In this article, I will examine what crypto exchanges operate in New York. The state has stringent laws which stipulate that a BitLicense or a trust charter needs to be held by the platform.

This article focuses on the key licensed exchanges accessible to крипто New York users, their key features, reasons for absence of certain global exchanges and popular ones in New York.

What Is Crypto Exchanges?

The emergence of new technologies has transformed the financial landscape with the introduction of cryptocurrencies, which serve as a digital and decentralized substitute for conventional currencies.

However, individuals require a marketplace that allows them to transact with these digital currencies to buy, sell, and trade. This is where crypto exchanges come in.

A crypto exchange is an online marketplace where users can buy and sell cryptocurrencies, for example, Bitcoin, Ethereum and thousands of other altcoins.

Just like conventional stock exchanges, these platforms have been designed specifically for digital currencies

Which Crypto Exchanges are licensed to Operate In New York?

Some of the major licensed exchanges in New York include:

1.Coinbase

Coinbase ranks among the leading cryptocurrency exchanges in the world and holds a full license to operate in New York. It has a very low barrier to entry with a simple interface which allows the buying, selling, and storing of cryptocurrencies to be done with ease.

Coinbase has a large selection of digital assets which include Bitcoin, Ethereum, and a good number of altcoins. It has also offered educational modules, staking opportunities, and advanced features tailored to more seasoned traders.

Security is a primary concern as shown in having 2FA and cold storage of funds. Coinbase users are offered a very well regarded exchange under strict regulations.

2.Gemini

Gemini is a US licensed exchange operated by the Winklevoss twins. Gemini promotes security and compliance with a user-friendly platform aimed at beginners and allows for complex trading activities such as limit orders, recurring buys, and even institutional-level custody solutions for advanced users.

Gemini holds a reputation for its focus on security with measures like cold storage, insurance, two-factor authentication, and more. In addition, Gemini holds a variety of cryptocurrencies and offers staking as well as Gemini Earn services

Where users can earn interest on their cryptocurrencies. Gemini is safe and trustworthy with the earning and interest features along with full compliance of the law, making it a great platform for all users.

3.Robinhood

While Robinhood is primarily known as a stock trading platform, it also facilitates cryptocurrency trading under its New York BitLicense. Users can trade Bitcoin, Ethereum, and Dogecoin, alongside other stocks. Robinhood is tailored for beginners and stocks are traded through a simple interface.

Although the platform lacks a wide range of cryptocurrencies compared to other specialized exchanges, its zero-commission trading, ease of use, and integration with other investment products add to its convenience.

Users accounts are protected with two-factor authentication and funds are monitored, but the platform holds custody of the funds which means users do not have control of private keys.

4.eToro

eToro is a leading social trading platform dealing in cryptocurrencies stocks, and a variety of other assets. Operating in New York, eToro is known for its copy trading feature, which allows less-experienced users to trade in tandem with established investors.

This feature automates the learning process for new traders. eToro accepts a broad range of cryptocurrencies, facilitates fiat and cryptocurrency conversions, and has an excellent portfolio diversification feature.

eToro’s mobile application is quite intuitive, as is the platform’s encryption, regulatory compliance, and account safety features. eToro is best suited for beginner traders who want some guidance when trading in cryptocurrencies.

5.Uphold

Uphold is a multi-asset platform that permits trading in cryptocurrencies, fiat currencies, precious metals and even commodities. Uphold is licensed in New York under a Limited Purpose Trust Charter which gives it a unique advantage over competitors in streamlining user trust and regulatory compliance.

Uphold supports a multitude of currencies and cryptocurrencies and comes with a simple and friendly interface that is helpful for both beginner and intermediate traders.

Uphold promises compliance with regulations, and, at the same time, focuses on offering transparent and regulated solutions such as automatic conversion between assets, recurring purchases, and more.

Uphold is one of the few crypto exchanges that allows users to invest across both traditional and crypto assets within a single platform.

6.Bitstamp

As one of the world’s earliest cryptocurrency exchanges, Bitstamp is licensed to conduct business in New York. It serves experienced traders exclusively, providing robust liquidity, industry-standard tools, and reasonable fee structures.

It supports trading in major cryptocurrencies like Bitcoin, Ethereum, and Litecoin and offers limit and market orders, real-time charting, and algorithmic trading via API.

Fund security is critical, employing cold storage for most funds and insurance coverage. For traders and investors, Bitstamp offers a reliable exchange featuring a strictly regulated environment.

Why are Some Exchanges Not Allowed In New York?

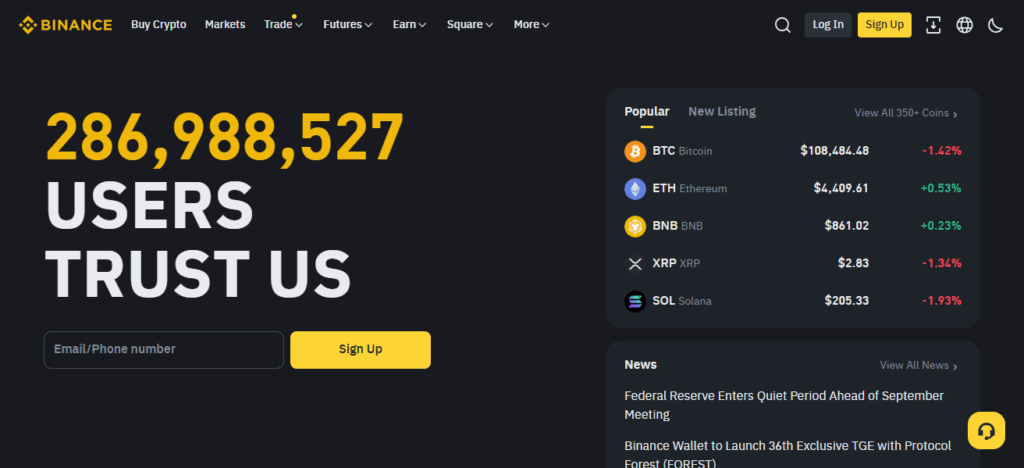

1.Binance

Binance is among the largest cryptocurrency exchanges in the world. It is well known for an extensive range of cryptocurrencies, advanced trading features, and low fees.

Nonetheless, it does not possess BitLicense or New York trust charter which are prerequisite to operate in New York.

These regulatory restrictions mean New York residents are barred from using Binance. Binance users in New York are still able to access other licensed exchanges to trade cryptocurrencies in a safe and legal manner.

2.Crypto.com

Apart from offering trading and staking of cryptos, Crypto.com also issues a crypto debit card. Because it lacks a BitLicense and New York trust charter, Crypto.com is unable to serve users from New York.

Due to stringent regulatory compliance mandates, residents of the state are unable to open accounts and access the services. Licensed exchanges are the only compliant, secure, and legal options for trading cryptocurrencies from within New York.

3.KuCoin

KuCoin is a global cryptocurrency exchange that is popular due to its user-friendly interface and the vast selection of altcoins on the exchange. Despite its global reach, KuCoin does not possess a BitLicense and New York trust charter, hence

New York residents are prohibited from trading on the exchange. Users are bound to select licensed exchanges due to state regulations in order to comply with local laws and secure legal and financial protections for their funds.

Regulatory Landscape and Industry Trends

The crypto industry is regulated in a balancing act of innovation and consumer protection shaping governance in exchanges and adoption in the U.S.

Discussion of Debates Around the BitLicense

Debates surrounding consumer innovation and safety practices in the BitLicense encourage innovation stagnation while the legal framework remains protective and ambiguous.

Challenges vs. Benefits of Regulation: Security vs. Innovation

Regulations are a double-edged sword; they protect against fraud and abuse, but overly stringent regulations can limit crypto services and new projects.

Recent Trends: Push for Regulatory Reform, Impact on Crypto Innovation

Regulatory revision initiatives are focused on fueling innovation, easing compliance, and expanding the crypto and decentralized finance markets.

New York’s Role in the U.S. Crypto Ecosystem

New York emerges as a primary hub in the crypto ecosystem as home to licensed exchanges and innovation shaping country-wide governance and market.

Conclusion

To summarize, New Yorkers have access to various licensed cryptocurrency exchanges such as Coinbase, Gemini, Robinhood, eToro, Uphold, and Bitstamp. These exchanges offer regulatory compliance, security, and reliable trading.

Limited access to some major international exchanges may be inconvenient; however, the licensed exchanges offer cryptocurrencies and enable users to trade confidently within the state’s strict regulatory framework.

FAQ

A regulatory license from NYDFS that allows crypto exchanges to legally operate in New York.

Coinbase, Gemini, Robinhood, eToro, Uphold, and Bitstamp.

No, they lack a BitLicense and cannot legally operate in the state.