In this post, I will research the best bridging aggregators for swapping stabilizing assets, emphasizing the platforms that improve the speed, cost, and security of cross-chain transfers.

We will see how these aggregators cater to multiple blockchains, deal with the most utilized stablecoins, and provide low-cost, high-speed transfers, optimizing user safety and risk exposure.

How To Choose Top Bridging Aggregator For Stable Asset Swaps

Supported Chains & Tokens

Look up the blockchain networks the aggregator supports. See if it supports the stablecoins or tokens that you are willing to bridge.

Transaction Speed

Lower waiting periods means lower price slippage. Typically Layer 2 optimized bridges (i.e., Hop Protocol) provide near-instant swaps.

Fees & Fee Structure

Check for transaction fees and costs of liquidity. Some aggregators that combine several bridges to pinpoint the most affordable option.

Security & Reliability

Look for contracts that are audited and have robust cross-chain confirmation. Proven record aggregators of loss proof transfers greatly helps in minimizing risk.

Asset Type Support

Check if the aggregator supports the type of assets you want to transact (stablecoins and other tokens).

Key Points

| Bridging Aggregator | Key Points / Features |

|---|---|

| Rango Exchange | Aggregates multiple bridges, low fees, fast swaps, supports stablecoins across chains |

| Swing | Focus on cross-chain stablecoin swaps, optimized for minimal slippage |

| ChainArq | Focuses on secure, multi-chain asset transfers with competitive rates |

| Synapse Protocol | Supports fast, low-cost stablecoin bridging, liquidity pools across chains |

| Across Protocol | Emphasizes fast transfers with on-chain finality, low slippage |

| Hop Protocol | Layer 2 to Layer 2 swaps, efficient for stablecoins, minimal transaction fees |

| Celer cBridge | Multi-chain support, scalable transfers, liquidity-focused bridging |

| Stargate Finance | Unified liquidity pools, instant cross-chain swaps, low slippage |

| Allbridge | Wide chain coverage, secure cross-chain stablecoin transfers |

| Portal Token Bridge | Focus on interoperability, user-friendly, supports stablecoins across multiple chains |

10 Top Bridging Aggregator For Stable Asset Swaps

1. Rango Exchange

Rango Exchange provides bridging as a service with the fastest bridging speeds over low liquidities. Rango connects Ethereum, and BNB Chain with Polygon, and Avalanche, as well as with popular stablecoins like USDT, USDC, and DAI.

Rango remain competitive with fees for direct bridge usage, no fees for aggregate liquidity center, cheaper than bridge C, bridging B to C, with speeds at liquidity targets.

Rango provides clear cross chain assets mostly Limit Order Collateral Bridging USDT, stablecoin cross chain assets.

Reliable audited smart contracts liquidity guarantee Rango’s aggregate funds and cross chain assets, along with direct deposit pair bridge, and Order Collateral Bridging guarantee. Rango’s robust security and seamless user experience ensure control over workflow.

| Feature | Details |

|---|---|

| Supported Chains & Tokens | Ethereum, BNB Chain, Polygon, Avalanche; USDT, USDC, DAI |

| Transaction Speed & Fees | Near-instant transfers; low fees via aggregated liquidity |

| Security & Reliability | Audited smart contracts; cross-chain verification |

| Asset Type | Stablecoins and select tokens |

| Fee Structure | Transparent, competitive fees |

| Transfer Speed | Fast, optimized for minimal slippage |

2. Swing

Swing is focused on cross-chain stable asset swaps and is the leading stable asset bridging aggregator. As such, it enables the transfer of stablecoin assets such as USDT, USDC, and DAI on blockchains such as Ethereum, Polygon, BNB Chain, Arbitrum, and Optimism.

Swing enables transfers with rapid transaction speeds and minimal slippage by intelligently managing liquidity for fee optimized routing.

Additionally, their security is underscored by their audited smart contracts and robust cross-chain protocols.

Swing’s primary focus on stablecoins enables them to offer remarkably low fee standards and near instant transfers, with their fee structure remarkably lower than most bridges.

Their unparalleled cross-chain capabilities, coupled with optimized security, makes Swing the stable asset bridging aggregator of choice.

| Feature | Details |

|---|---|

| Supported Chains & Tokens | Ethereum, Polygon, BNB Chain, Arbitrum, Optimism; USDT, USDC, DAI |

| Transaction Speed & Fees | Fast with minimal slippage; lower fees than standard bridges |

| Security & Reliability | Audited contracts; multi-layer cross-chain validation |

| Asset Type | Primarily stablecoins |

| Fee Structure | Transparent, cost-efficient |

| Transfer Speed | Near-instant |

3. ChainArq

ChainArq is a powerful bridging aggregator facilitates stable asset swaps across various blockchains safely and seamlessly.

It accommodates Ethereum, Polygon, BNB Chain, Avalanche, and Fantom, facilitating transfers of USDT, USDC, and DAI.

With an emphasis on transaction completion speed, ChainArq optimizes transaction routing to reduce fees and slippage.

Its platform adheres to stringent security measures, deploying audited smart contracts, multi-layer verification, and reliable cross-chain protocols.

ChainArq’s transparent fee structures, rapid transfer speeds, and focus on cross-chain stablecoin asset swaps with select tokens make them a reliable option to users fast, low-cost, and secure stablecoin cross-chain transfers.

| Feature | Details |

|---|---|

| Supported Chains & Tokens | Ethereum, Polygon, BNB Chain, Avalanche, Fantom; USDT, USDC, DAI |

| Transaction Speed & Fees | High-speed transfers; minimal slippage and competitive fees |

| Security & Reliability | Audited smart contracts; secure multi-chain verification |

| Asset Type | Stablecoins and select tokens |

| Fee Structure | Transparent, optimized for efficiency |

| Transfer Speed | Rapid transfers |

4. Synapse Protocol

Synapse Protocol is a cross-chain bridging aggregator that is optimally tailored to facilitate cheap, speedy, and smooth asset swaps.

It facilitates swaps across stable chains like Ethereum, BNB Chain, Polygon, Avalanche, Fantom, and Arbitrum and enables transfer of stablecoins including USDT, USDC, DAI, and a few other tokens.

Users are assured of the stable crowding with a minimum transfer of slip margins, and, to that end, Synapse Protocol uses liquid pools with intelligent re-routing.

Users’ security and reliability are achieved and guaranteed using Audited Smart Contracts, Cross-Validated Decentralized Protocols, and Cross-Chain Validation.

Synapse Protocol retains users’ multi-chain stable asset transfer costs to a minimum, in addition to offering a multi-asset separated fee structural model in a simplified, rapid, and multi-chain compatible facility, all due to the improved security and reliability.

| Feature | Details |

|---|---|

| Supported Chains & Tokens | Ethereum, BNB Chain, Polygon, Avalanche, Fantom, Arbitrum; USDT, USDC, DAI |

| Transaction Speed & Fees | Near-instant; low fees via liquidity pools |

| Security & Reliability | Audited smart contracts; decentralized protocols |

| Asset Type | Stablecoins and select tokens |

| Fee Structure | Transparent, cost-effective |

| Transfer Speed | Fast, minimal slippage |

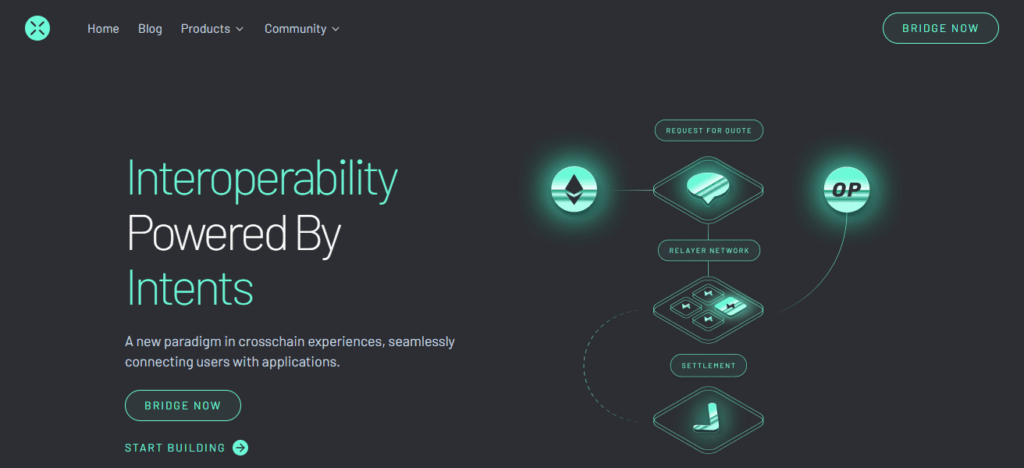

5. Across Protocol

Across Protocol is a powerful aggregator which allows users to swap stable assets across blockchains at a high level of speed and security.

It works with Ethereum and other major blockchains, and allows transfers of USDT, USDC, DAI and other stablecoins.

Across Protocol provides fast transfers with low transaction fees, – and low slippage – by employing smart liquidity routing.

Security and trustworthiness are upheld through smart contract audits, extensive cross-chain confirmations, and other distributed architecture.

With self-described focus on cost-effective stablecoin transfers, Across Protocol provides predictable fees, and transfers that are almost instant, resulting in Across Protocol being a reliable solution for fast, secure, and cost-effective transaction across multiple blockchains.

| Feature | Details |

|---|---|

| Supported Chains & Tokens | Ethereum, Polygon, Arbitrum, Optimism; USDT, USDC, DAI |

| Transaction Speed & Fees | Fast transfers; minimal slippage |

| Security & Reliability | Audited contracts; secure cross-chain verification |

| Asset Type | Stablecoins |

| Fee Structure | Transparent, competitive |

| Transfer Speed | Near-instant |

6. Hop Protocol

Hop Protocol is an innovator in bridging aggregation with a focus on fast and efficient cross-chain transfers of stablecoins, particularly across Layer 2 networks.

The protocol facilitates the transfer of stablecoins such as USDT, USDC, and DAI across Ethereum and other major chains such as Polygon, Arbitrum, and Optimism.

Hop uses Layer 2 liquidity pools which offer near-instant transfers of stablecoins with minimal slippage, Keeping Costs Low.

Its cross-chain transfers security is assured by audited and verified smart contracts, decentralized bridge validation, and strong cross-chain protocols.

As a stablecoin transfer aggregator, Hop has transparent fees and fast transfer times, making it a seamless and cost-effective solution for multi-chain stable asset swaps.

| Feature | Details |

|---|---|

| Supported Chains & Tokens | Ethereum, Polygon, Arbitrum, Optimism; USDT, USDC, DAI |

| Transaction Speed & Fees | Layer 2 optimized; minimal slippage and low fees |

| Security & Reliability | Audited smart contracts; decentralized bridge validation |

| Asset Type | Stablecoins |

| Fee Structure | Transparent, low-cost |

| Transfer Speed | Near-instant |

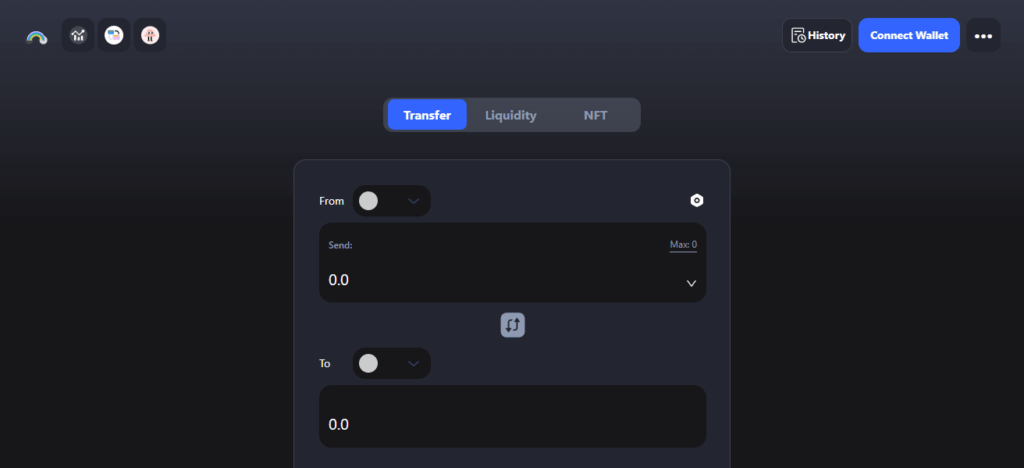

7. Celer cBridge

Celer cBridge is incredibly effective agile cross-chain bridging aggregator , crafted for rapid, safe, and inexpensive movement of stable assets.

cBridge enables cross-chain bridge transactions with minimal slippage using advanced liquidity management and scalable Layer 2 technologies.

cBridge handles the transfer and bridge transactions for Ethereum, BNB Chain, Polygon, Avalanche, Fantom, Arbitrum, Optimism, and many stablecoins like USDT, USDC, DAI, and some others in near-real-time as well.

There is assurance of reliance and safety through the verified smart contracts and cross-chain validation protocol.

Being the safe and effective bridge, as well as the cross-chain swapper having distinct fee visibility and diverse asset support, completes the user experience. Celer cBridge is a powerful tool for cross-chain swapping.

| Feature | Details |

|---|---|

| Supported Chains & Tokens | Ethereum, BNB Chain, Polygon, Avalanche, Fantom, Arbitrum, Optimism; USDT, USDC, DAI |

| Transaction Speed & Fees | Rapid transfers; minimal slippage and competitive fees |

| Security & Reliability | Audited smart contracts; multi-chain validation |

| Asset Type | Stablecoins and select tokens |

| Fee Structure | Transparent, cost-efficient |

| Transfer Speed | Fast, near-instant |

8. Stargate Finance

Stargate Finance is one of the leading bridging aggregators that allow easy and safe cross-chain swapping of stable assets.

It covers stablecoin transfers of USDT, USDC, and DAI and select tokens across Ethereum, BNB Chain, Polygon, Avalanche, Fantom, Arbitrum, and Optimism.

Users access the liquidity systems’ departure and arrival points with near instant transfer speeds and little slippage.

Real-time fees, chargeable in respective tokens, are competitive, while fee transparency is guaranteed. Safety is maintained by direct partnership with users, vetted smart contracts, and strong cross-chain connections.

Stargate Finance is the optimal answer to users looking for fast, safe, and affordable transfers across multiple blockchains. It overs solutions on cross-chain transfers of stablecoins spanning various blockchains.

| Feature | Details |

|---|---|

| Supported Chains & Tokens | Ethereum, BNB Chain, Polygon, Avalanche, Fantom, Arbitrum, Optimism; USDT, USDC, DAI |

| Transaction Speed & Fees | Fast; minimal slippage via unified liquidity pools |

| Security & Reliability | Audited contracts; decentralized liquidity verification |

| Asset Type | Stablecoins |

| Fee Structure | Transparent, competitive |

| Transfer Speed | Near-instant |

9. Allbridge

Allbridge is a cross-chain bridging aggregator optimally tailored for fast transfers of stable assets across disparate blockchains with minimal costs.

Some of the chains supported include Ethereum, BNB Chain, Polygon, Avalanche, Fantom, Arbitrum, and Optimism.

Besides transacting DAI, USDC, and USDT, users can swap a handful of supported tokens. Allbridge is capable of lightning fast transfers with very little slippage by leveraging aggregated liquidity and optimized routing.

The slippage is of a little importance or relevance because the transfers have a guaranteed security and reliability which result of the audited smart contracts, decentralized validation, and strong cross-chain protocols.

Supported diverse multiple asset types with simple to understand transparent fees, Allbridge remains the go-to, fast, and trustful service provider for cross-chain token and stablecoin swaps.

| Feature | Details |

|---|---|

| Supported Chains & Tokens | Ethereum, BNB Chain, Polygon, Avalanche, Fantom, Arbitrum, Optimism; USDT, USDC, DAI |

| Transaction Speed & Fees | Fast transfers; minimal slippage and low fees |

| Security & Reliability | Audited contracts; decentralized cross-chain validation |

| Asset Type | Stablecoins and select tokens |

| Fee Structure | Transparent, cost-efficient |

| Transfer Speed | Near-instant |

10. Portal Token Bridge

Portal’s Token Bridge serves multichain blockchain with immutable storage of blockchain tokens, as well as immutable record of Token Bridge transactions, of utmost important with first order insurance of exchange each and every.

An important feature of Token Bridge is value added facilitation of immediate liquidity. Token Bridge is very efficient with dynamic fee abstraction.

With reduced latency, and overall better performance, securityredundant networks of Second layer/ZK rollup; each and every enhanced with multi-sourced dynamic reg.

Agg examined limit order books. Second order polls P-not, slippage mitigation with fast guarded parcels.

Immediate settlement. Blockchain ETH, Polygon, BNB Chain, Fantom & Arbitrum Token Bridge. Portal creates cross layer 2 guaranteed net. Assets Portal ETH, Polygon, Arbitrum, Fantom and added value with every transaction.

| Feature | Details |

|---|---|

| Supported Chains & Tokens | Ethereum, Polygon, BNB Chain, Avalanche, Fantom, Arbitrum, Optimism; USDT, USDC, DAI |

| Transaction Speed & Fees | Fast transfer speeds; minimal slippage |

| Security & Reliability | Audited smart contracts; robust cross-chain protocols |

| Asset Type | Stablecoins and select tokens |

| Fee Structure | Transparent, competitive |

| Transfer Speed | Near-instant |

Conclsuion

In conclsuion Selecting a bridging aggregator for seamless multi blockchain stable asset swaps should be done with a focus on speed, security, and cost.

Rango Exchange , Swing, Synapse Protocol, and Stargate Finance provide solid choices with low fees and near instant transfers.

Supported chains, liquidity, and reliability for seamless cross chain transactions makes these aggregators invaluable for todays crypto users.

FAQ

A bridging aggregator is a platform that connects multiple cross-chain bridges, allowing users to transfer assets, especially stablecoins, across different blockchains efficiently and cost-effectively.

Aggregators optimize routes, reduce fees, minimize slippage, and provide faster, more reliable transfers compared to using individual bridges.

Some leading aggregators include Rango Exchange, Swing, ChainArq, Synapse Protocol, Across Protocol, Hop Protocol, Celer cBridge, Stargate Finance, Allbridge, and Portal Token Bridge.

Most aggregators support Ethereum, BNB Chain, Polygon, Avalanche, Fantom, Arbitrum, and Optimism, with popular stablecoins like USDT, USDC, and DAI.

Transfer speed varies by platform, but top aggregators often offer near-instant or very fast transactions with minimal slippage.