with FinCEN.

One of the distinct characteristics is the embedded trading bots (for instance, Grid Trading Bot), which permit passive strategy automation for step investors. Pionex.US has low fees, 0.1% or less, and a wide range of cryptocurrency options.

Its security is enhanced by the infrastructure of larger exchanges, but operates independently for regulatory compliance. Newer than most, it stands out with innovative tools, secure framework, and offers strong value.

| Feature | Details |

|---|---|

| Platform Name | Pionex.US |

| Founded | 2019 |

| Headquarters | Princeton, NJ, USA |

| Regulation | Registered as a Money Services Business (MSB) with FinCEN |

| Security Features | Hybrid hot/cold wallet storage, 2FA (Google Authenticator, SMS), 100% cryptocurrency storage reserve, regular Merkle tree updates, anti-money laundering (AML) compliance |

| Supported Cryptocurrencies | Over 430 (including Bitcoin, Ethereum, USDT, BNB, SOL, XRP, DOGE, etc.) |

| Fees | 0.05% for spot trading (maker/taker); futures trading: 0.02% (maker), 0.05% (taker); withdrawal fees vary (e.g., 0.00009 BTC for Bitcoin) |

| Trading Options | Spot trading, futures trading (up to 100x leverage), margin trading (3-10x), 16 automated trading bots (e.g., Grid Trading, DCA, Arbitrage) |

| Unique Features | 16 free automated trading bots, liquidity aggregated from Binance and Huobi, “Release Profit” option for Grid Bots, user-friendly mobile app |

| Best For | Traders using automated strategies, cost-conscious investors, U.S.-based users |

| Availability | Available in 47 U.S. states (restrictions in NY, CT, VT, and a few others); limited globally due to regulatory restrictions |

| Mobile App | iOS and Android apps with trading, bot management, and real-time monitoring |

| Customer Support | 24/7 support via email (service@pionex.com), live chat, Telegram, one-on-one consultations |

| Drawbacks | No fiat withdrawals, mandatory KYC for trading, past security breach in 2022 (resolved with compensation), limited U.S. state availability |

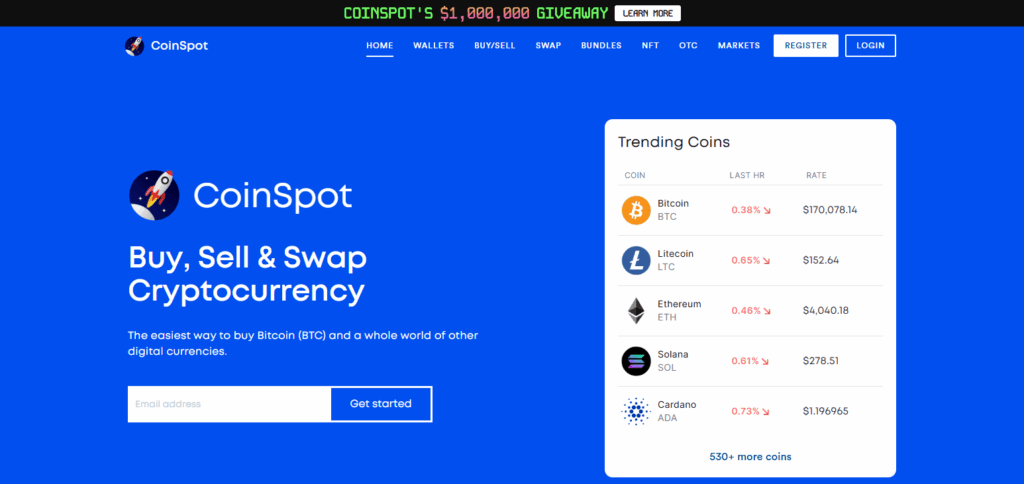

10. CoinSpot

An Australian exchange, CoinSpot Most Secure Place To Buy Bitcoin in the Asia and Pacific region, especially Australians. It operates in accordance with AUSTRAC regulations, applies 2FA, cold storage, and multi-signature wallets.

Unique for CoinSpot is the certification of ISO 27001 awarded due to enterprise grade security. With over four hundred cryptocurrencies supported and a friendly interface, funds deposits in AUD for Australian users are also instant.

Fees are on par, 0.1-1% depending on trade type, with no major breaches reported making their track record uninterrupted for security. CoinSpot is an optimal choice for localized Australian users looking for security. Best For: Australian users focused on compliance.

| Feature | Details |

|---|---|

| Platform Name | CoinSpot |

| Founded | 2013 |

| Headquarters | Melbourne, Victoria, Australia |

| Regulation | Registered with AUSTRAC, compliant with Australian financial crime laws |

| Security Features | Majority of assets in cold storage, 2FA (authenticator app), ISO 27001 certification, anti-phishing phrase, geo-locking, manual withdrawal disable option, HackerOne Bug Bounty Program, biometric security on mobile app |

| Supported Cryptocurrencies | Over 420 (including Bitcoin, Ethereum, XRP, etc.) |

| Fees | 0.1% for market/OTC trades; 1% for instant buy/sell; 2.5% for cash deposits; free AUD withdrawals |

| Trading Options | Spot trading, instant buy/sell, OTC trading, swaps between cryptocurrencies, NFT marketplace access |

| Unique Features | Largest selection of cryptocurrencies in Australia, multiple AUD deposit methods (PayID, POLi, Direct Deposit, PayPal, Cash), ‘Trending’ feature for market insights, CoinSpot Learn program for education |

| Best For | Australian residents, beginners, investors seeking diverse crypto options |

| Availability | Primarily Australia; limited international access due to regulatory focus |

| Mobile App | iOS and Android apps with trading, wallet management, and real-time market data |

| Customer Support | 24/7 support via live chat, email (support@coinspot.com.au), help center with FAQs; high Trustpilot rating (4.4/5 from 1,872 reviews) |

| Drawbacks | Higher fees for instant trades (1%), limited global availability, no advanced trading tools for professionals |

Conclusion

Identifying a fully regulated and trusted trading platform is a prerequisite for safely purchasing Bitcoin.

Coinbase, Kraken, and Gemini are exemplary because of their regulatory compliance, user protection, cold storage facilities, and ease of access.

Regardless of their trading experience, beginners need to choose platforms that offer high-level security so that their funds are protected as the crypto market continues to develop.