This article covers the Top Bridging Aggregators With an Audit where I focus on the safest and most efficient options for cross-chain swaps.

These audited aggregators guarantee secure, clear, and minimal cost transfers of assets across a multitude of blockchains.

Ranging from Jumper and Bungee to Across Protocol, they all present verified smart contracts and refined routing to ease interoperability within the DeFi space.

Key Points & Top Bridging Aggregators With An Audit

| Aggregator | Key Point / Audit / Security Feature |

|---|---|

| Jumper Exchange | Has undergone third-party smart contract audits; supports many chains |

| Bungee Exchange | Offers gas refuel + bridging in one step; security audits claimed |

| Rango Exchange | Wide cross-chain support; audit reports available on site |

| ChainHop | Low-fee bridging; audited routing contracts |

| 1inch | Primarily DEX aggregator but supports cross-chain routing; audited modules |

| OpenOcean | Supports cross-chain swaps; has audit disclosures |

| ParaSwap | Multi-DEX/bridge routing; audit history public |

| DeFiLlama | Aggregates data across DEX + bridges; security transparency |

| Portal Bridge | Cross-chain intent protocol; audits on bridge logic |

| Across Protocol | It focuses on genuine asset transfers rather than wrapped tokens, enhancing reliability. |

10 Top Bridging Aggregators With An Audit

1. Jumper Exchange

Developed by LI.FI, Jumper Exchange seamlessly crosses multiple blockchains. Jumper consolidates different DEXs and bridges to determine the best and most cost-effective transactional route with minimal slippage and fees.

Jumper Exchange supports Ethereum, Polygon, Arbitrum, Optimism, BNB Chain, and Avalanche networks.

Its platform is designed for beginners and features clear route breakdowns. Jumper provides cross-chain asset transfers with the utmost accuracy and efficiency. Its security is validated by Quantstamp, a top-tier auditing company.

Its cost-efficient cross-chain asset swap features make Jumper Exchange the primary cross-chain asset bridges aggregator and the primary cross-chain asset bridges aggregator.

Features Jumper Exchange

Cross-Chain Aggregation – Jumper Exchange integrates various DEXs with bridges in order to find the optimal routes for cross-chain swaps.

Multi-Network Support – Jumper Exchange operates on and supports big networks such as Ethereum, Polygon, Arbitrum, and Avalanche.

Audited Security – Smart contracts audited by Quantstamp, ensuring safety and reliability.

User Transparency – Clearly shows each detail before finalizing a transaction, such as the route taken, the expected fees, and slippage.

2. Bungee Exchange

Socket built Bungee Exchange and is a multichain trust Bridge and Swaps Aggregator. Bungee Exchange is designed to make moving and swapping assets between chains easier.

Bungee Exchange integrates liquidity from multiple bridges and DEXs and intelligently routes your transactions along the most optimal paths. Bungee connects to all the major chains- Ethereum, Polygon, Base, Optimism and Arbitrum.

Bungee is known for its easy to use interface, estimating gas costs, and showing time and route comparisons between different swapping routes.

Socket pass audits for their smart contracts and bridge integrations by Quantstamp and OpenZeppelin. This makes Bungee one of the most reliable and efficient solutions for cross-chain transfers and token swaps.

Bungee Exchange

Smart Route Optimization – Bungee Exchange analyses several DEXs and bridges to offer the best route for the user’s token swap.

Broad Chain Coverage – Bungee Exchange works on and supports blockchain networks such as Base, Arbitrum, Polygon, and Optimism.

Audited & Verified – Socket’s contracts are audited by Quantstamp and OpenZeppelin.

Gas & Speed Insights – Available transaction data includes time estimates and gas fees, which enhances user experience.

3. Rango Exchange

Rango Exchange is a multi-chain DeFi aggregator that connects DEXs, cross-chain bridges, and swap protocols into a single interface.

Its multichain capabilities span over 60 chains, including EVM and non-EVM protocols, enabling token swaps within a layer-2 ecosystem and beyond.

Rango Exchange uses top cross-chain bridges like Thorchain, Axelar, and Stargate, and optimizes routes based on speed and cost.

The Exchange is audited by Hacken, which makes it lenient and compliant to show operational transparency and is secured by smart contracts.

Rango Exchange has features of slippage control and a transaction preview in a mobile-friendly design and is for casual and pro defi users. Cross-chain trading aims to be as simple, and seamless as single-chain swaps.

Rango Exchange

All-in-One Cross-Chain Aggregator – Rango leverages over 60 blockchains and top bridge networks such as Thorchain and Axelar.

Optimized Routing – Rango offers the best routes for any token swap in the system, ensuring their routes are the fastest and cheapest.

Audited Protocol – Hacken’s audit includes verification for security and reliability and overall system code.

User Control – Users can set their preferred slippage and other transaction settings, giving them ultimate control over their transactions.

4. ChainHop

ChainHop is a sophisticated cross-chain swap aggregator that allows users to exchange tokens across several blockchains with a single click.

Taking advantage of integrated DEXs and automated DEXs ChainHop finds the most optimal routes while reducing costs and time delays.

ChainHop services all the major blockchains including Ethereum, BNB Chain, Polygon, Arbitrum, and Avalanche.

ChainHop is a product of the OKX ecosystem which offers it high liquidity and security audits by SlowMist and PeckShield.

While ChainHop has a minimalist user interface, it is powerful because it shows all the routes in a swap, the current price, and the time to execute the swap.

The routing system is transparent, and the smart contracts have been audited, proving ChainHop’s reliability and safety while cross-chaining assets.

ChainHop

Instant Cross-Chain Swaps: Permits one-click token swaps over major chains in record time.

Deep Liquidity: Ecosystem used for the OKX system supports large- volume transfers seamlessly.

Security Audits: Smart contracts security assured by SlowMist and PeckShield.

Real-Time Transparency: Articulates live prices, estimated time, and route breakdowns.

5. 1inch

1inch is perhaps the most popular DEX aggregator which has developed capabilities for cross-chain swaps and built bridging functionalities on proprietary integrated protocols.

To provide the best token swap, 1inch analyzes liquidity across various DEXs and integrated bridges and offers users the optimal route with the lowest slippage.

1inch provides services on Ethereum, BNB Chain, Polygon, and Arbitrum, enabling fast, inexpensive swaps.

The numerous smart contract security audits that 1inch passed with high grades, are a testament to their users trust.

The powerful Pathfinder algorithm and intuitive design together enable straightforward cross-chain routing of trades while ensuring top security and transparency.

1inch

Advanced Aggregation Engine: Swaps across DEXs and bridges are optimized by the Pathfinder algorithm.

Cross-Chain Capabilities: Swaps within Ethereum, BNB Chain, Polygon, and others are possible.

Strong Audit Record: For robust protection, SlowMist and ConsenSys Diligence audited them.

User-Centric Tools: Provides gas optimization, limit orders, and slippage control for the users.

6. OpenOcean

OpenOcean is an all-in-one aggregator as it combines DEX and cross-chain bridge functions.

OpenOcean pulls liquidity from top exchanges and protocols on over 20 blockchains, such as Ethereum, BNB Chain, Solana, and Polygon.

OpenOcean intelligent routing algorithms usage ensures the best swap prices and lowest. OpenOcean has passed security audits conducted by CertiK and SlowMist.

OpenOcean versatility comes from supporting derivatives, CeFi integrations, and user service reliability.

OpenOcean transparent analytics dashboard, gas optimization tools, and ease of cross-chain trading provide reliability.

OpenOcean

Unified Aggregation: DEX, CeFi, and cross-chain bridges are unified in one interface.

Wide Blockchain Reach: 20+ networks supported including Solana, Polygon, and Avalanche.

Audited Security: For system integrity security, SlowMist and CertiK audited them.

Smart Routing Algorithm: Provides optimal swap prices while minimizing transaction costs.

7. ParaSwap

ParaSwap is a DEX aggregator with cross-chain functionality via integrated bridges. Order splitting across DEXs and liquidity pools helps provide users with the best rates.

The blockchains of Ethereum, Avalanche, Arbitrum, and Polygon are some of the networks supported by ParaSwap. Slippage is kept to a minimum when token swaps are done.

Audits from Trail of Bits and PeckShield confirmed the protocols custom smart contracts security.

Users nbsp gas and fees optimization of ParaSwap, its governance mechanism, and transparent fee structure makes ParaSwap a well known choice among professional traders.

ParaSwap

DEX & Bridge Aggregation: For the best prices, orders are routed across multiple liquidity pools and bridges.

Supported Networks: Operates on Ethereum, Arbitrum, Polygon, and Avalanche.

Audited Infrastructure: High security was ensured by auditing Trail of Bits and PeckShield.

Efficiency Tools: Provides gas optimization, batch swaps, and clear fee structures.

8. DeFiLlama

DeFiLlama has expanded its functionality to include bridging and swap aggregation. Users can perform cross-chain swaps and bridging without changing interfaces.

Because DeFiLlama does not impose fees, it is one of the most affordable choices available. The swap suggestions use data from leading bridge Stargate and Hop.

Its contracts and integrations available to the public are audited to guarantee compliance. The use of unbiased data and open-source tools is the basis of DeFiLlama being the most trustworthy and community-driven option for secure cross-chain transactions.

DeFiLlama

Transparent Aggregation: Aggregates bridges and DEX routes with no additional fees charged to users.

Data-Driven Interface: Displays real-time data to identify the optimum routes and best swap rates.

Audited & Open-Source: Code is fully transparent, and the product is regularly reviewed for security.

Community-Oriented: Non-custodial and unbiased resources, sourced from DeFiLlama’s open DeFi community.

9. Portal Bridge

Enabled by Wormhole, Portal Bridge is a cross-chain transfer portal bridging Ethereum, Solana, Avalanche, and Polygon and offering cross-chain NFT transfers.

Users can transfer their assets and NFTs across networks with ease and safety. The Wormhole infrastructure is audited for compliance and safeguarded by Kudelski Security and OtterSec. Users enjoy a convenient interface with real-time transfer confirmation.

Deployed Wormhole decentralized guardians and verifiers are confident in the asset transfer integrity and can perform real-time compliance checks.

Portal Bridge is security updated to guarantee compliance and is one of the most secure and scalable bridging options in the Web3 ecosystem.

Portal Bridge

Powered by Wormhole: Utilizes a decentralized messaging protocol to securely move assets and currency.

Multi-Asset Support: Bridges tokens and NFTs across Ethereum, Solana, and a handful of major chains.

Security Audits: Audited by Kudelski Security and OtterSec, emphasizing trustworthiness.

Fast Transfers: Provides rapid confirmations and a high capacity for transactions.

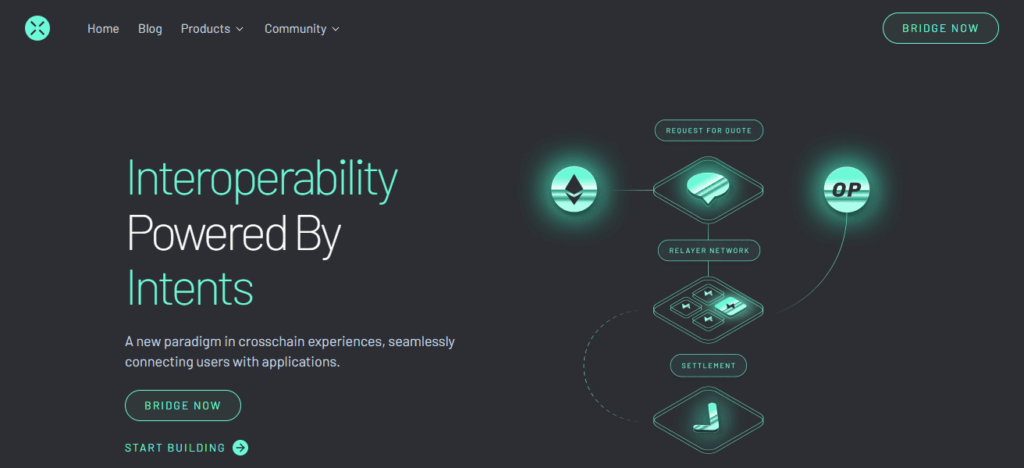

10. Across Protocol

As a fast and secure cross-chain bridge, Across Protocol is designed with capital efficiency and low transfer costs in mind.

It permits instantaneous token transfers from Ethereum and L2 networks, including Arbitrum, Optimism, and Base.

With a decentralized, self-shielding relayer network, Across allows for instant liquidity and low latency.

The protocol’s smart contracts have received audits from OpenZeppelin, Certora, and Quantstamp and have demonstrated a high standard of security.

The underlying incentive design is tailored for relayers and liquidity providers to achieve best synergy.

Across Protocol offers transparent governance, and its bridge aggregator Across is deeply trusted with cross-chain transfer liquidity, notable for its safety, speed, and low cost.

Across Protocol

Optimized for Speed: Enables rapid token moves between Ethereum and Layer-2 solutions such as Arbitrum and Base.

Capital Efficiency: Employs decentralized regulators to slash fees and obliterate slippage.

Heavily Audited: Audits from OpenZeppelin, Quantstamp, and Certora.

Decentralized Governance: Designed by the community to ensure no manipulation and dependability.

Conclsuion

In summary, Jumper, Bungee, Rango, ChainHop, 1inch, OpenOcean, ParaSwap, DeFiLlama, Portal Bridge, and Across Protocol as the most audited bridging aggregators provides secure, transparent, and efficient cross-chain transfers.

Their reputable smart contracts, optimized routing, and extensive blockchain support establish them as reliable options for users needing safe, affordable, and effortless multi-chain DeFi transactions.

FAQ

Bridging aggregators connect multiple bridges and DEXs to enable seamless cross-chain swaps with the best rates.

Audits ensure smart contract safety, preventing hacks and fund losses.

Across Protocol, Jumper Exchange, and Bungee Exchange are among the most audited and trusted.

Most aggregators only charge network fees; DeFiLlama even adds no extra fees.

They support major networks like Ethereum, Polygon, Arbitrum, Optimism, BNB Chain, and Avalanche.